-

Alexander most recently headed up mortgage lending and before that co-led the integration of Key's acquisition of First Niagara. He replaces Dennis Devine, who recently left the company.

February 18 -

Digitization presents opportunities for lenders to streamline the mortgage process in ways that benefit them and their borrowers, but three things stand in the path to full adoption.

February 12 Fiserv Inc.

Fiserv Inc. -

United Wholesale Mortgage invested in regional Super Bowl advertising for the first time and local competitor Quicken Loans added to its longstanding national marketing ties to the game.

January 31 -

CEO VanTrojen: Employees are the No. 1 client.

January 29 -

Dan Gilbert has been back in the office and could soon be making his first public appearance since suffering a stroke last May, Quicken Loans CEO Jay Farner said.

January 16 -

More than half of Columbus homebuyers are millennials, according to a new study from the mortgage lead generation company LendingTree.

January 14 -

Quicken Loans, which has a history of advertising its Rocket Mortgage digital application with high-profile Super Bowl promotions, is doubling down on its ties to the National Football League event.

January 7 -

Canadian Imperial Bank of Commerce expects its growth in domestic mortgages to be more “market-like” in 2020, after last year’s contraction in home-loan balances, Chief Executive Officer Victor Dodig said.

January 7 -

Consumer attorneys are filing more Telephone Consumer Protection Act lawsuits than ever and if a piece of follow-up legislation becomes law, the peril to mortgage lenders will grow.

December 27 Jornaya

Jornaya -

A new National Credit Union Administration proposal would raise the threshold for residential mortgages that require appraisals. However, the final rule is by no means a done deal.

November 21 -

Roostify is working with Level Access — a software provider enabling disabled people access to technology — to offer Americans with Disabilities Act compliant websites and mobile applications.

November 15 -

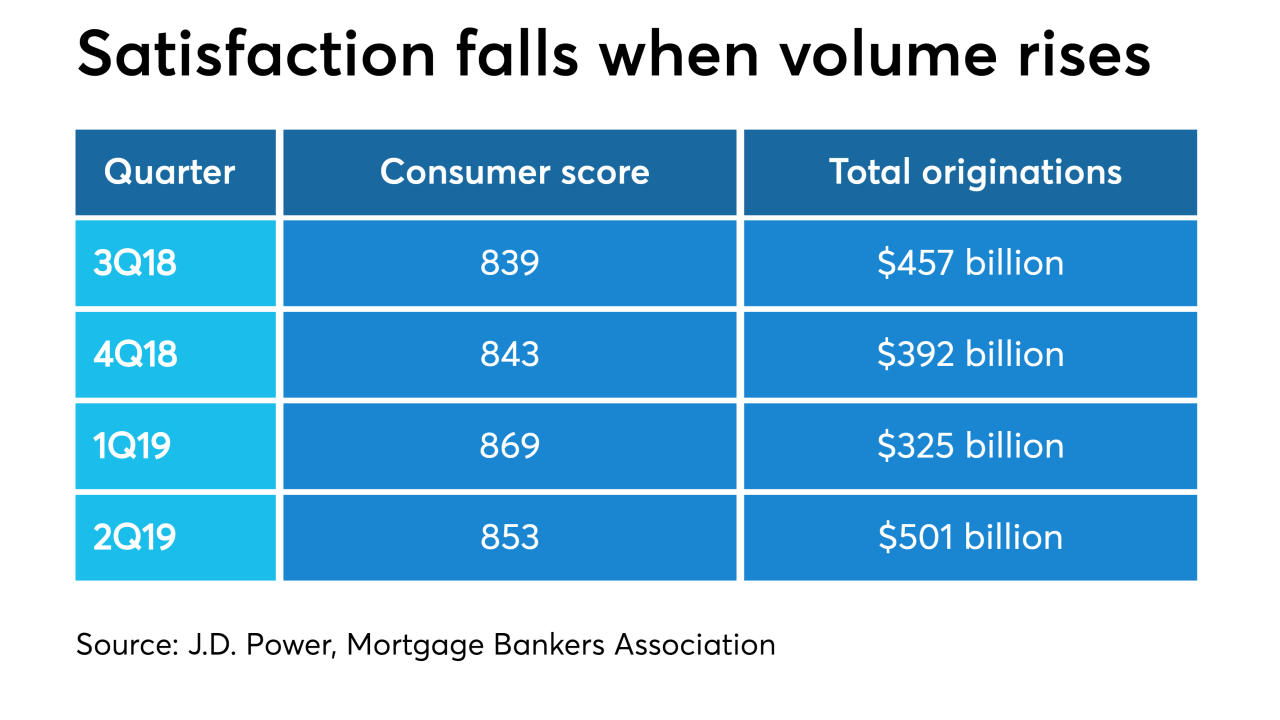

Consumer mortgage originator satisfaction scores fell in the second quarter as lenders had to work through the increase in application activity, a J.D. Power report said.

November 14 -

The average number of attempts to defraud mortgage companies each month increased by 42% this year and hit the smallest businesses hardest, according to LexisNexis Risk Solutions.

October 29 -

The National Credit Union Administration has unveiled a proposal to address a federal judge's concerns that its 2016 field-of-membership overhaul could discourage lending in low-income areas.

October 24 -

Count Citizens Financial’s Bruce Van Saun among those who think interest rate cuts could halt by mid-2020. The key, he says, is to focus on delivering services customers are willing to pay fees for and to skillfully reprice deposits until then.

October 18 -

Charles Scharf’s most immediate priorities will be mending fences with regulators and getting the bank out from under a Fed-imposed asset cap. But he also must come up with strategies for spurring revenue growth and reining in expenses.

September 27 -

Scharf next month will become the fourth leader at Wells Fargo in three years. Meanwhile, Bank of New York Mellon has named Thomas P. "Todd" Gibbons as acting chief executive.

September 27 -

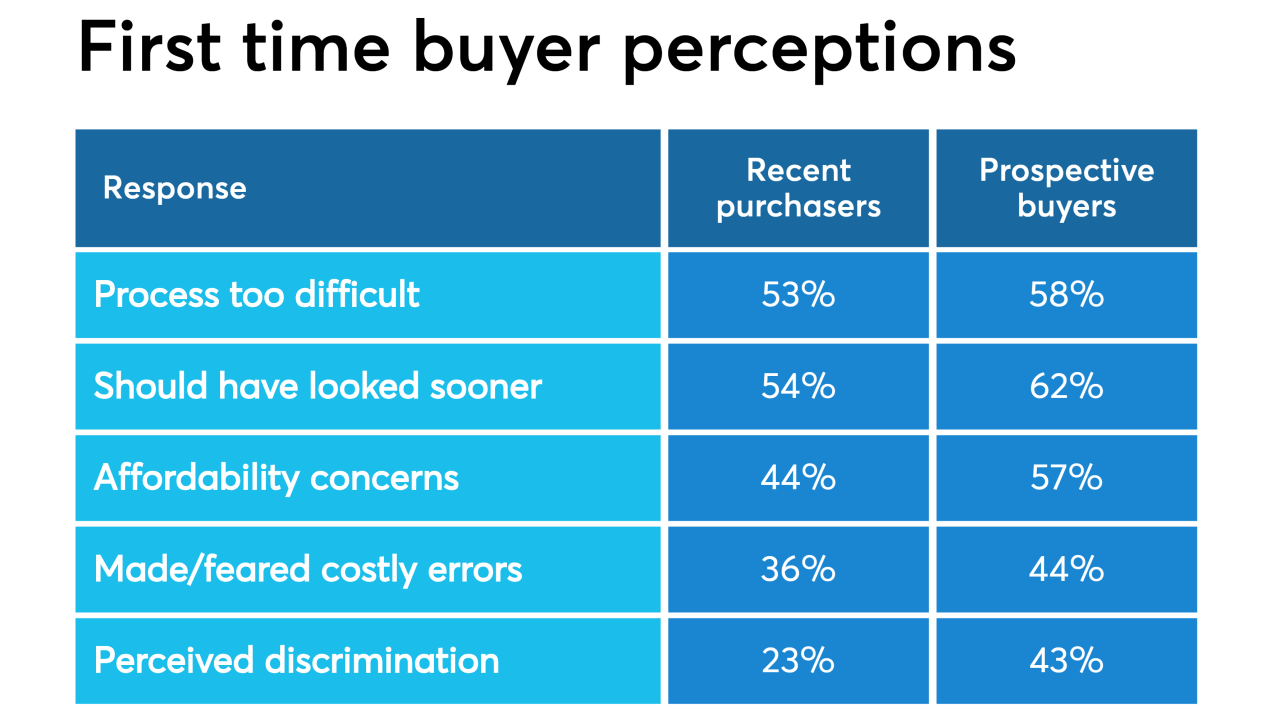

More than half of recent, as well as prospective, first-time homebuyers said purchasing a house was more difficult than it should be, according to a survey for Framework.

September 25 -

Business intelligence software from a compensation management technology provider and an auto-fulfillment service for disclosures were among new offerings introduced by companies at Digital Mortgage.

September 24 -

With the mortgage industry inching closer to full digitization, lenders need to strike the right balance of man-versus-machine as borrowers still look to leverage human interaction during the origination process.

September 20