-

The Mortgage Bankers Association raised its refinance projections for 2020, a move precipitated by an application volume increase of 55.4% from one week earlier.

March 11 -

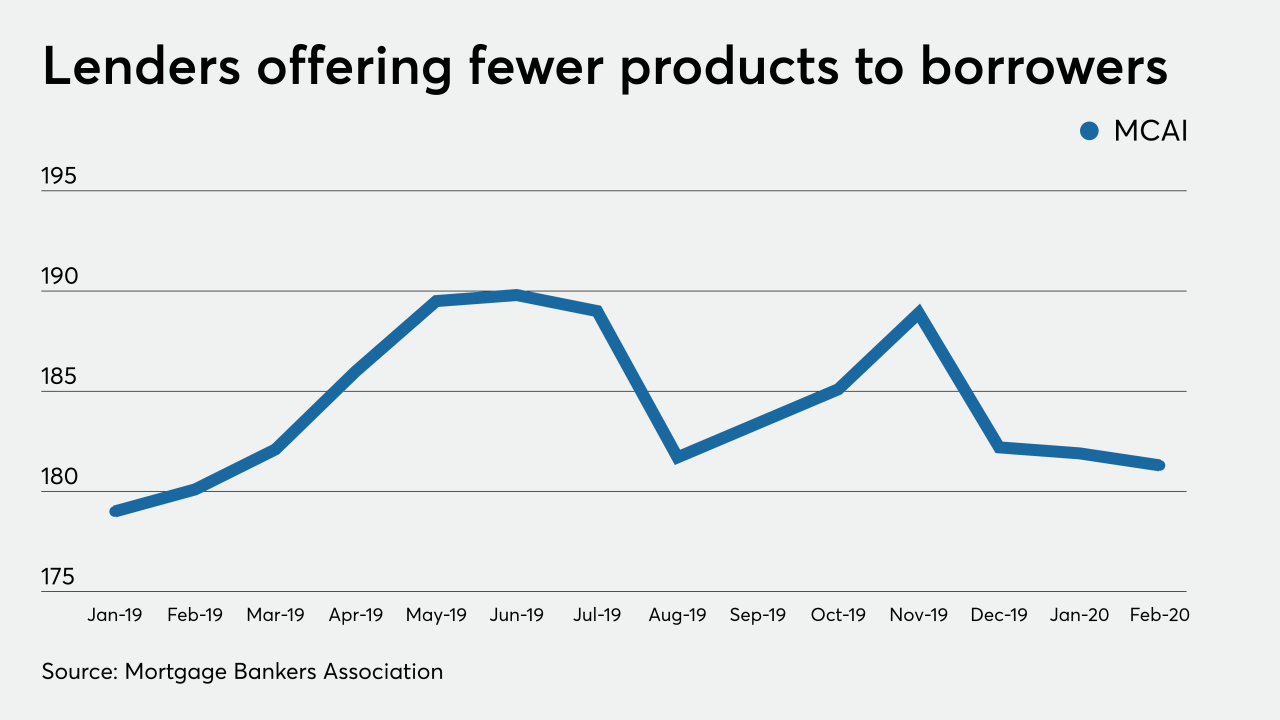

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

March 10 -

Nearly all the main components of home sale statistics on Hawaii island and Kauai rose last month, according to a report released last week.

March 10 -

Consumer sentiment for home buying stayed near its record high behind low mortgage rates and a strong job market, though the declining stock markets and COVID-19 concerns may change that soon, according to Fannie Mae.

March 9 -

Canadian housing starts remained at elevated levels in February, amid strength in the detached-home market.

March 9 -

Mortgage rates, which fell to a 50-year low last week, are keeping Oahu's real estate market relatively strong even as uncertainties mount over the economic impacts of coronavirus outbreaks.

March 9 -

Mortgage interest rates dropped this week to the lowest level on record, fueling an already hot spring housing market and triggering a refinance boom in the Twin Cities.

March 6 -

Even as concern over the rapid spread of the novel coronavirus mounts, the most recent data on area home sales from the Northwest Multiple Listing Service shows the market for Seattle-area residential realty remains hot.

March 6 -

Single-family home sales in the Rockford, Ill., region rose last year to heights not seen in more than a decade and climbed even higher in January, according to the Rockford Area Association of Realtors.

March 6 -

January's plummeting mortgage rates led to a spike in the share of millennials refinancing their home loans, a trend that should carry into February and March, according to Ellie Mae.

March 5 -

The dollar amount of fix-and-flip properties purchased using financing reached a 13-year high in 2019, but the share of flips financed was lower year-over-year, according to Attom Data Solutions.

March 5 -

For the fifth consecutive year, the Texas housing market broke records in terms of the number of homes sold and median prices, according to the 2019 Texas Real Estate Year in Review report issued by Texas Realtors.

March 5 -

The Spokane County, Wash., median home price continued to rise, but sales held steady in February, according to the Spokane Association of Realtors.

March 5 -

Toronto home prices surged in February, and sales jumped from a 10-year low, as buyers stampeded back into the market.

March 4 -

A drop in interest rates in response to the coronavirus outbreak is adding urgency to a hiring spree across the mortgage industry.

March 4 -

Above-average snowfall and rising concerns about the coronavirus didn't put a damper on local home sales last month, according to the Denver Metro Association of Realtors.

March 4 -

Mortgage application volume increased 15.1% from one week earlier, and with interest rates still falling, even higher refinance demand is probable in the short term, according to the Mortgage Bankers Association.

March 4 -

Women are becoming more and more empowered in home purchasing, thanks in part to the digitization of the mortgage and real estate industries, according to a report from Compass and Better.com.

March 4 -

Home sales across Connecticut started off 2020 on an upbeat note as overall prices paid in January rose to their highest level in 12 years for the month accompanied by an encouraging increase in sales.

March 4 -

Investors' purchases of 10-year Treasurys after the Fed's 50 basis point short-term rate cut drove the yield below 1% for a period of time.

March 3