-

The history of riskier lending over the last half century can offer lessons for today's market.

May 7 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Many originators stopped making riskier products, including jumbo loans and low credit score offerings, during April.

May 7 -

An early look at securitized residential home-loan performance amid the coronavirus pandemic indicates encouraging trends thus far in impairment levels of non-qualified mortgages, according to a new report from investor analytics firm Dv01.

April 30 -

Impac Mortgage temporarily shut lending operations and furloughed 333 workers due to market turmoil tied to the novel coronavirus.

April 22 -

The Federal Reserve's $2.3 trillion loan stimulus includes plans for outstanding commercial mortgage-backed securities and newly issued collateralized loan obligations.

April 9 -

New Residential Investment, a real estate investment trust focused on housing, is selling a portfolio of debt with a face value of $6 billion.

March 31 -

Impac Mortgage Holdings suspended all mortgage lending activity for a two-week period effective March 31, citing liquidity constraints at the company's secondary market counterparties as a result of the coronavirus.

March 30 -

One of the largest U.S. mortgage firms catering to riskier borrowers slashed 70% of its workforce, signaling a deep slowdown in that business.

March 27 -

Flagstar Bancorp, one of the nation's biggest lenders to mortgage providers, has stopped funding most new home loans without government backing.

March 23 -

The agency's director said both steps will come as part of an ongoing review of agency rules and show her "commitment under the law to be effective and evidence based” in providing clarity to stakeholders.

February 25 -

Quontic has rolled out a streamlined non-qualified mortgage refinance product that will not require the borrower to provide verifications or documentation.

February 19 -

Finance Minister Bill Morneau is relaxing mortgage qualification rules to make it easier for homebuyers to secure financing, a move that could give Canada's real estate market another boost.

February 19 -

Debt-to-income doesn't perfectly measure a borrower's likelihood of making timely mortgage payments, but it shouldn't be replaced as the ability-to-repay rule evolves, it should be made more flexible instead.

February 5 Platinum Home Mortgage Corp.

Platinum Home Mortgage Corp. -

Now that the Consumer Financial Protection Bureau says it will scrap an unpopular standard for so-called qualified mortgages, the big question is what will take its place.

February 3 -

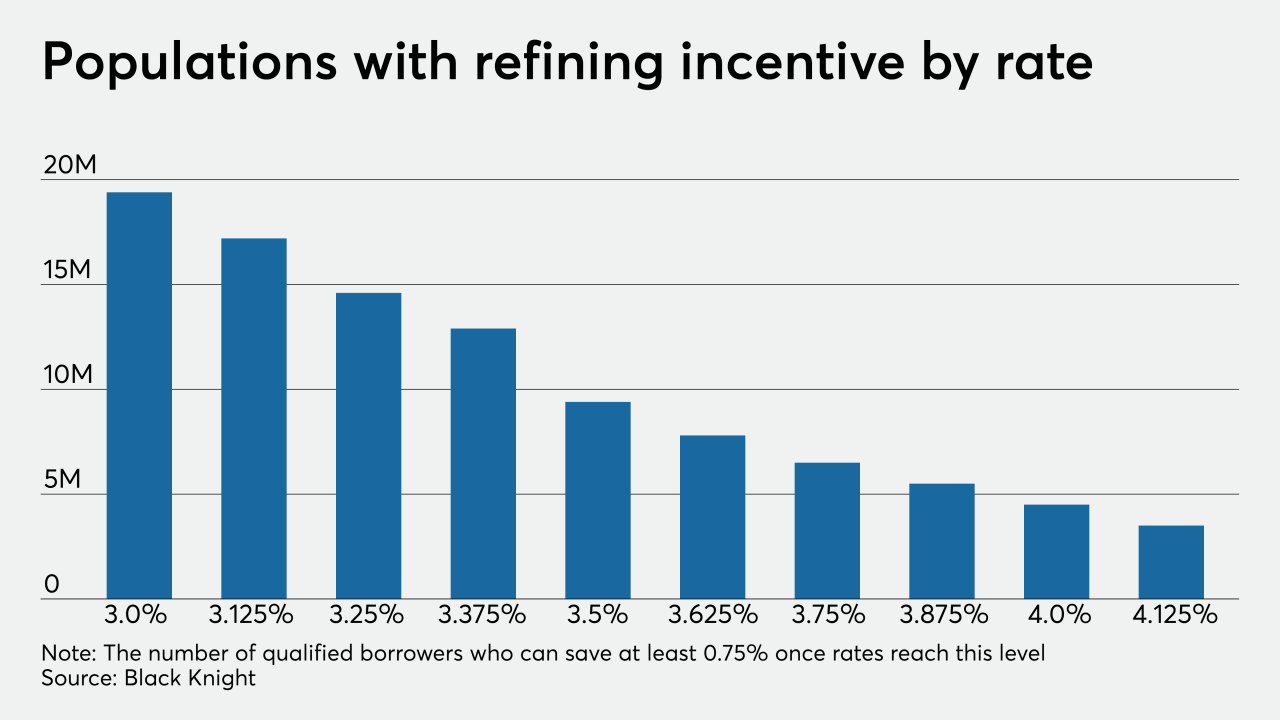

After being range-bound for several weeks, mortgage rates are fluctuating enough to spur significant changes in refi incentive, according to Black Knight.

January 29 -

Non-QM lending is expected to grow again in 2020, but it has some obstacles to navigate. Altisource CRO John Vella shares his insight into the sector and other hot topics.

January 23 -

Director Kathy Kraninger has told lawmakers that the agency will delay the expiration of the so-called QM patch, now set for January 2021.

January 21 -

Fannie Mae is sponsoring a $1.03B CRT transaction, while Caliber Homes Loans, New Residential and Onslow Bay fill the non-QM pipeline

January 14 -

Now is not the time for the government to cut Federal Housing Administration premiums and enter new segments of the housing market.

December 24

-

Changing or eliminating the exemption to the qualified mortgage rule could harm consumers and put smaller lenders at a disadvantage to the big banks.

November 20 Freedom Mortgage Corp.

Freedom Mortgage Corp.