-

Florida's first-ever — and short-lived — climate change czar set a clear priority for the state: Protect the real estate market.

April 27 -

Mortgage fraud risk plummeted in the first quarter of 2020 amid historically low mortgage rates and a boom of refinances, but the coronavirus could create a new set of risks, according to CoreLogic.

April 22 -

Servicers' obligations to advance or temporarily absorb unpaid funds could range from $3 billion to $13 billion per month, according to Black Knight.

April 6 -

Consumer needs are in flux and Top Producers were looking at technology and risks associated with unexpected financial challenges as areas where they weren't yet meeting those needs. The coronavirus only intensified the urgency.

April 1 -

As real estate prices soared in recent years, working-class adults everywhere have increasingly relied on mortgages backed by the Federal Housing Administration — and U.S. taxpayers.

March 25 -

A proposal to tighten financial requirements for government-sponsored enterprise counterparties that sought to lower risk in a volatile market should be suspended, a group representing smaller lenders said, arguing it would aggravate current distress.

March 18 -

Facebook and other social media platforms are a powerful way to connect members and loan officers, but lenders must ensure they first have a culture of compliance.

March 13 Gremlin Social

Gremlin Social -

Insurance brokerage and risk management firm Brown & Brown plans to expand its lender-placed business by combining operations run by two former rivals with healthy respect for each other.

March 10 -

Fannie Mae completed its first two Credit Insurance Risk Transfer transactions of 2020, shifting $1 billion of single-family loan credit risk to insurers and reinsurers.

March 4 -

The Fed’s decision to cut its benchmark interest rate amid growing coronavirus concerns is bound to have an impact on banks, but just how broad and how deep remains to be seen.

March 3 -

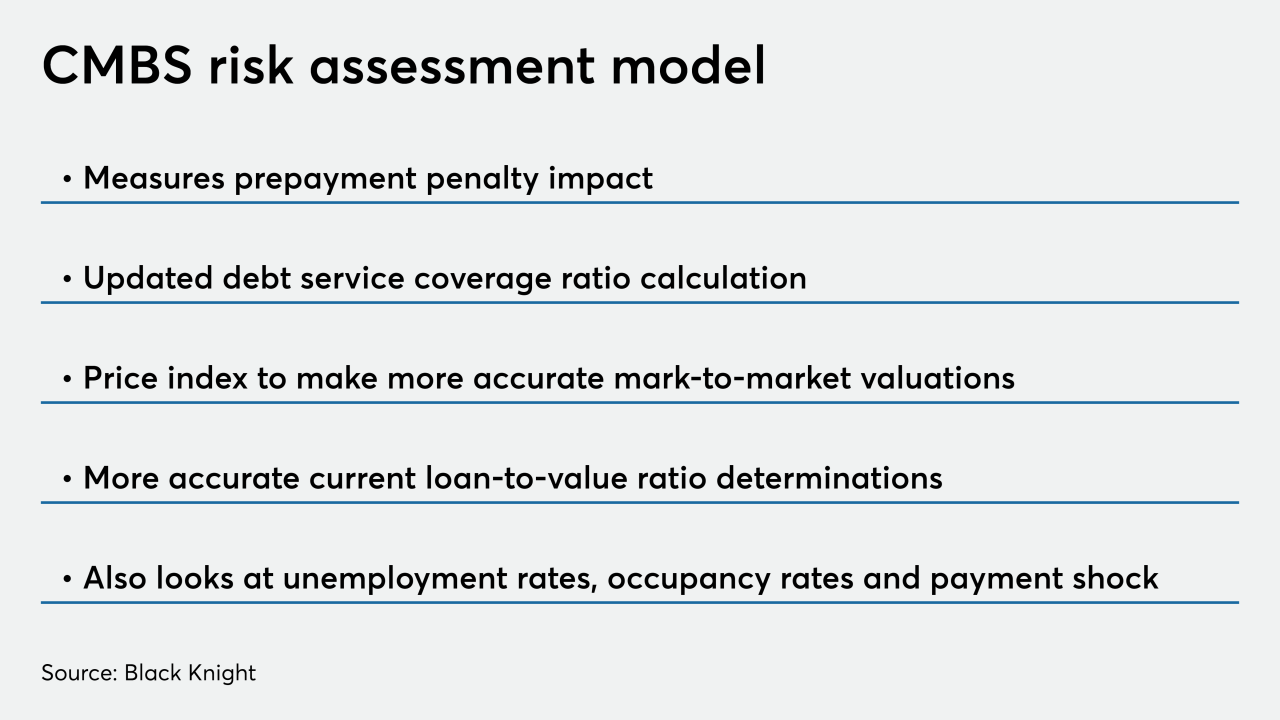

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

Freddie Mac saw a decline in net profit in 2019 due to decreased interest rate income, lower amortization revenue and risk-reducing investment costs, but its consecutive-quarter results improved.

February 13 -

Fannie Mae identified the adoption of hedge accounting and regular issuance of multifamily Connecticut Avenue Securities deals as among strategies it could continue to pursue while navigating regulatory uncertainties and change.

February 13 -

NMI Holdings saw its insurance-in-force grow 38% over the past year as 90% of its clients used its black box pricing module during the fourth quarter.

February 12 -

To paint nonbanks as a source of systemic risk, particularly given the track record of commercial banks in causing the 2008 subprime mortgage fiasco, seems absurd.

February 7 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Mortgages guaranteed by the Department of Veterans Affairs may increase in certain regions due to a new option that can offset a broader fee increase.

February 6 -

The Federal Housing Finance Agency is considering bringing back the idea of imposing stricter criteria for purchasing mortgages in areas where residential Property Assessed Clean Energy financing is available.

January 21 -

Mortgage lenders' uptake of innovations in artificial intelligence, big data and other technologies has been relatively slow. It's an approach that may not be tenable in 2020.

January 16 -

The Federal Housing Administration has implemented defect taxonomy revisions for 2020 that it considers one of several milestone achievements in its efforts to "provide greater clarity and consistency for lenders.”

January 3 -

The FHFA’s attempt to move some of its balance sheet into the private sector could leave investors with greater liabilities than they were initially told.

January 3 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center