-

Mortgage application defect risk is down from a year ago, but Hurricane Florence will likely tear through results in affected areas in the coming months.

September 26 -

A decade after the credit crisis, investors are returning to where it all began. The mortgage sector, blamed in large part for the near-collapse of the global financial system, is now seen by many as a high-quality market forged by fire.

September 14 -

NMI Holdings is laying the groundwork for President Claudia Merkle to replace CEO Bradley Shuster next year.

September 14 -

Future reductions in loan application defect risk are likely because of mortgage lenders' fintech investments, even as the purchase origination share grows, said First American Financial.

August 31 -

Moody's Investors Service downgraded JPMorgan Chase's prime jumbo mortgage originator assessment to its second-highest rating, citing the bank's growing reliance on correspondents with delegated underwriting authority and shortcomings in its technology infrastructure.

August 24 -

Signals are flashing red in the structured credit market, according to Bank of America.

August 13 -

Wells Fargo estimates that in 400 instances, borrowers later went through foreclosure who were improperly denied or not offered a mortgage modification.

August 6 -

Freddie Mac produced modest second-quarter results, reflecting a stabilizing business that CEO Donald Layton compared to a utility company.

July 31 -

Loan defect risk rose in only three states and a handful of metropolitan regions in June thanks to the continuing spread of digital mortgage initiatives that improve data quality.

July 31 -

CoreLogic has updated its Risk Quantification and Engineering tool amid California wildfires to include U.S. Wildfire and U.S. Severe Convective Storm models to support the mortgage and insurance industries in better assessing natural disaster risk.

July 31 -

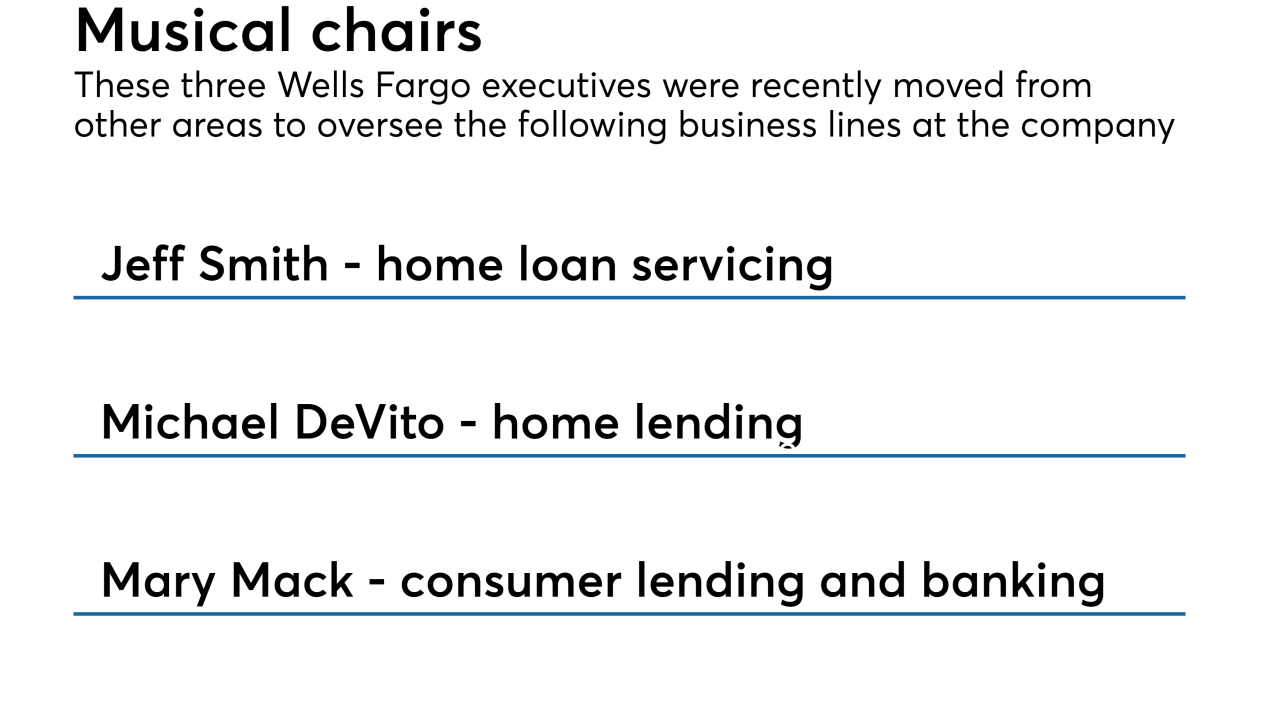

Wells Fargo has named Senior Vice President Jeff Smith to succeed Perry Hilzendeger as head of home loan servicing following Hilzendeger's earlier appointment to head of retail home lending.

July 26 -

The fees that Fannie Mae and Freddie Mac charge for low down payment mortgages disproportionately reflect their risk exposure and make homeownership more difficult for underserved borrowers.

July 23 Milken Institute Center for Financial Markets

Milken Institute Center for Financial Markets -

The high cost of preparing for both CFPB and state exams has a disproportionate impact on small independent mortgage banks that don't have the compliance economies of scale of larger lenders.

July 19 MLB Residential Mortgage

MLB Residential Mortgage -

With better-than-expected performance of the underlying mortgages, Fitch Ratings cut its loss projections for seasoned government-sponsored enterprise credit risk transfer deals.

July 3 -

Credit reporting firms with significant operations in New York will face new cybersecurity and registration requirements to stave off concerns related to a breach of Equifax's systems last year.

June 25 -

Freddie Mac hit the $1 trillion mark on credit risk sharing for single-family mortgage loans with its second lower LTV deal of the year.

June 13 -

Genworth Financial's mortgage insurance business, which had slipped in market share, has more certainty about its future prospects after a federal government committee approved the holding company's acquisition by China Oceanwide.

June 11 -

Private mortgage insurance was used on approximately 4% fewer loans in 2017 when compared with 2016, according to the U.S. Mortgage Insurers.

June 8 -

The ability-to-repay standard is responsible for the reduction in loan application defects over the past four-plus years, according to First American Financial.

May 30 -

As mortgage lenders continue seeking ways get more trustworthy consumers into the housing market, a majority of them are utilizing alternative credit as a means of assessing borrower risk, according to Experian.

May 25