-

Freddie Mac is partnering with Finicity to give lenders access to a new automated process that advances efforts to consolidate borrower-authorized data validation checks used in the secondary market underwriting process.

September 18 -

A mortgage industry executive with ties to a firm penalized in a U.S. predatory lending crackdown is being considered by the Trump administration to run Ginnie Mae, according to people familiar with the matter.

September 17 -

A mere 7-basis-point increase in interest rates reduced what was a record-high number of borrowers with refinancing incentive by 2 million in a matter of days, according to Black Knight.

September 13 -

Independent mortgage bankers reported their highest average profit per loan originated in almost three years, benefiting from a large drop in production expenses, the Mortgage Bankers Association said.

August 29 -

Mortgage-backed securities investors are looking to the specified pool market to counter higher prepayment speeds seen with loans purchased through the TBA window.

August 9 -

Mortgages auctioned off through a HUD distressed loan sale program perform worse than those unsold and are more likely to result in foreclosure, according to a new Government Accountability Office report.

August 2 -

President Trump has signed the Protecting Affordable Mortgages for Veterans Act, which aims to address concerns that rules around certain VA refinances were impeding those loans' inclusion in secondary market pools.

July 26 -

Waterstone Mortgage is now qualifying borrowers without a traditional credit history for both its conventional and government mortgage programs.

July 24 -

Pretax mortgage income at NVR Inc. surged 37% year-over-year in the second quarter while originations rose 1%, contrasting more tepid home-loan earnings results relative to originations at big banks.

July 19 -

A Nomura Holdings Inc. unit will repay customers about $25 million to settle U.S. regulators' allegations that it failed to supervise traders who made false statements in negotiating sales of mortgage securities.

July 15 -

Lenders who employ a technology stack that tracks, collects and analyzes homebuyer behavior will have a distinct advantage as application volume rises.

July 9 NestReady

NestReady -

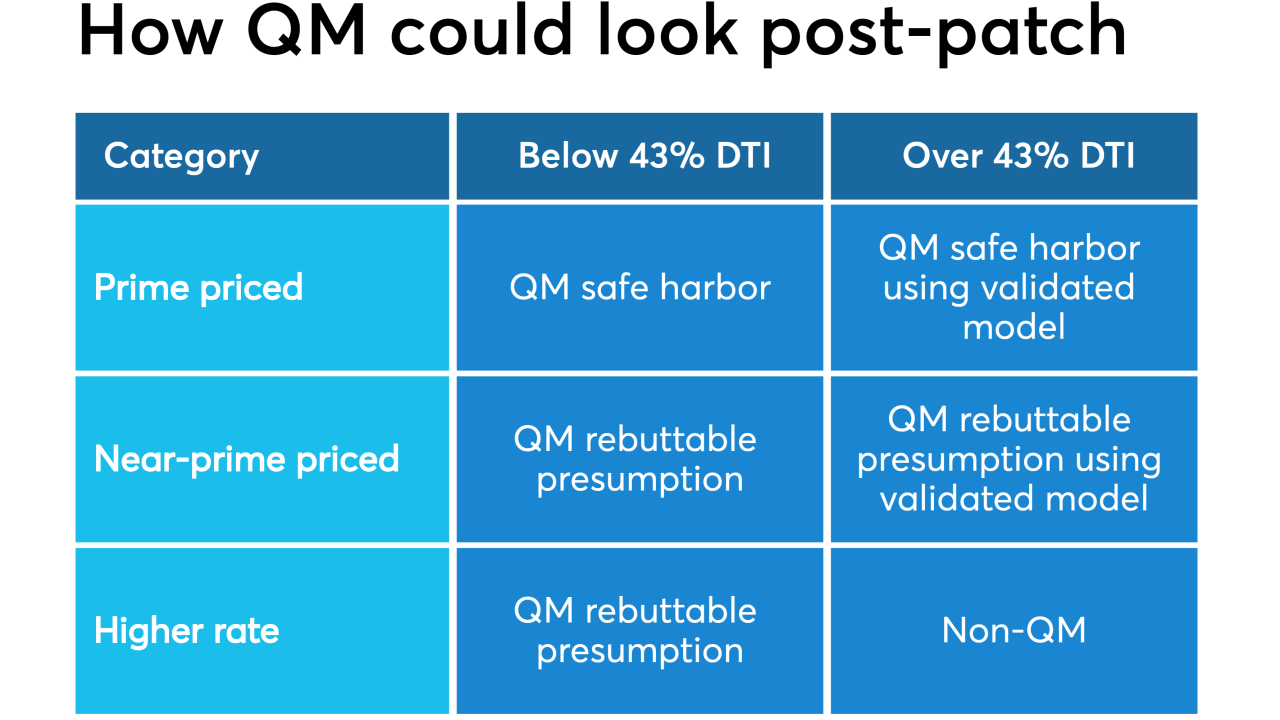

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

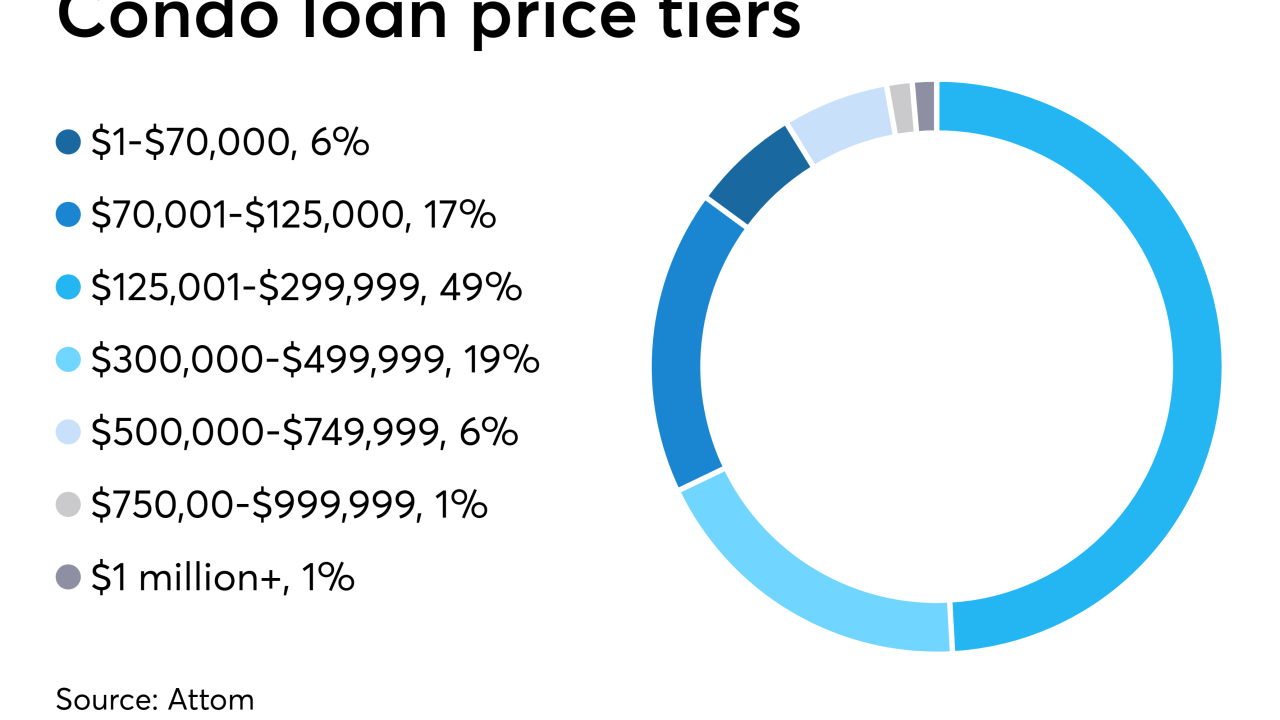

Making low-balance loans with poor economies of scale is tough in a market with slim margins, but it could have its rewards.

June 27 -

Freddie Mac fulfilled its promise to offer a single mortgage that finances the home purchase price and improvements completed after closing.

June 20 -

As officials prepare plans for the government-sponsored enterprises' exit from conservatorship, there's no shortage of speculation about what those plans might look like and how they might affect the mortgage industry.

June 19 -

Housing finance agencies reported increased demand for their loan products, but at the same time the inventory shortage constrains activity and drives them to work with other public entities to find solutions, Moody's said.

June 17 -

Mortgage Industry Advisory Corp. will collect bids Tuesday on behalf of a seller for a more than $1 billion mortgage servicing rights package that includes securitized loans with alternative remittance cycles.

June 17 -

Ginnie Mae is examining whether the shift in business to nonbank issuers has implications beyond the risks it has historically looked at, and identifying advantages that should be nurtured as well.

June 10 -

Independent mortgage banks became profitable again at the start of the year after realizing losses of $200 for each loan they originated in the fourth quarter of 2018, according to the Mortgage Bankers Association.

June 6 -

The assumption that conservatorship can end without significant changes in how the GSEs operate may be the most dangerous one of all.

June 4 Whalen Global Advisors LLC

Whalen Global Advisors LLC