-

The government-sponsored enterprises are going through a transition period. From proposals for rebuilding their capital cushions to tackling shortages in affordable housing, Fannie Mae and Freddie Mac face a number of key challenges with wide-ranging consequences this year.

February 14 -

Late payments on loans backing commercial mortgage bonds continued falling at the start of the year, due to strong new issuance volume and continued resolutions for precrisis loans by special servicers, according to Fitch Ratings.

February 11 -

Och-Ziff Capital is suing BNY Mellon, as trustee, to compel it to calculate interest in a way that is more favorable to the class of securities it holds.

February 6 -

Just as the Trump administration appears focused on releasing a framework without Congress, the Senate Banking Committee has re-entered the policy fray with a new proposal.

February 1 -

Residential mortgage-backed securities servicers are better able to weather a downturn and the resulting loan defaults today versus before the crisis because of their investments in technology and regulatory compliance, Fitch Ratings said.

February 1 -

Ginnie Mae has restricted loanDepot's ability to securitize Veterans Affairs mortgages because of apparent churning of recent originations.

January 30 -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28 -

Plans to begin rating securitizations backed by fix-and-flip mortgages may help lenders create new capacity and satisfy growing demand for short-term financing of house flipping projects.

January 25 -

A security lapse left millions of mortgage records exposed online without proper data protections, according to security researchers.

January 23 -

Rising mortgage rates will only be "a mild deterrent" to home purchase activity during 2019 as other indicators like price and demand will cancel that out, according to Standard & Poor's.

January 23 -

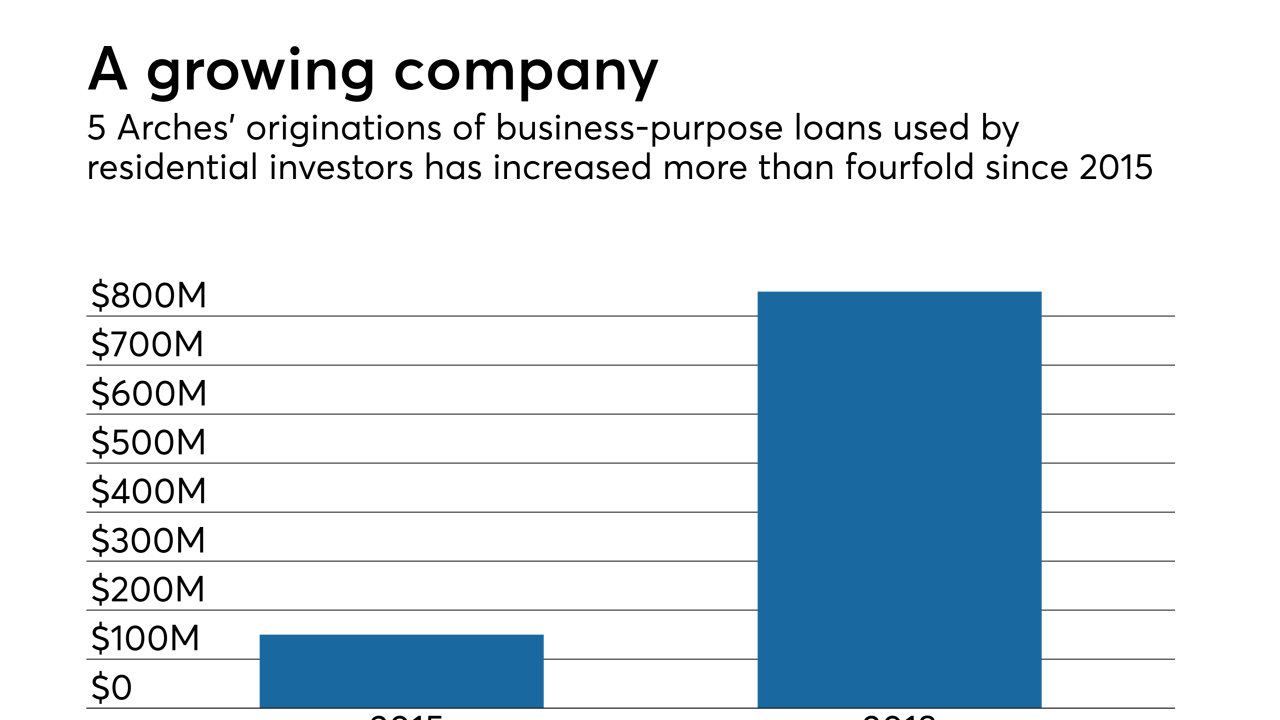

Redwood Trust has exercised its option to expand its minority stake in 5 Arches to 100%, increasing Redwood's exposure to loans used for house flipping and other types of residential investment.

January 23 -

The specialty finance company is contributing all of the collateral for the $259.7 million deal; by comparison, the previous deal included collateral contributed by Goldman Sachs.

January 22 -

Loans in commercial mortgage-backed securities originated after 2009 by nonbank lenders have a significantly higher default rate than those originated by banks, a Fitch Ratings report said.

January 14 -

At Ginnie Mae, Michael Bright worked closely with Congress to fight churn in VA mortgages; he plans to bring the same collaborative approach to the Structured Finance Industry Group.

January 10 -

Michael Bright is resigning as acting president of Ginnie Mae to run the Structured Finance Industry Group, a trade association that's been without a CEO since Richard Johns resigned in July amid a reported split with the group's board.

January 10 -

Due diligence firm American Mortgage Consultants has purchased Meridian Asset Services as part of its continuing efforts to expand through acquisition or organic growth.

January 10 -

Acting Ginnie Mae President Michael Bright will leave his post on Jan. 16 and will no longer seek confirmation to be the permanent head of the mortgage secondary market agency.

January 9 -

Cascade Financial Services has become the only manufactured housing loan-focused servicer currently rated by Fitch, adding signs of a rebound in factory-built home financing that could lead to new private securitization.

January 9 -

Lagging construction, rising interest rates and the broader economy don't really bode well for buyers of commercial real estate, but most CRE lenders still expect originations to increase in 2019, according to the Mortgage Bankers Association.

January 8 -

Freddie Mac completed its first multifamily credit risk transfer transaction that used an insurance/reinsurance structure.

January 4