Technology

Technology

-

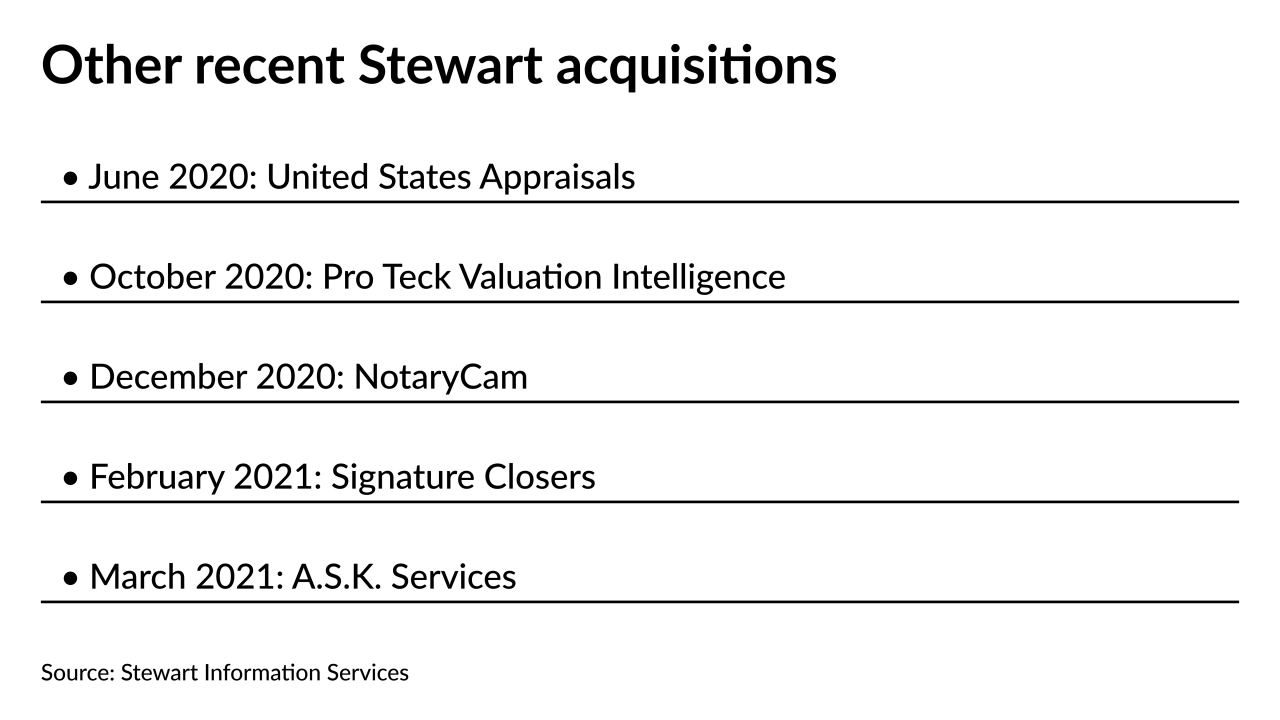

This is the multi-hyphenate company’s sixth deal since the start of 2020 — a series of acquisitions in a variety of sectors within the industry, ranging from analytics to artificial intelligence.

May 28 -

Rather than completing another equity raise, the five-year-old mortgage technology company went looking for a partner.

May 27 -

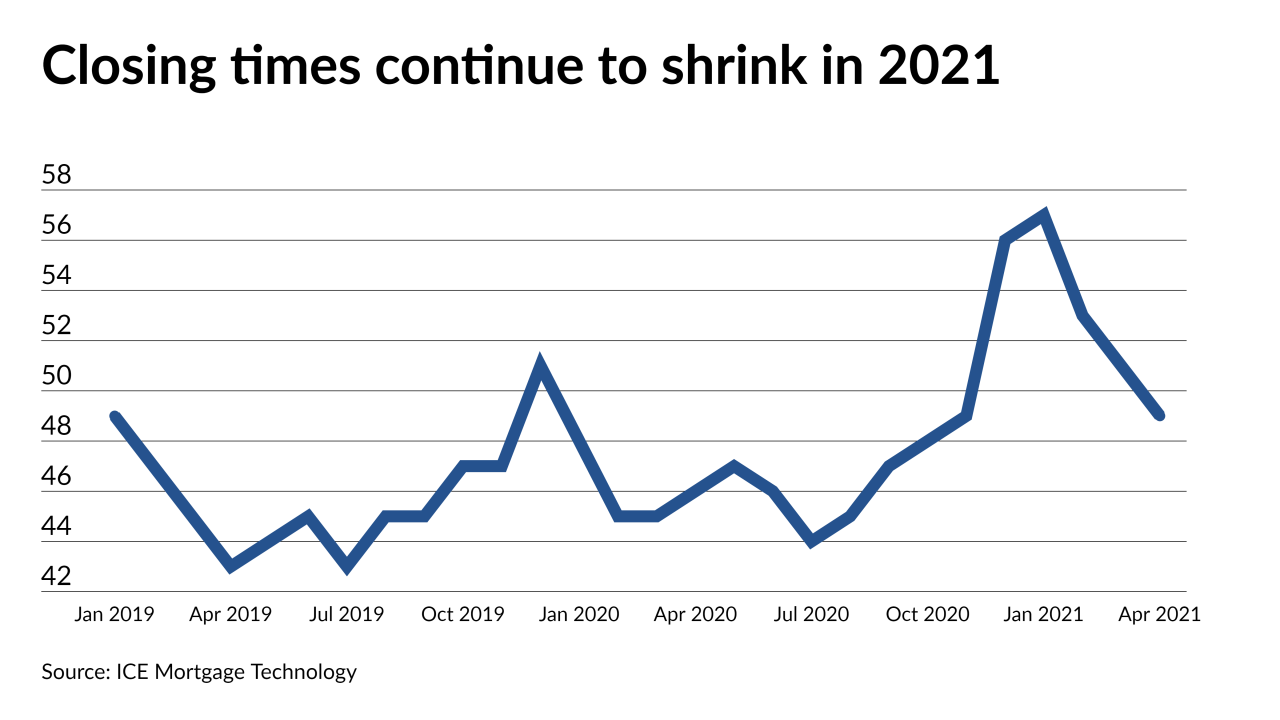

Average days to close dropped closer to pre-pandemic levels in April, according to ICE Mortgage Technology.

May 26 -

The cloud-based mortgage closing platform’s Series D round earned $150 million for the company.

May 25 -

The deal adds to the burgeoning technology stack at the Houston-based title underwriter, which added NotaryCam in December.

May 25 -

Financial institutions said they needed more time to weigh in on issues such as how they use artificial intelligence for fraud prevention and underwriting.

May 17 -

While COVID-19 pushed digitization to the forefront of lending, a majority of borrowers still want some degree of human interaction, according to a survey by ICE Mortgage Technology.

May 13 -

What are the most exciting trends in financial technology today, and which startups are poised to win?

May 11 -

Juliet Weissman of New York City's Cornell Tech campus discusses the role of higher education and partnerships in luring startups and their workforces.

May 10 -

COVID-19 has shown us that technology can rapidly evolve to meet customer needs, in areas from contactless payments to digital banking to mobile wallets. However, we still see great disparities when it comes to the use of contactless and digital banking by low- to moderate-income (LMI) workers. The question is, will emerging tech in the post-COVID economy provide an opportunity to include new people in the financial system-- or leave them even further behind?

-

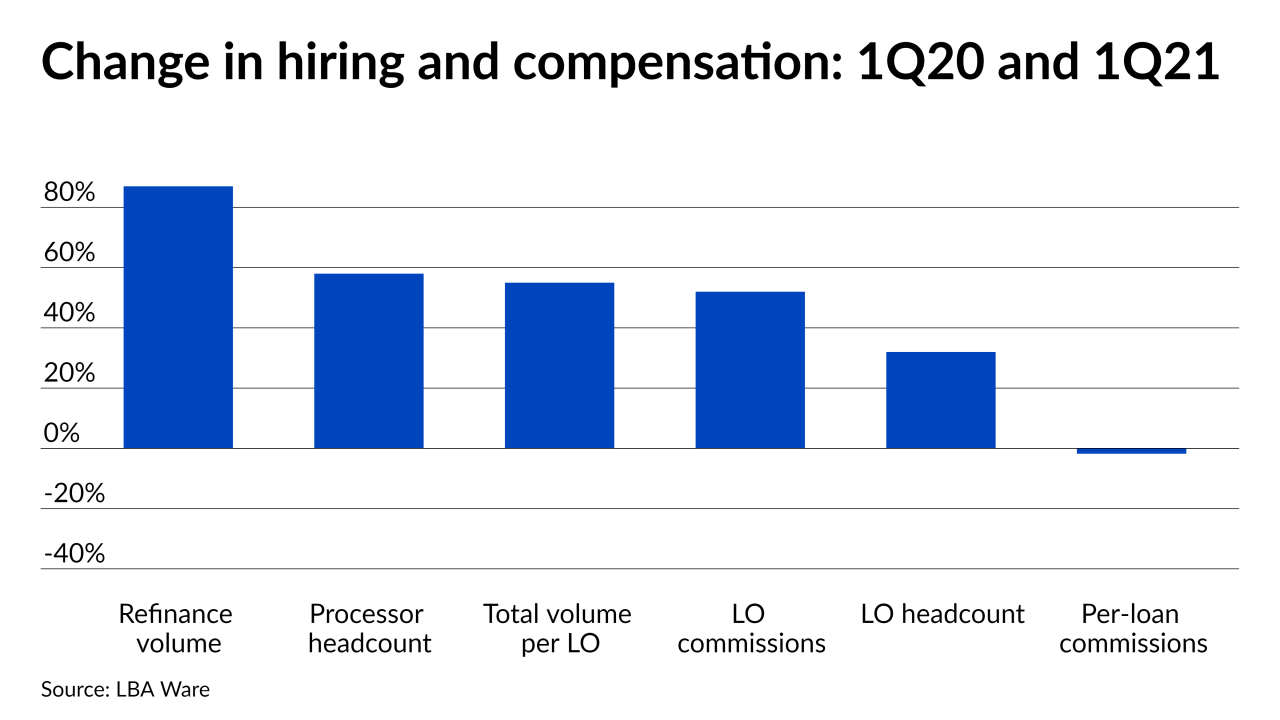

Also, per-loan compensation keeps dropping due to the persistence of refinancing in the mix but it could rise as the purchase share of the market increases.

May 5 -

The digital transformation of payments has reached its next phase — with banks and fintechs leading the way. Avoiding the one-size-fits-all approach to deliver the experience customers want is key.

May 5 -

There are only a handful of servicers who have unlocked the secret to achieving high retention rates, and they are performing over 3x better than the industry average of 18%. How are they doing it? It’s all about the data, writes the head of consumer finance at Jornaya.

May 5 -

There is no doubt 2020 was a year of contactless transactions. But what implications do contactless payments present when it comes to security?

May 4 -

Some say Equifax, Experian and TransUnion are too slow to investigate grievances, prompting more complaints to the Consumer Financial Protection Bureau. But the big three say other forces are at work.

April 30 -

People want their payments to be quicker, safer, and more readily available across a wider range of channels. How are industry leaders leveraging data to build stronger relationships with their clients?

April 29 -

A total of 480,000 customers may have been affected by the duplicate drafts and so far it looks like far fewer than 1% of them incurred non-sufficient funds fees, Mr. Cooper said Tuesday.

April 28 -

The recent compression allays fears that lenders would have difficulty serving the needs of borrowers with time-sensitive purchase contracts during a peak season.

April 27 -

System updates, which may be a result of changes to the Preferred Stock Purchase Agreements, have Community Home Lenders Association members saying loans that were approved previously are getting rejected when put back through.

April 26 -

The incident points to a risk mortgage companies should be aware of as they shift to digital servicing strategies.

April 26