-

Reskilling and giving AI the boring work are two approaches banks take to making agentic AI palatable to workers who may fear that bots will take their jobs.

November 20 -

Thirty-eight TD Bank locations and 24 Flagstar branches are set to shut down. Both banks are coming out of tumultuous periods.

March 14 -

TD has been adjusting its balance sheet to comply with a cap on its U.S. retail banking assets, imposed last year as part of its money-laundering plea.

February 10 -

The Toronto-based bank suspended its medium-term growth targets and announced a full-scale review of its strategies following historic anti-money-laundering failures.

December 5 -

The latest violations come as the bank expects to face more than $3 billion in regulatory fines for anti-money-laundering failures.

September 11 -

Executives at the Toronto-based bank said last year that they planned to add 150 branches in the United States. But when pressed on Thursday, they could not say how much they'll scale back their ambitions due to investigations over TD's anti-money laundering practices.

May 23 -

The New York bank's AI research group has published 400 papers, according to new research from Evident; TD Bank Group's Layer 6 unit published 14 last year. These groups work to solve real-life problems in the business units.

February 22 -

Merger arbitrage traders were expecting hiccups in Toronto-Dominion Bank's proposed takeover of First Horizon, but they were unprepared for its cancellation.

May 4 -

The companies cited an inability to secure regulatory approvals after postponing multiple times a closing that had been originally expected last fall.

May 4 -

The rising number of positions appears to reflect an ongoing need to adjust capacity to address rate-driven demand.

August 7 -

The second-quarter jump in provisions may be three to four times higher than a year earlier and will be mostly for loans that have yet to go bad, analysts said.

May 22 -

DBRS Morningstar and Moody’s Investors Service have assigned preliminary ratings to the Classic RMBS Trust, Series 2020-1 transaction sponsored by Home Trust Co.

February 24 -

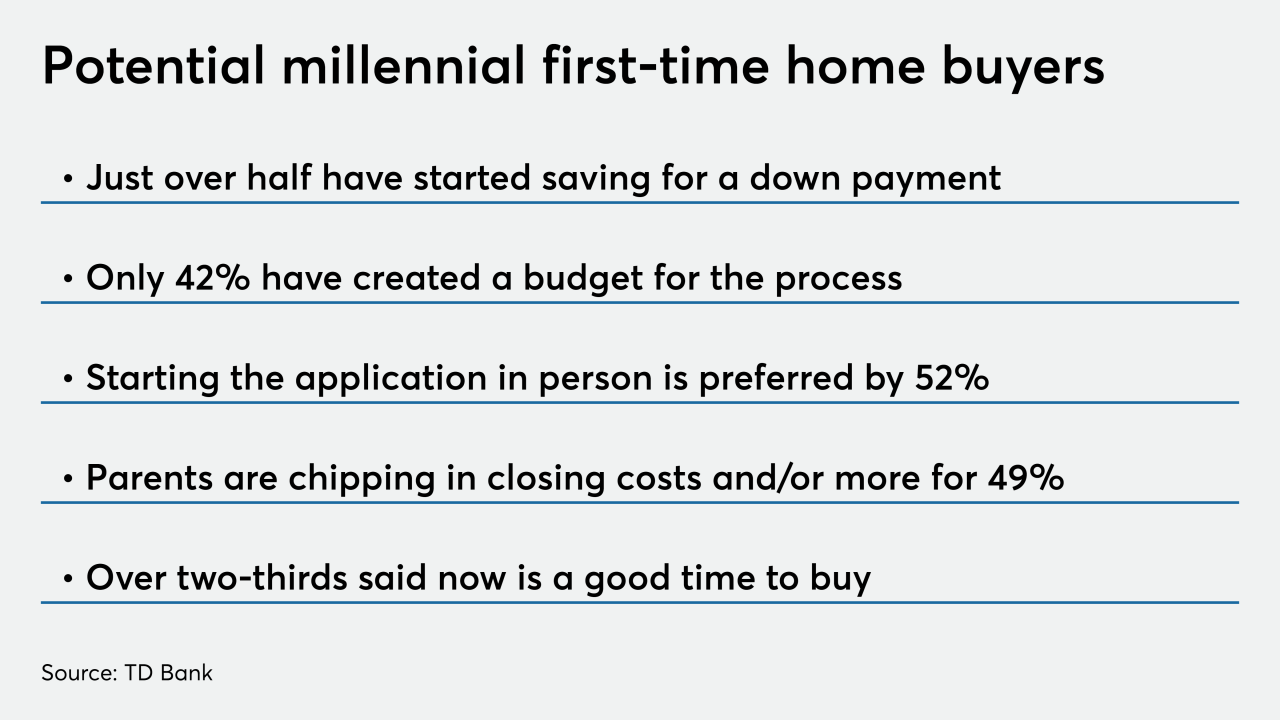

A significant number of millennials planning to purchase their first home during 2020 have not yet taken the financial steps necessary to successfully complete the process, a TD Bank survey found.

January 27 -

A bank, a drug store, another bank: Odds are, a stroll down a random Manhattan avenue devolves quickly into a retail snoozefest.

January 24 -

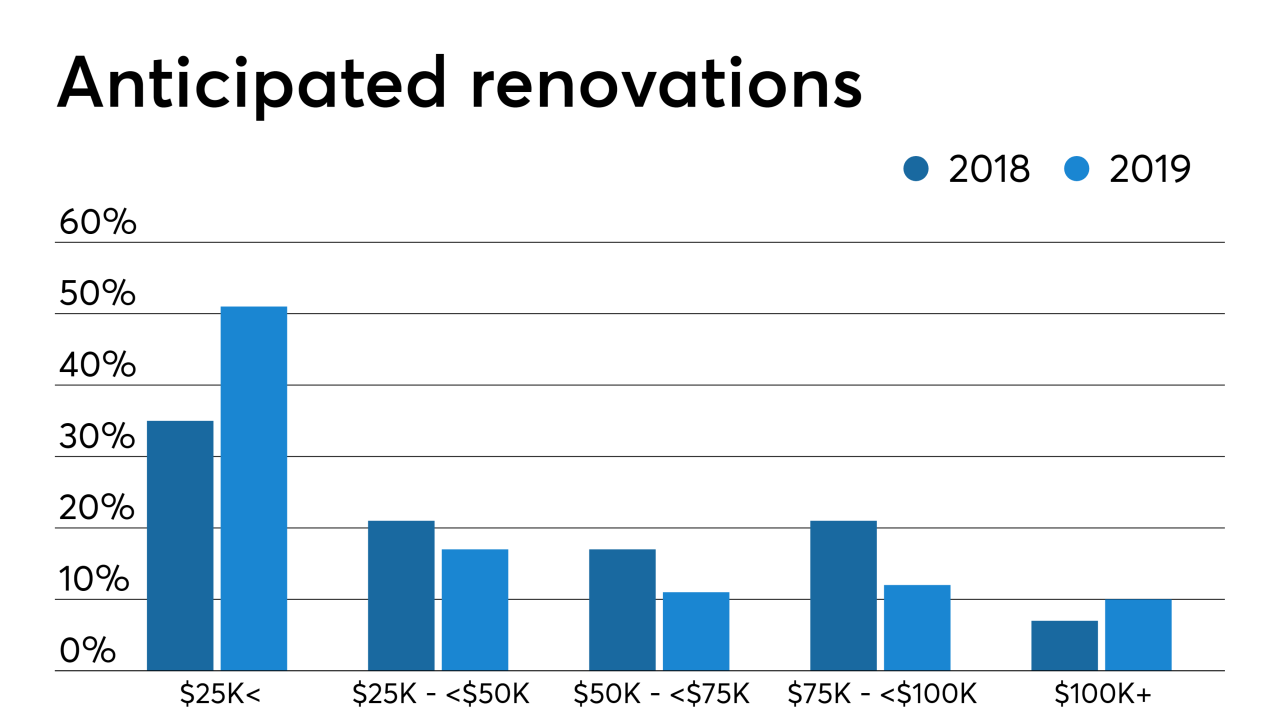

With nearly half of homeowners renovating in the next two years, HELOCs stand as the most likely form of lending sought out by consumers, according to TD Bank.

July 10 -

Mandate for loan officers is to be able to inform on customers' specific financial needs in areas that extend well beyond the home loan.

July 9 -

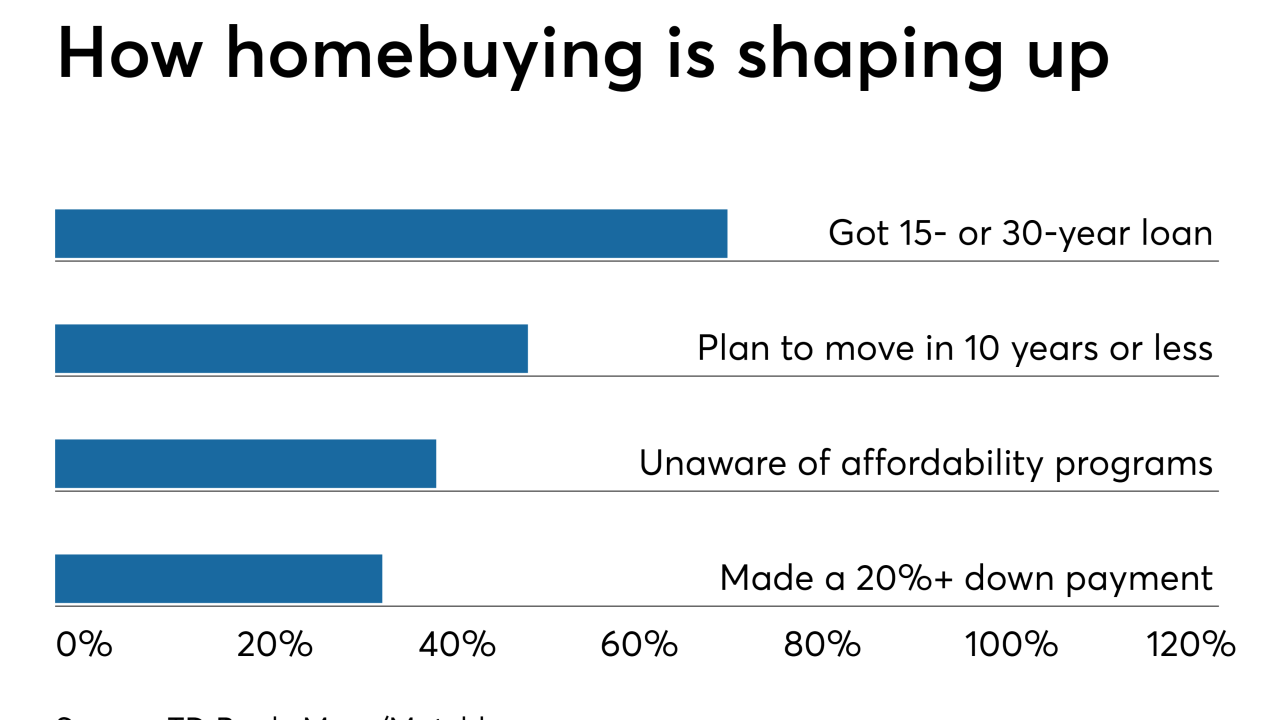

Increased use of the digital mortgage process contributes to improved closing times, but falls short when it comes to borrower education, according to a TD Bank survey.

May 30 -

The two lenders are bucking the trend for the overall industry, which saw year-over-year mortgage growth slide to a 17-year low in March, according to the Bank of Canada.

May 23 -

With the launch of its Medical Professional Mortgage Product, TD Bank is leveraging an opportunity to attract new customers and to address what it says is a knowledge gap among this group of professionals.

March 22 -

Millennials make up the largest cohort of homebuyers, but a quarter of them don't even know their credit score, which could be a call for mortgage lenders to help them prepare to enter the housing market.

March 13