The Senate-approved bill that hadn't yet cleared the House at the time of this writing would fund agencies like HUD through the end of the fiscal year.

A Community Home Lenders of America adds arguments against use of single bureau while another paper takes the position that the idea merits further study.

The new regulation, which passed overwhelmingly in the state legislature, would allow insurers to remove wildfire protections from standard homeowners policies.

Lennar Corp. and Taylor Morrison Home Corp. are among the firms that have worked on the proposal, which calls for builders to sell entry-level homes into a pathway-to-ownership program funded by private investors, according to people familiar with the plan.

Jonathan Yasko pleaded guilty to diverting monies in real estate transactions to cover unrelated closings, and to pay for his own cars and personal travel.

-

Dan Sogorka is leaving Rocket to be with his family in San Diego, while Austin Niemiec's title is unchanged but he will no longer be responsible for retail.

-

Mortgage subsidiary Newrez expects to begin moving borrowers onto the platform by 2027, with the deal marking its second major tech investment this year.

-

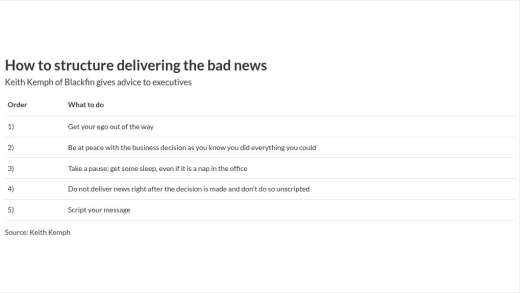

How the message from Sierra Pacific Mortgage could have been delivered in a better, more empathetic fashion rather than leaving affected workers embittered.

-

Michael Strauss faces massive Sprout liabilities as his wife and a former associate launch a new mortgage firm, raising questions about ties to the fallen lender.

-

Preemption would hurt affordability for many, the Conference of State Banking Supervisors and the American Association of Residential Mortgage Regulators said.

-

Primelending produced a pretax loss of $5.2 million in the fourth quarter, significantly lower than the loss of $15.9 million in the same period a year earlier.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

If they exit conservatorship, Fannie Mae and Freddie Mac might increase fees or retain servicing rights, shrinking their market share, according to the Chairman of Whalen Global Advisors.

-

True ROI in mortgage tech comes from business goals, not operational fixes, writes the Chief Growth Officer of Rocktop Technologies.

-

ChatGPT is changing how borrowers search. If your mortgage business isn't showing up in AI answers, your website may no longer be your best storefront, writes the founder of Mortgage Advisor Tools.

As interest rates rise, pressure to deliver a better customer experience is becoming more intense

The path to artificial intelligence implementation can be costly and arduous. Are financial leaders reaping the benefits?

-

The service offered by Halcyon is aimed at diversifying lender revenue and strengthening relationships with borrowers.

- ON-DEMAND VIDEO

The Federal Open Market Committee meets Dec. 12 and 13 and in addition to their statement, they will issue a Summary of Economic Projections.

-

Sergey Dyakin, CIO of Celink, outlines the nuances of implementing new technology in the HECM servicing business

- Partner Insights from Lender Price

- Partner Insights from Lender Price

- Partner Insights from Lender Price

- Partner Insights from Lender Price