Poor credit is a barrier for many Black homebuyers, blocking them from mortgages and contributing to racial gaps in homeownership.

The Consumer Financial Protection Bureau said in a new circular that it's still watching for attempts to get borrowers to sign away rights that can't be waived.

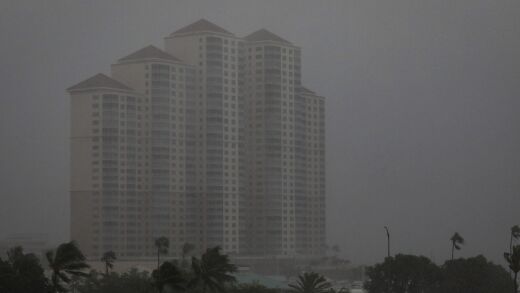

Over 1 million single-family and multifamily homes along the coast are at risk of storm surge damage.

Washington Federal Bank and Planet Home Lending are both off the hook for the remainder of their consent orders, which the bureau quietly terminated.

Nearly 20% of homeowners had a mortgage rate of at least 6% in the second quarter of this year, signaling Americans are warming up to higher rates, Redfin said.

-

Citigroup Inc. Chief Executive Officer Jane Fraser met with President Donald Trump on Wednesday to pitch public stock offerings for mortgage giants Fannie Mae and Freddie Mac.

-

MBA urges GSEs to drop tri-merge credit rule, calling it outdated and costly as FHFA weighs broader credit reporting and scoring reforms.

-

One loan sale is planned for Wednesday, while the other is tentatively happening in September. All-in-all, the two offerings are worth close to $1 billion.

-

The company also added a new marketing executive to drive growth, with current expansion coming after it also secured an origination purchase deal last month.

-

While the company exceeded analyst expectations on several fronts, its Q3 outlook includes softer revenue and a slide back into negative EBITDA.

-

With federal oversight easing, Rhode Island joins states pushing cybersecurity laws for finance companies not covered by federal bank regulators.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Today, LinkedIn is the de facto standard to connect with other business executives on social media.

-

Though the bulk of the ambitious Housing New York plan is intended to build or rehabilitate rentals, there are several homeownership components as well.

-

Previously there were a few larger institutions assuming the majority of the risk in the mortgage servicing market, but now this risk is more evenly distributed across smaller institutions.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland