The rule, effective July 7, puts into place requirements similar to those for banks, except nonbanks do not have to make community investments or grants.

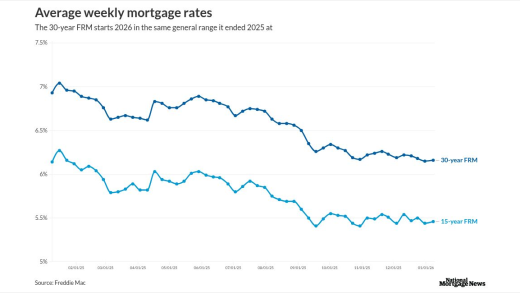

For the second consecutive week, the 30-year fixed rate mortgage increased as investors were still sorting through the lack of information due to the shutdown.

The lawsuit accuses Village Capital of failing to pay full price for servicing assets and refusing to reimburse Change for a large Ginnie Mae payment.

The company reported net income of $5.6 million in 2025, up 61.9% from the year prior, while mortgage banking revenue decreased by $120,000, or 39.5%.

-

Financial markets took a tumble Monday morning after Federal Reserve Chair Jerome Powell announced that he was the subject of a Justice Department inquiry concerning the central bank's headquarters renovation. Lawmakers and former Fed officials decried the move as political intimidation.

-

Continuing to retreat from Biden-era rules, the Consumer Financial Protection Bureau and Department of Justice withdrew a 2023 advisory opinion that had cautioned about denying credit to immigrants.

-

A new move that would open up more use of certain dedicated savings accounts for home purchase purposes is under consideration, according to Politico.

-

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting.

-

The survey, taken before Pres. Trump's $200 billion MBS buy demand, finds panelists worried over inflation, but also see employment as the larger downside risk.

-

But a senior administration official said the DOJ, not Pulte, is behind the subpoena that relates to Powell's congressional testimony about Fed building renovations.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Replacing title policies with attorney opinion letters could exacerbate consumer and lender risks now and into the future, writes the president of Incenter's Boston National Title Agency.

-

We should use the extra time we have to increase our focus on helping people wherever they are in the housing journey, writes the Executive Vice President of Corporate Strategy at Clear Capital.

-

Republican control of the House of Representatives means that CFPB could be sidelined for years, writes the Chairman of Whalen Global Advisors

-

From finding new efficiencies to redefining the customer experience; fintechs are permanently changing financial services. But what does the actual acquisition process look like?

-

The coronavirus pandemic has turned every industry on its head. For lending, it exposed the need for modernized, fully digital platforms.

-

Banks, lenders, and fintechs have been on a path toward digitizing the mortgage process from end-to-end — long before the term coronavirus entered our daily lexicon. How has the pandemic affected progress?