In a contentious House Financial Services Committee oversight hearing, Treasury Secretary Scott Bessent sidestepped questions on the Trump family crypto conflicts of interest and inflation with pugnacious responses to Democratic lawmakers' questions.

Propy, a real estate technology company, tapped the private credit market for the first time, securing $100 million to support the startup's acquisition strategy.

Many servicing metrics look weaker amid lower rates although valuations can vary depending on companies' models, operations and portfolio composition.

In a contentious House Financial Services Committee oversight hearing, Treasury Secretary Scott Bessent sidestepped questions on the Trump family crypto conflicts of interest and inflation with pugnacious responses to Democratic lawmakers' questions.

After four years, the senior note classes will either pay a 100 basis-point increase to the fixed coupon or the net weighted average coupon (WAC) rate, whichever is lower.

-

Federal Reserve Gov. Stephen Miran, who had been on a leave of absence from his position as Chair of the White House Council of Economic Advisers since he was confirmed to the central bank in September, resigned his CEA role Tuesday to uphold his promise to resign his White House role if he remained past the expiration of his term, which concluded Jan. 31.

-

Property inspection waivers were granted on 40.2% of the underlying mortgages, reflecting an increasing trend of agency mortgages being originated without them.

-

The partial US government shutdown is on track to end later Tuesday after the House passed a funding deal President Donald Trump negotiated with Senate Democrats, overcoming opposition from both ends of the political spectrum.

-

As measured by earnings available for distribution at the REIT, Two posted a profit of $0.26 per share but this was well below the consensus estimate of $0.37.

-

Mortgage rate trends in late 2025 led the lender into the red in the fourth quarter, even as Newrez originations picked up from the prior quarter and year.

-

Lennar Corp. and Taylor Morrison Home Corp. are among the firms that have worked on the proposal, which calls for builders to sell entry-level homes into a pathway-to-ownership program funded by private investors, according to people familiar with the plan.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

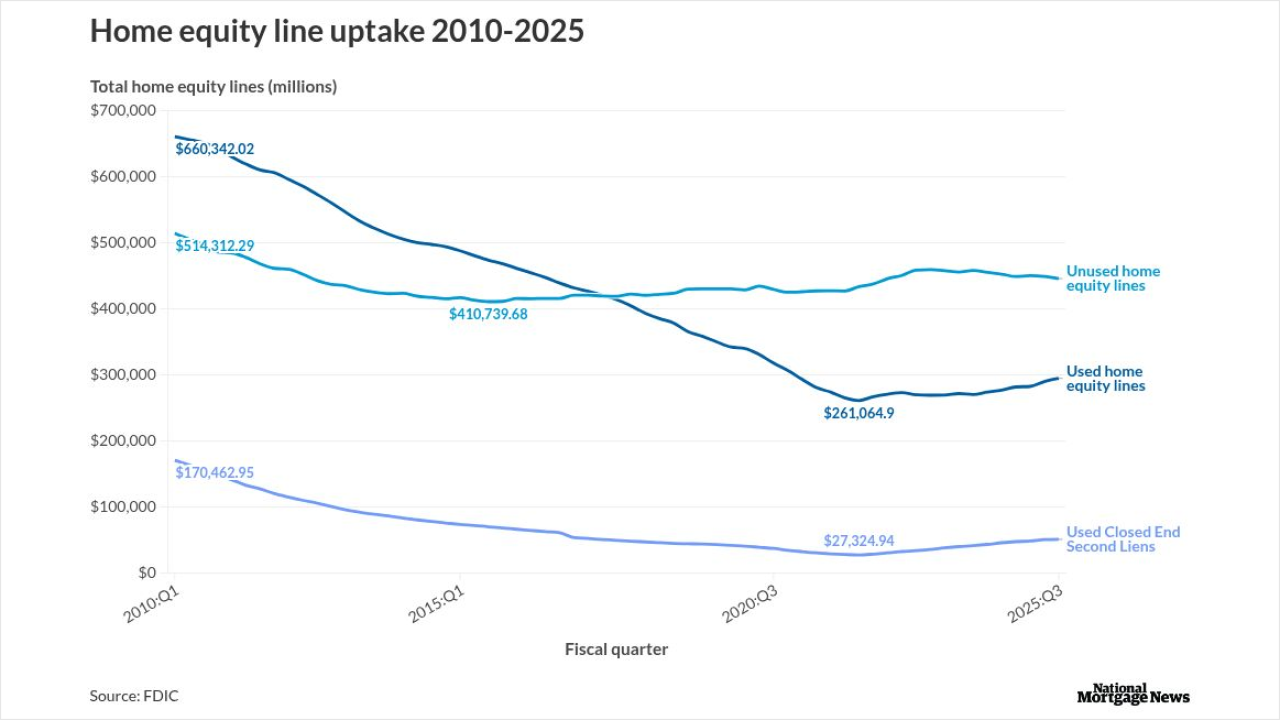

Billions in home equity sit untapped as second-lien loans struggle to gain traction, writes the chairman of Whalen Global Advisors.

-

Years ago, the Federal Housing Administration helped finance thousands of loans for manufactured housing. An effort to restart that program would help millions of Americans afford their own homes.

-

Non-QM's rapid rise is reshaping how lenders underwrite and manage risk, setting a model the rest of the industry will follow, writes the founder of Prudent AI.

Mortgage industry leaders say technology, whether in training or implementation, isn't effective without consistent, thoughtful human guidance.

Mortgage companies are looking for ways to open up credit to more borrowers, but insurance-cost spikes have made a difficult situation more challenging.

- ON-DEMAND VIDEO

The Federal Reserve began cutting rates in September. The December meeting is its last of 2024. Will the cutting continue, or will there be a pause? Doug Peta, Chief Strategist, U.S. Investment Strategy, at BCA Research, discusses the meeting and future policy.

- ON-DEMAND VIDEO

The Federal Open Market Committee is expected to cut interest rates at its September meeting, which will also provide a new Summary of Economic Projections. Marvin Loh, senior macro strategist at State Street Global Markets, examine the meeting, the SEP and Fed Chair Powell's press conference.

- ON-DEMAND VIDEO

Matthew McQueen, Head of Municipal Banking and Markets and Global Mortgages within the Global Markets business at Bank of America, sits down with Bond Buyer Executive Editor Lynne Funk to talk about getting deals done amid an uncertain global macroeconomic landscape.