Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

While distressed mortgage rates continued the fall’s short-term slide, serious delinquencies are three times higher than the year-ago total, according to CoreLogic.

January 12 -

The deal will add to SitusAMC’s tech suite, making the connection between loan originators and lenders more efficient.

January 11 -

A slowdown in the increase of loans exiting forbearance “implies that those who were able to absorb the shock of the pandemic and get back on their feet, may have already done so,” said Andy Walden, Black Knight economist.

January 8 -

December’s housing market sentiment hit a seven-month low, indicating that inventory could be further constrained by sellers waiting for a better time to list, according to Fannie Mae.

January 7 -

As housing and lending companies try to eradicate racism and bias from their industries, automated valuation tools could help reach that goal, according to the American Enterprise Institute.

January 5 -

With limited plan removals due to the holidays, mortgages in coronavirus-related forbearance rose by 15,000, according to Black Knight.

January 4 -

Remote online notarization helped originators close loans amid social distancing measures, but complex local laws remain a barrier to its widespread use.

December 30 -

The agency's request for input will shape how mortgages underwritten by Fannie Mae and Freddie Mac handle appraisals and curb risk.

December 29 -

Despite intensified demand and plummeting inventory, consumer home purchasing power made gains behind falling interest rates in October, according to First American.

December 28 -

High property value growth can be locked in through proximity to one of the top amenities an area can have: grocery stores.

December 23 -

About 4,400 loans started the foreclosure process in November, alongside 176,000 mortgages in active foreclosure.

December 22 -

The forbearance rate rose behind slowed economic recovery, according to the Mortgage Bankers Association.

December 21 -

The new bill ordering $600 stimulus checks and $25 billion in emergency rental assistance won't be enough to help millions of Americans struggling to make housing payments, according to industry watchers.

December 21 -

With infection rates rising and unemployment claims increasing since Thanksgiving, mortgages in coronavirus-related forbearance rose by 37,000 last week, according to Black Knight.

December 18 -

The boom continues, with refinances making up a 61% share of all mortgage loans issued that month, according to Ellie Mae.

December 17 -

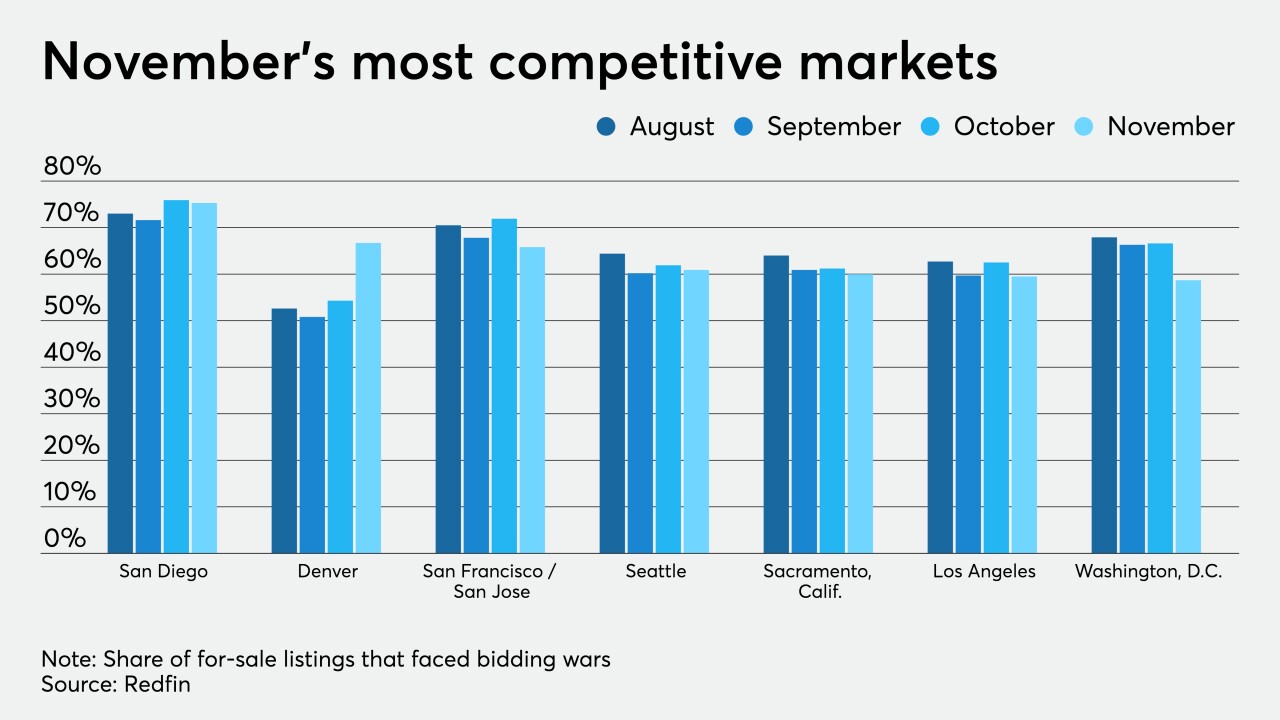

While the haggling tapered off slightly alongside the housing market’s seasonal slowdown, home sales remained five times more competitive than the year before, according to Redfin.

December 16 -

With coronavirus inoculations underway and government stimulus likely to come, the outlook for next year’s housing market and lending environment grew more optimistic in December.

December 15 -

The forbearance rate continued its improvement, but the surge of COVID-19 cases could lead to more borrowers needing mortgage relief, according to the Mortgage Bankers Association.

December 14 -

The largest concerns are with pandemic risk and defaults, along with business resilience and adaptability, according to a Wolters Kluwer survey.

December 14 -

While 12,000 mortgages exited forbearance, the most borrowers entered forbearance protection in a week since early September, according to Black Knight.

December 11