Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Median home prices rose annually in 74% of Opportunity Zones across the country in the third quarter, with 53% growing by 10% or more, according to Attom Data Solutions.

November 12 -

More than six months after the CARES Act became law, the two entities joined a host of industry organizations in launching the COVID Help for Home campaign to educate borrowers on the next steps in forbearance.

November 11 -

The overall mortgage delinquency rate improved in the third quarter as the economy got healthier while late-stage delinquencies hit a decade high, according to the Mortgage Bankers Association.

November 11 -

While moratoria keep foreclosures low compared to last year's rates, October activity jumped 20% from September, according to Attom Data Solutions.

November 10 -

Plans for a first-time homebuyer tax credit and expanded affordable housing opportunities may be attractive to lenders, but they’re wary of increased regulation.

November 10 -

The forbearance rate continued recovering in lockstep with employment improvement, according to the Mortgage Bankers Association.

November 9 -

A number of unknowns about the election and the coronavirus response kept consumer confidence in check, according to Fannie Mae.

November 9 -

Under 2.9 million borrowers sit in coronavirus-related forbearance as GSE-backed mortgages drove the latest decrease, according to Black Knight.

November 6 -

Growing equity levels increased the share of equity-rich and pulled borrowers out from underwater in the third quarter, according to Attom Data Solutions.

November 5 -

More borrowers between 21 and 40 are leveraging the historically low mortgage rates to either buy their first homes or slash their monthly payments, according to Ellie Mae.

November 4 -

The race enters a complicated phase that could impact financial markets.

November 4 -

With a dearth of inventory, September generated the largest price growth in the housing market since May 2014, according to CoreLogic.

November 3 -

Getting ahead of the next wave of mortgage fraud calls for rock-solid systems with several protective tools deployed at once. But that only goes so far without the proper employee preparation.

November 3 -

The forbearance rate improved to the a level not seen since early April, but getting back to pre-COVID levels will require employment gains or additional government stimulus measures, according to the Mortgage Bankers Association.

November 2 -

Meanwhile, the delinquency rate is up 89% year-over-year, according to Black Knight.

November 2 -

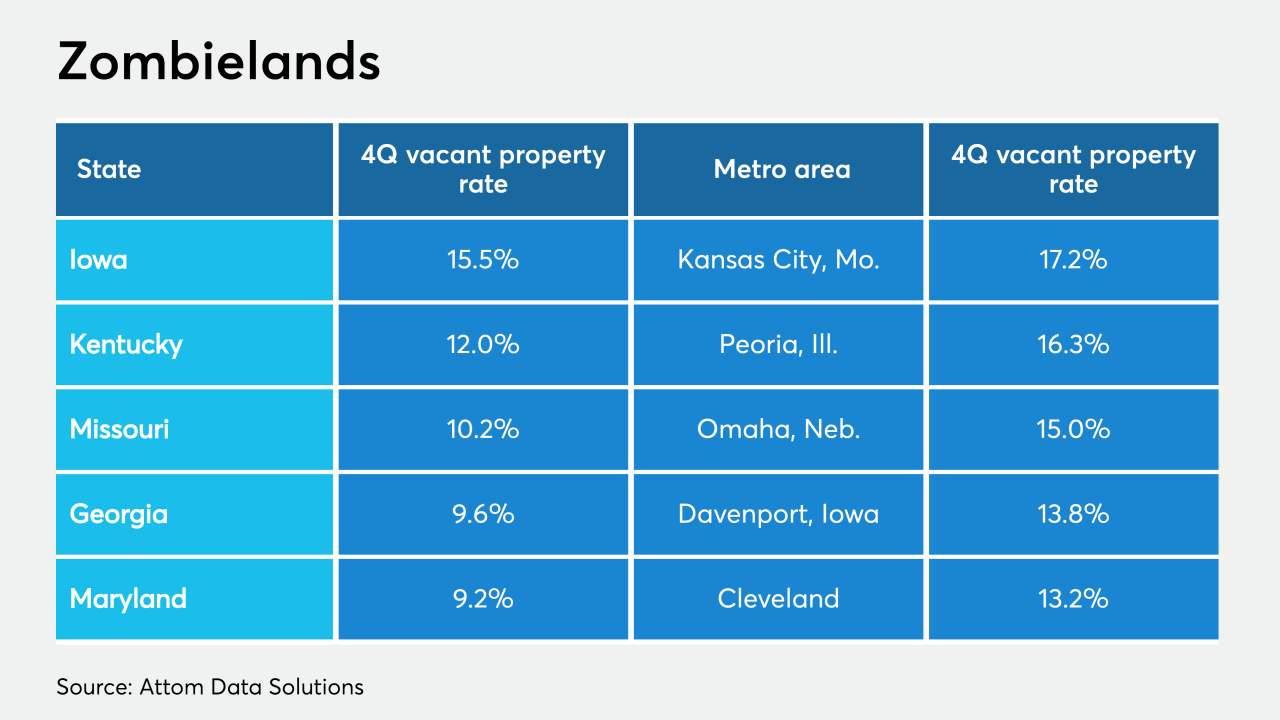

While the total foreclosures continued to fall with coronavirus moratoria in place, the share of zombie properties rose in the fourth quarter, according to Attom Data Solutions.

October 30 -

Mortgage application fraud risk dropped drastically from 2019 with the spike in refinances, but the fallout from the coronavirus means next year could come with more risk, according to CoreLogic.

October 28 -

Black borrowers locked in an average mortgage rate of 4.44% for conventional loans — 15 basis points higher than white borrowers, according to an analysis of HMDA data by the National Association of Real Estate Brokers.

October 28 -

With the real estate market in desperate need for more housing stock, some industry leaders are pinning their hopes on governmental policies to make building more affordable. But how the two presidential candidates may approach these issues varies greatly.

October 27 -

A booming housing market contrasts with a slow-to-improve job market, making for lopsided improvement in the number of troubled mortgages, according to numbers from the Mortgage Bankers Association.

October 26