Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

The deal between the two fintechs aims to cut mortgage decisioning times for lenders and expand access to financing for consumers.

November 16 -

The fintech’s algorithms are programmed like "Tesla’s self-driving cars," according to the company’s CEO.

November 15 -

The majority of prospective home sellers want to list their properties in the next six months, according to a recent survey by Realtor.com.

November 11 -

Mortgage defaults, bank repossessions and auctions rose for the third month in a row, according to Attom Data Solutions.

November 10 -

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

The two fintechs look to streamline document capture and credit decisioning for lenders.

November 8 -

The two fintechs’ venture looks to solve the long-standing problem of connectivity as the barrier to full lending digitization.

October 21 -

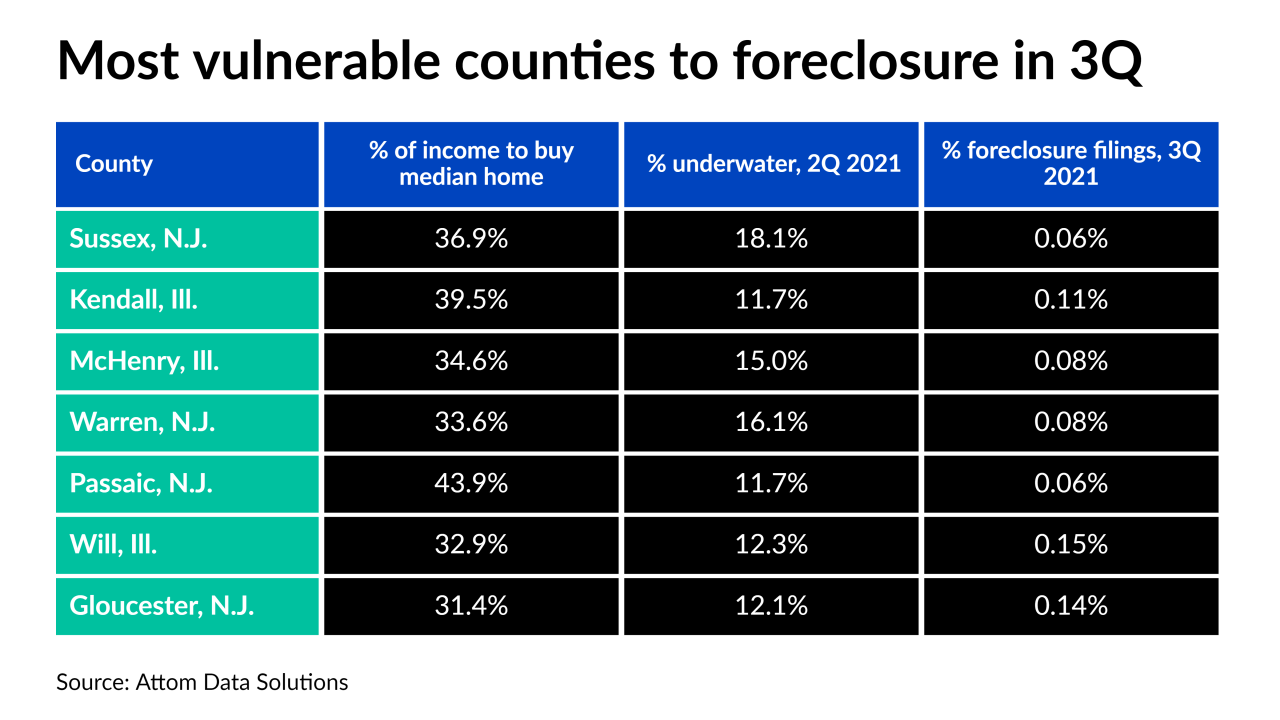

Counties in the West faced the least risk from pandemic distress in the third quarter, according to Attom Data Solutions.

October 21 -

The financial services technology provider will leverage multiple data sources to verify borrower salaries at a “flip of a switch.”

October 20 -

Listing times, price appreciation and inventory of for-sale homes all made incremental gains in favor of buyers, according to Zillow

October 19 -

The lack of inventory pushed the median housing price to double-digit annual growth for the 14th straight month, according to Redfin.

October 15 -

Rising inflation and moves by the Federal Reserve are expected to fuel interest rate growth into 2022.

October 14 -

Following the federal moratorium’s end, the number jumped, marking the highest quarterly growth on record, according to Attom Data Solutions.

October 14 -

But overall improvement in September employment numbers are likely to encourage the Federal Reserve to begin tapering their asset purchases.

October 8 -

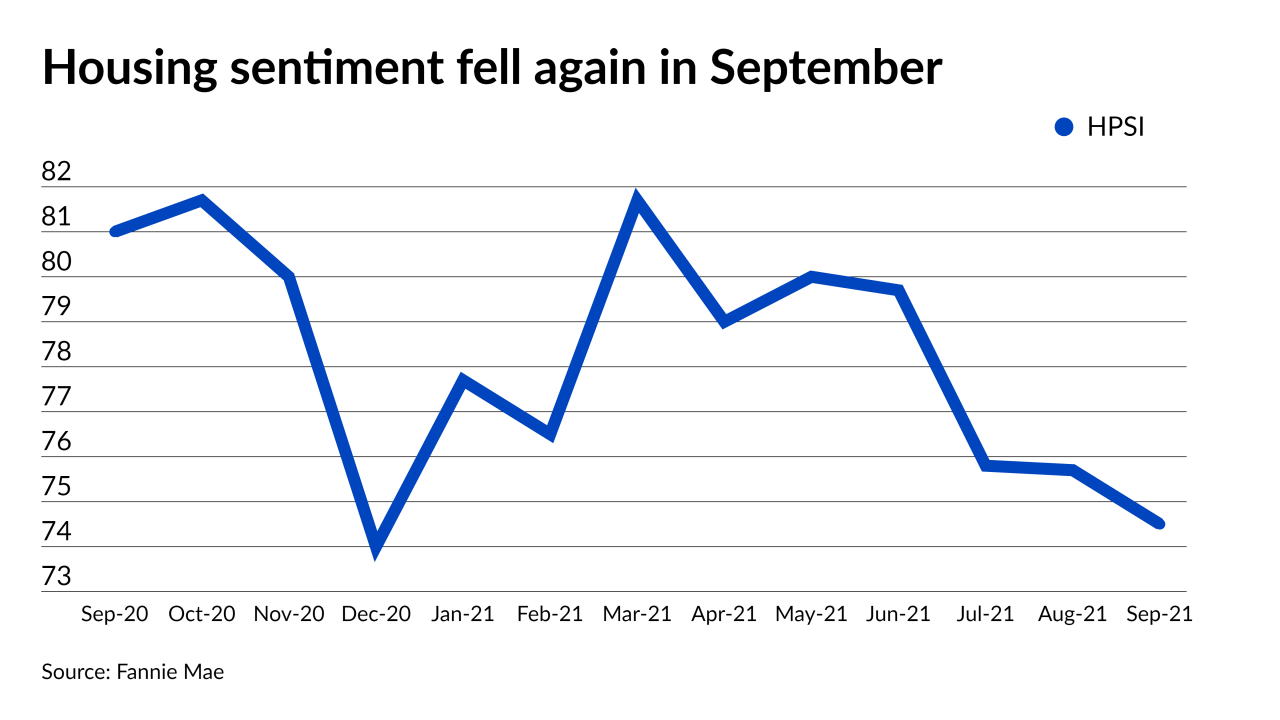

The share of borrowers who thought it was a good time to buy hit an all-time low, according to Fannie Mae.

October 7 - NMN - DEI

Industry professionals share their experiences of racism and sexism on the job and offer the best ways to help eliminate it.

October 6 -

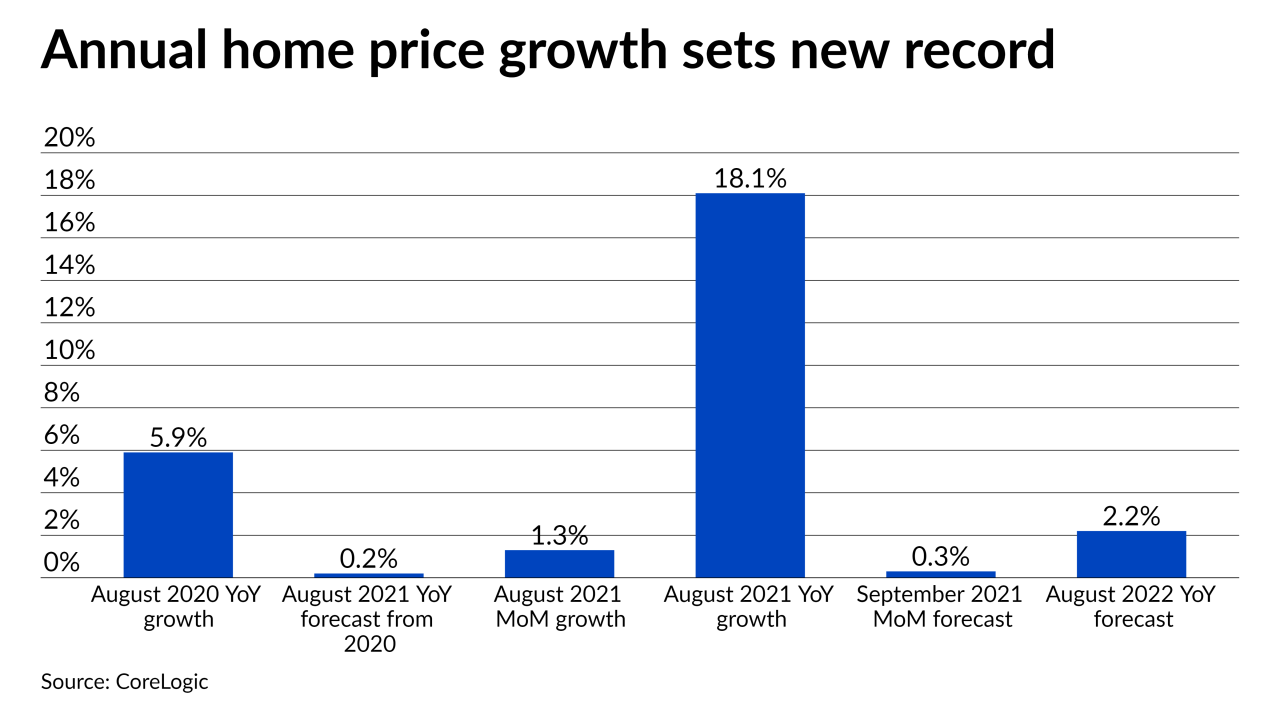

Appreciation more than tripled the year-ago rate, according to CoreLogic.

October 5 -

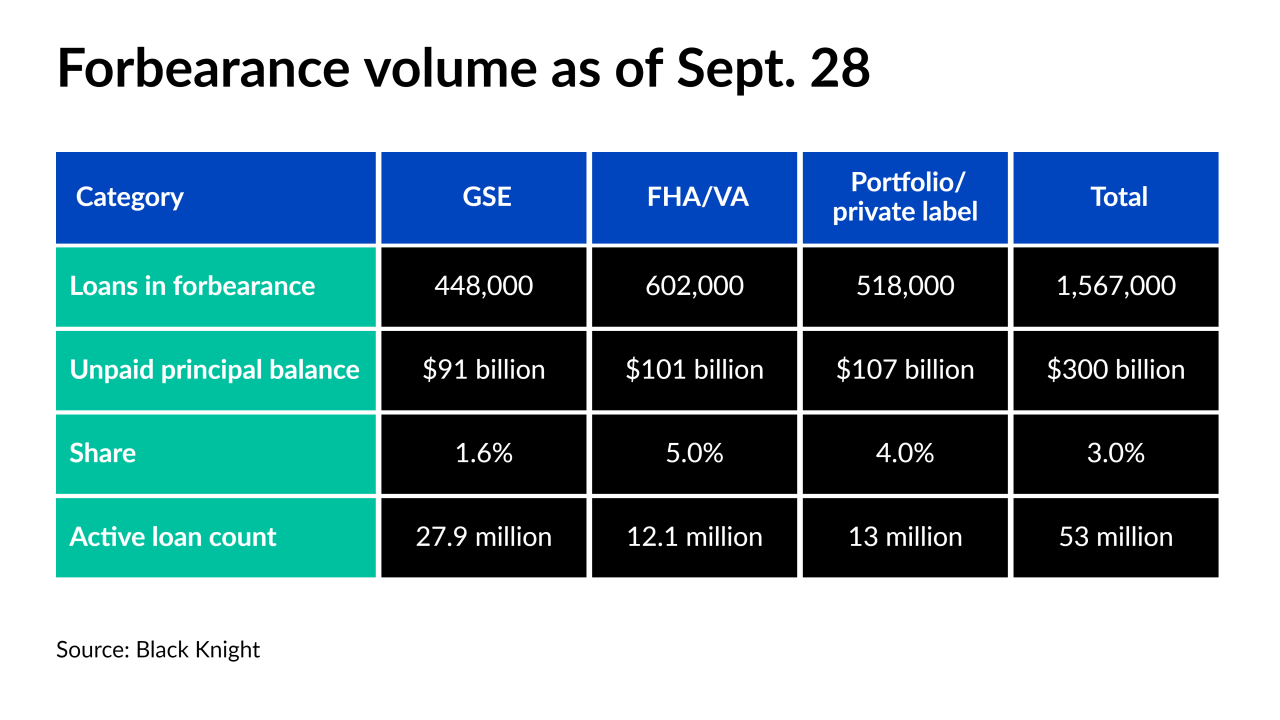

While record price appreciation led to trillions of dollars in equity, forborne borrowers still face the risk of losing their properties, according to Black Knight.

October 4 -

Although over 1.5 million forborne borrowers remain, a fifth could exit their plan in the next week, according to Black Knight.

October 1 -

More for-sale homes hit the market than at any point this year but a turning point may lie ahead, according to Realtor.com.

September 30