Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Bolstered home equity gains from rising prices put owners in a stronger position should another housing bubble be on the horizon, according to CoreLogic.

July 18 -

The onset of summer typically comes with the largest volume of home sales, however exorbitant prices kept potential buyers at bay, according to Remax.

July 17 -

Homebuilders' optimism increased as low mortgage rates fueled demand. However, affordability constraints and the continuing scarcity of construction workers and land parcels remain concerns.

July 16 -

Damage related to flash flooding from Tropical Storm Barry has the potential to affect about 340,000 homes, according to CoreLogic. Reports estimate a worst-case total of $10 billion in reconstruction cost value.

July 15 -

Savings related to artificial intelligence could add up to a couple million dollars within 12 months for lenders with sufficient scale, according to an independent researcher hired by Black Knight.

July 12 -

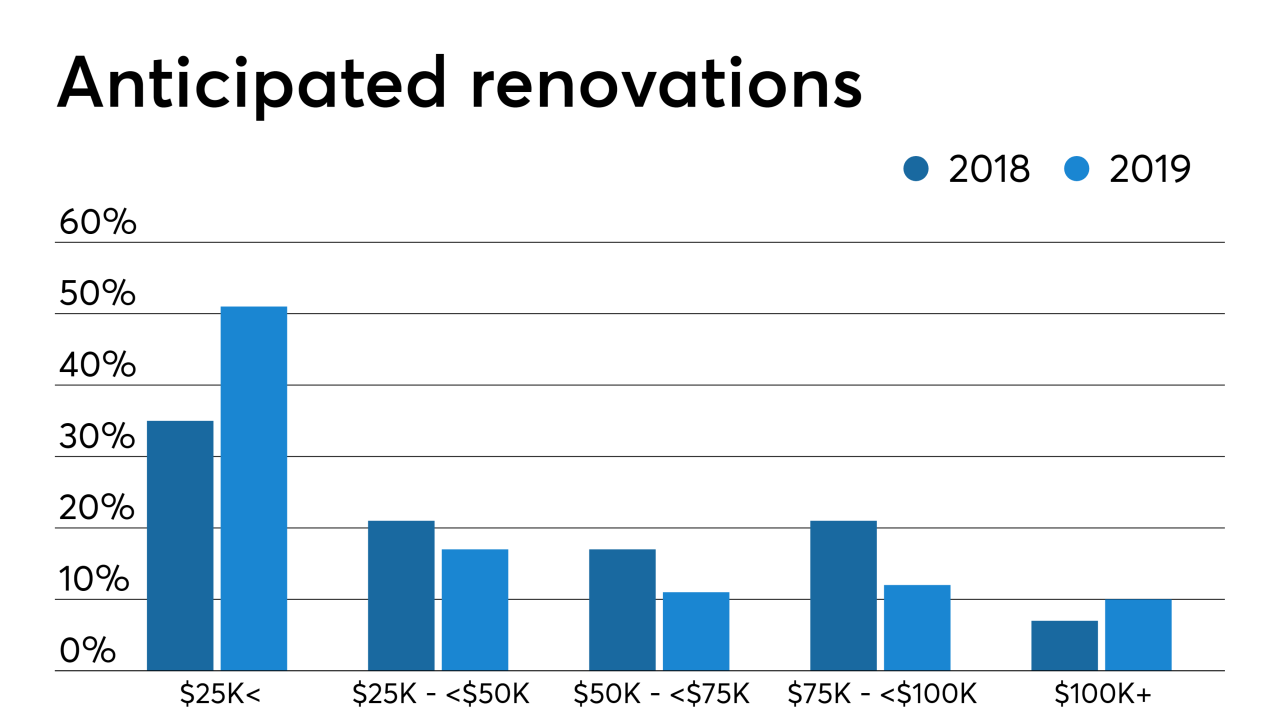

With nearly half of homeowners renovating in the next two years, HELOCs stand as the most likely form of lending sought out by consumers, according to TD Bank.

July 10 -

With affordability still an issue despite falling interest rates and harnessed home value growth, lenders further loosened credit standards in June, according to the Mortgage Bankers Association.

July 9 -

From Middle America to upstate New York, here's a look at cities offering the best opportunities to millennial buyers.

July 8 -

After months of backsliding followed by a modest increase in April, nondepository mortgage companies added 3,200 workers in May, as the overall job market gained steam.

July 5 -

Rising affordability through declining mortgage rates brought more buyers to the table and cut down the national inventory of for-sale homes, according to Redfin.

July 3 -

The rate of annual home price appreciation rose again in May, offsetting the affordability gains from declining mortgage rates, according to CoreLogic.

July 2 -

As 30-year fixed-rate mortgages continue dipping below 4%, June had the most borrowers in position to refinance since late 2016, according to Black Knight.

July 1 -

A cocktail of simmering home price appreciation, declining mortgage rates and stronger employment shot the country's housing market outlook to a three-year peak, according to Nationwide.

June 28 -

Average wages can't afford a median priced home in three quarters of housing markets around the country, but slowing appreciation shifts that balance, according to Attom Data Solutions.

June 27 -

The refinance share of mortgage applications climbed to the highest level since January 2018 as the average 30-year fixed interest rate continued tumbling, according to the Mortgage Bankers Association.

June 26 -

Fuller transparency from lenders in the mortgage decision process and disclosure on disapprovals would help keep biases in check and take down racial barriers to homeownership, according to a study by Clever Real Estate.

June 24 -

Large banks had huge losses from originating mortgages in 2018 as costs were three times higher than similar-sized independent lenders, according to research conducted by Stratmor and the Mortgage Bankers Association.

June 21 -

Housing prices rose commensurate with the temperature, but ongoing inventory issues will keep sales in check, according to Redfin.

June 20 -

As mortgage rates dip lower and lower through home buying season, the rate of closing loan applications keeps climbing, according to Ellie Mae.

June 19 -

As Amazon looms over the mortgage industry, expert views differ on the retail monolith claiming its stake in the sector.

June 18