Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

While home prices continued the gradual annual growth in February, its plateaued monthly progression could open a big spring for mortgage lending, according to Quicken Loans.

March 13 -

Strong loan performance continued into December as all delinquency stages fell annually behind equity gains and the sustained rise of home prices, according to CoreLogic.

March 12 -

As housing starts gradually rise, the proportion of homes getting built outside of metropolitan areas is declining due to fewer jobs there to support them.

March 11 -

Despite a lower rate of increase, 2019 equity gains could pull 350,000 households from being underwater on mortgages, according to CoreLogic.

March 7 -

Millennial homebuyers took advantage of a winter lull in interest rates, using the opportunity to refinance their loans, according to Ellie Mae.

March 6 -

Minneapolis' offering of affordable starter homes and inflated supply of below-median-priced options made it the housing market with the highest low-income ownership rate, according to Redfin.

March 5 -

Freddie Mac closed its fifth LIHTC fund since 2018 and will make three investments in affordable housing through a partnership with National Equity Fund.

March 4 -

Rises in the amount of low down payment loans and private mortgage insurance due to tight affordability led to the most first-time homebuyers since 2006, according to Genworth Mortgage Insurance.

March 1 -

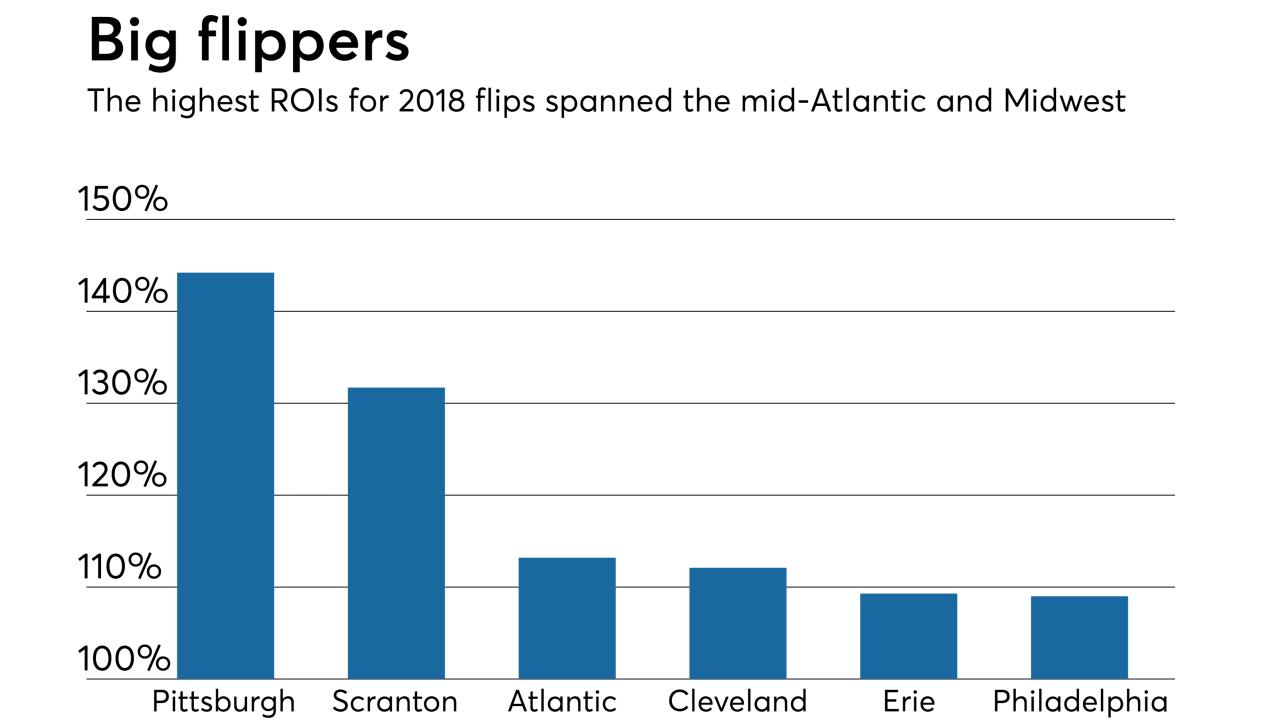

Financing poured into purchasing homes to flip in 2018, reaching the highest total since 2007, according to Attom Data Solutions.

February 28 -

The Money Source has filed three provisional patent applications as part of its efforts to develop new innovations in mortgage servicing, including the use of blockchain technology.

February 27 -

Slower home price growth and cooled mortgage rates could bring buyers out in droves in 2019, according to NerdWallet.

February 26 -

Rising household incomes paired with December's drop in mortgage rates gave consumers their largest monthly jump in home buying power since 2013, according to First American Financial Corp.

February 25 -

While overall housing sales have suffered due to affordability, the trend is even more drastic for typically higher-priced new homes, according to Redfin.

February 22 -

With its latest round of funding, the mortgage fintech company will continue to build its digital platform, with a goal of reducing the complexities and costs of home buying.

February 21 -

As expected economic growth remains at 2.2% — down from 2018's 3.1% — 2019 should only be accompanied by a solitary rate hike from the Federal Reserve, according to Fannie Mae.

February 21 -

Through digital validation and intelligent data automation, borrowers will know if their loan would be approved in as little as seven minutes and be able to close in eight days, according to loanDepot.

February 20 -

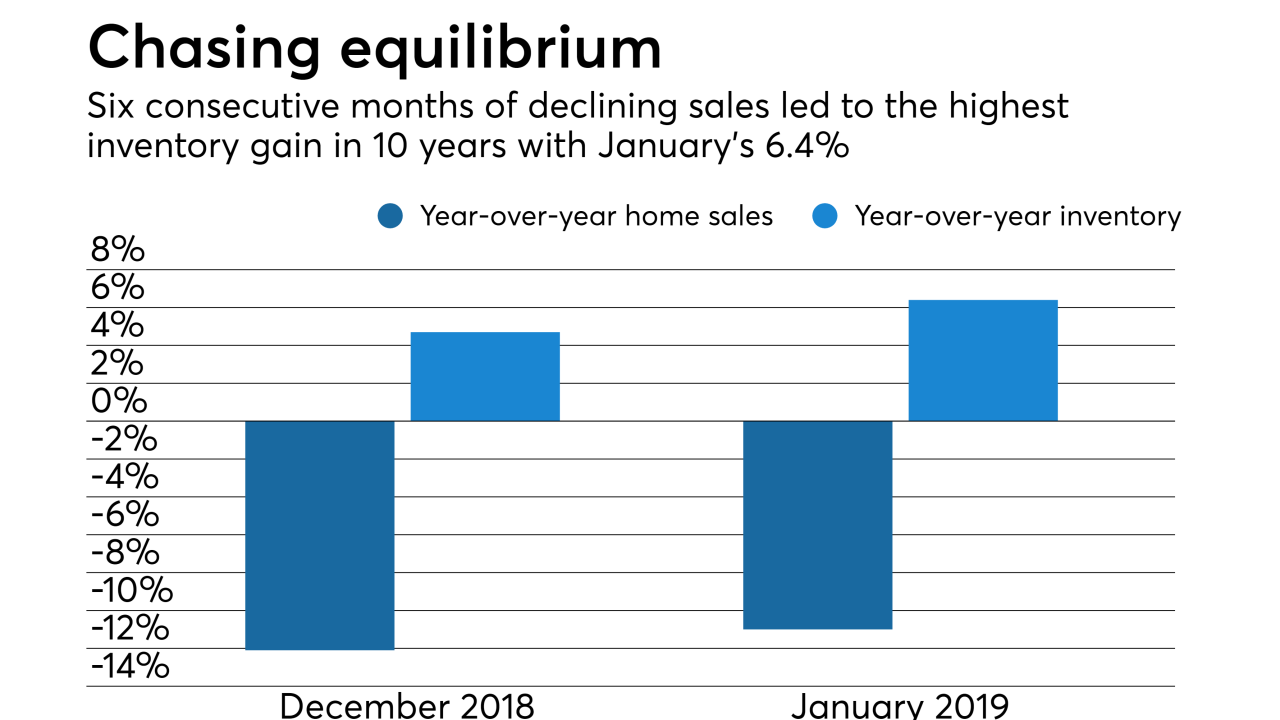

After a half-year of decreased sales, the supply of homes grew for the fourth consecutive month in January, setting up a potentially big spring for buying.

February 19 -

With a growing market share of home sales and wider breadth of services, Redfin posted significant annual revenue gains.

February 15 -

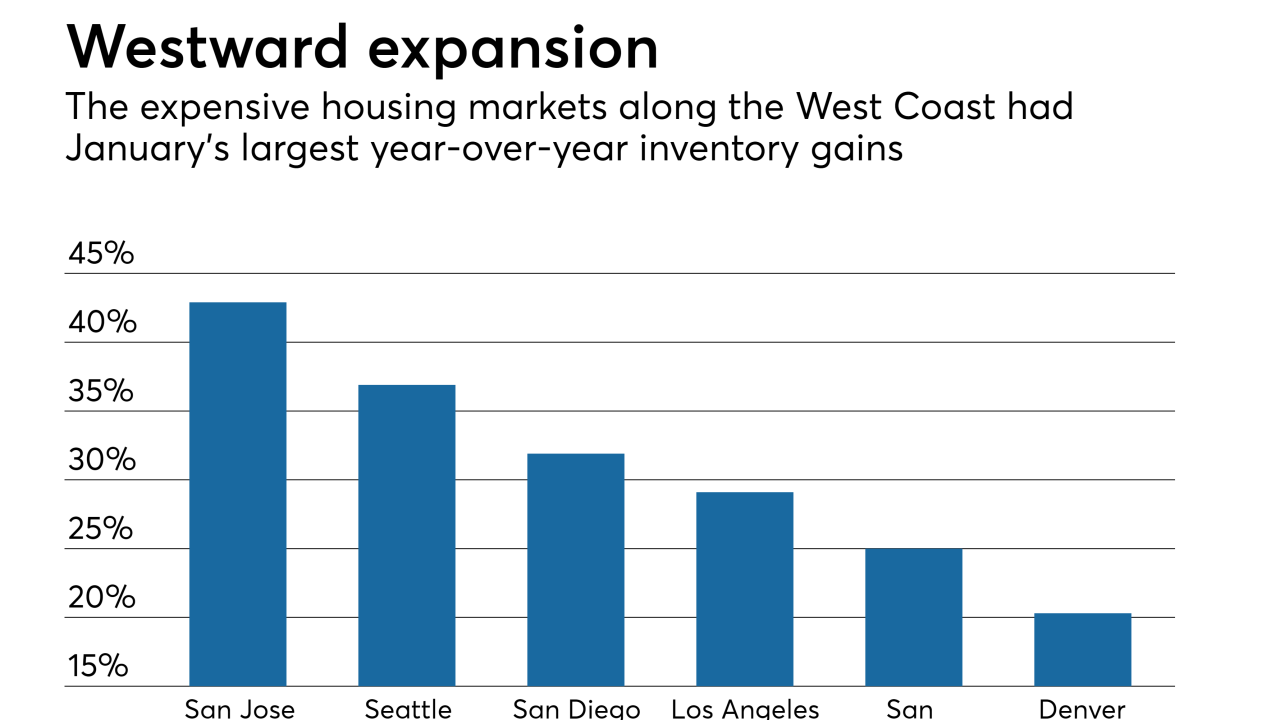

While the supply of homes still has a ways to go before becoming a buyer's market, incremental steps have taken place, especially on the West Coast, according to Zillow.

February 14 -

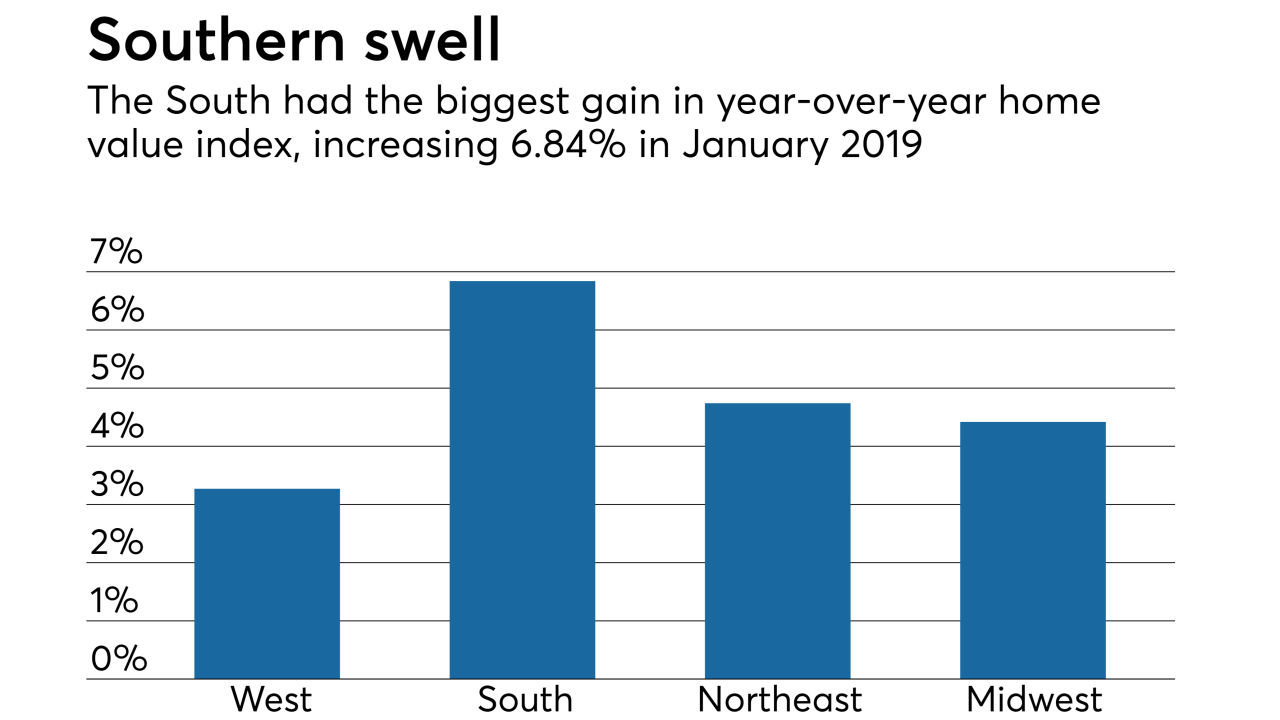

While home price appreciation showed steady growth in January, it's a lower rate than years past and consumer appraisal perception lags reality, according to Quicken Loans.

February 13