-

While many lenders lately managed their business expecting reduced volume, now they get to capitalize on extremely low mortgage rates. But today's benevolent conditions will not always be with the industry.

September 9 Freedom Mortgage Corp.

Freedom Mortgage Corp. -

Expectations of lower mortgage rates are the only thing keeping up consumer confidence in the housing market, according to Fannie Mae's Home Purchase Sentiment Index.

September 9 -

For the third time in five months, the San Francisco bank made a downward revision Monday to its guidance on net interest income. An executive cited the impact of lower interest rates.

September 9 -

Nonbank mortgage companies added 4,600 employees to their payrolls in July and may add more to address continuing rate-driven increases in loan volume.

September 6 -

It was the most robust August in at least five years for Twin Cities homebuilders.

September 6 -

Barely more than a tenth of homebuyers found themselves in a bidding war in August, as consumers shied away with a possible recession looming on the horizon, according to Redfin.

September 5 -

Mortgage rates fell to lows not seen October 2016, affected by concerns over manufacturing and the ongoing trade war with China, according to Freddie Mac.

September 5 -

Mortgage applications fell 3.1% from one week earlier even with another decrease in rates, according to the Mortgage Bankers Association.

September 4 -

In Denmark, where banks have been grappling with negative interest rates longer than in any other country, there's one corner of their business that's raking in a lot more money.

September 4 -

Strong home purchase activity — especially by millennials — pushed up annual price appreciation in July after a disappointing June, according to CoreLogic.

September 3 -

The bucket of homeowners in the money to refinance includes anyone who bought a home in the last 18 months, and lenders are on the phone calling them.

September 3 -

Home equity lenders expect origination activity to remain dreary through next year even though consumers can potentially access more proceeds now than in 2006, a Mortgage Bankers Association survey found.

September 3 -

Home price gains in the Twin Cities metro have outpaced the national average for much of the year, but those gains have cooled in recent months.

September 3 -

In a reprieve for Southern California's sluggish housing market, home sales rose in July from a year earlier. It was the first sales increase in 12 months.

September 3 -

A growing share of refinances born by lower rates is pushing down risk levels for fraud on a mortgage application, according to First American.

August 30 -

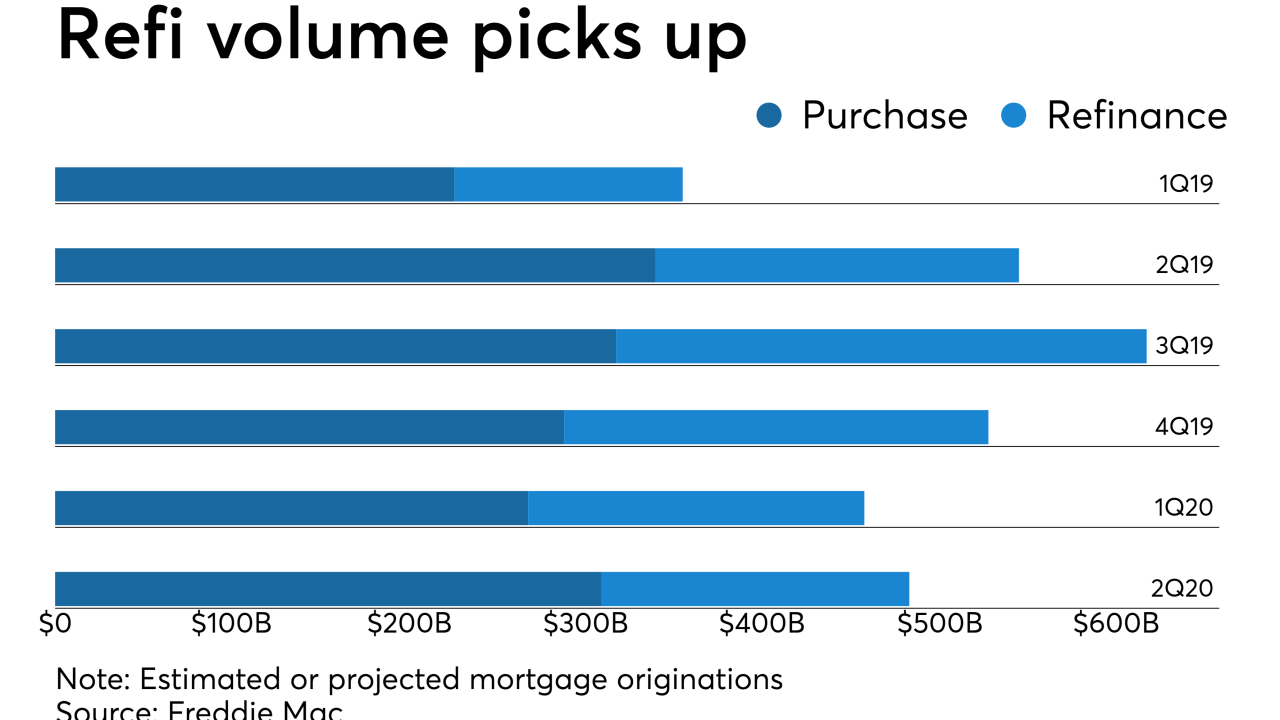

Freddie Mac now forecasts that refinance volume will make up nearly half of third and fourth quarter production, and has increased its origination estimate for the year to over $2 trillion.

August 30 -

Contract signings to purchase previously owned homes fell in July by the most since early 2018, indicating a pause in buyer interest even against a backdrop of falling mortgage rates, a firm job market and steady income gains.

August 30 -

Mortgage debt climbed to a new peak of $9.4 trillion in the second quarter and the distribution across the U.S. varies greatly.

August 29 -

Mortgage rates remained near three-year lows last week, but their movement did not mirror the period's big shifts in the 10-year Treasury yield.

August 29 -

Single-family home prices in Colorado Springs rose by 8.2% from the second quarter of last year to the second quarter of 2019, which ranked as the fifth highest appreciation rate among the nation's 100 largest metro areas.

August 29