-

Loan applications for newly constructed properties accelerated going into this year's peak home buying season, contrasting with the weakness seen in the market a year ago, according to the Mortgage Bankers Association.

April 9 -

Consumers believe softening home prices and mortgage rate declines are on the horizon, according to Fannie Mae. While these suggest positive sentiments on conditions for buyers, they signal rewards for those who wait.

April 8 -

Sacramento's home real estate market remained cool in the opening months of 2019, but there are hints a springtime buzz may be on the way.

April 8 -

Nondepositories in the mortgage business cut 2,900 more jobs in February, bringing industry employment to its lowest point in nearly three years.

April 5 -

Sales of existing single-family homes in Maine eased slightly, although prices remained strong, rising 2.85% comparing February 2019 to February 2018.

April 5 -

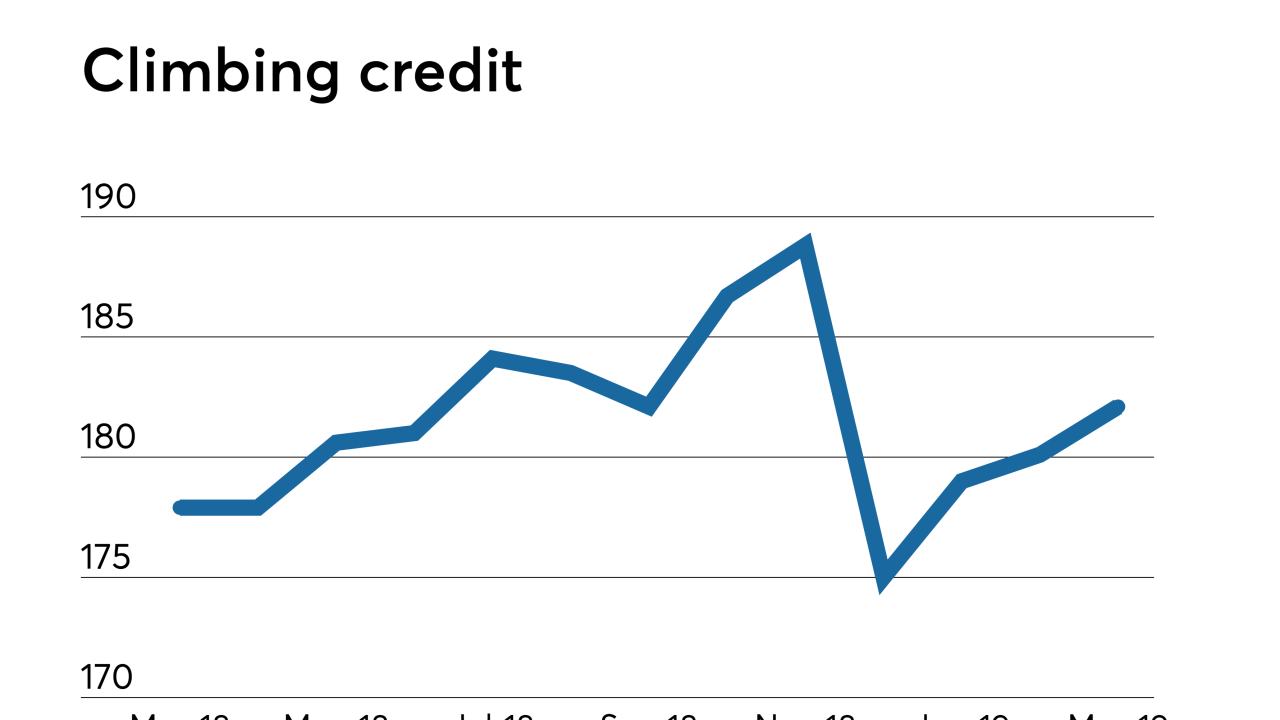

Mortgage lending standards loosened in March, as a swell in jumbo credit helped drive an expansion in availability for the third straight month, according to the Mortgage Bankers Association.

April 4 -

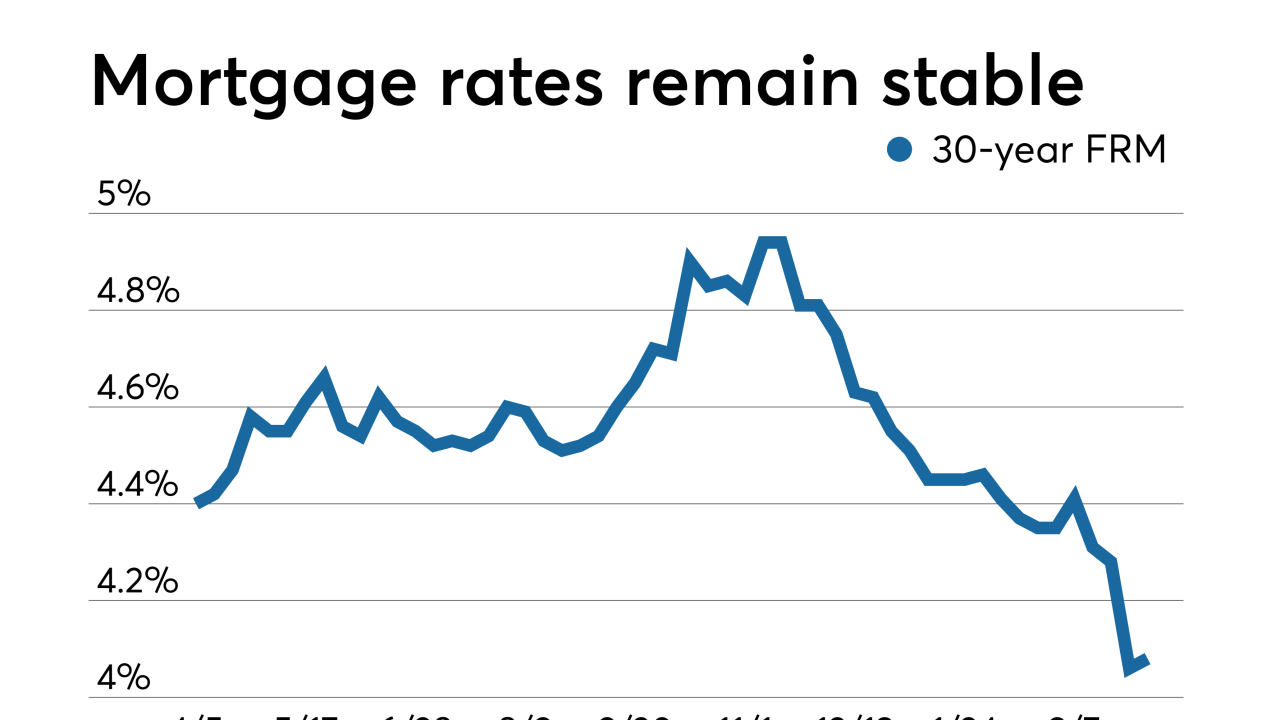

Mortgage rates held steady after several weeks of declines, during which there was the largest weekly drop in more than 10 years, according to Freddie Mac.

April 4 -

From where to find borrowers that competitors overlook, to how to adjust strategies when interest rates change course, top producers are adapting when market conditions change.

April 3 -

With interest rates down, purchase mortgages accounted for the vast majority of millennial homebuyers' loans in February, according to Ellie Mae.

April 3 -

Homebuilders in the Twin Cities metro had their sleepiest March in four years with single-family and multifamily construction falling sharply.

April 3 -

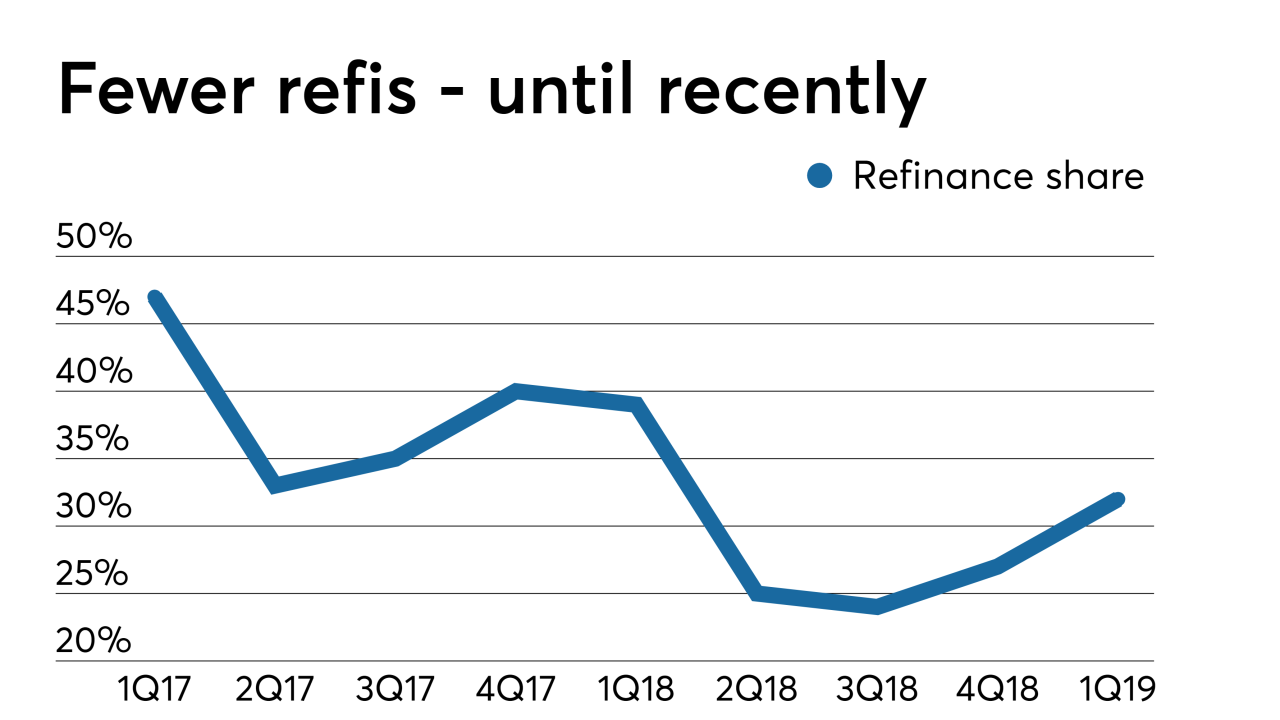

Mortgage refinance applications reached their highest level in three years as interest rates plunged last week in the aftermath of the Federal Open Market Committee's March meeting.

April 3 -

February's median price for single-family homes in Santa Cruz County, Calif., reached a new area record high of $937,000. The previous record was $935,100 in March 2018.

April 3 -

Despite slowing home price growth, nearly 75% of millennials make financial concessions to afford housing compared to 40% of older generations, according to CoreLogic.

April 2 -

Mortgage borrowers don't know about the logistics of applying for a loan, which is the basis for their erroneous ideas about the process, the respondents to the 2019 Top Producers Survey said.

April 2 -

After two straight down months, home sales in New Hampshire rebounded in February setting records for the month in price and number of closed deals.

April 2 -

After several months of sluggish activity, sales of Marin County, Calif., homes surged 7.1% in February to 180, up from the 168 sold in February 2018.

April 2 -

The total number of days that elapsed between consumers' initial home tours and their closing dates fell to the lowest level in at least six years this winter, according to Redfin.

April 1 -

The number of homeowners likely to qualify for a refinance nearly doubled in a single week following the largest mortgage rate decline since the housing bubble burst, according to Black Knight.

April 1 -

Income-related mortgage application fraud risk has the potential to increase as competition rises among buyers during the peak spring season, First American said.

March 29 -

Sales of new homes rebounded to the best pace in almost a year and exceeded estimates in February, led by the Midwest, as lower mortgage costs helped buyers afford properties.

March 29