-

Home price appreciation tapered as buyers battling tight inventory and rising housing costs pulled back from the market, according to CoreLogic.

March 5 -

Home purchaser affordability declined in the fourth quarter, which also negatively affects the amount Americans have to spend on cost-of-living expenses, a report from Zillow said.

March 5 -

Sales of new homes unexpectedly rose in December after a downwardly revised November reading, as lower mortgage rates and more-affordable properties offered some relief for buyers.

March 5 -

While millennials comprise the largest cohort of homebuyers, the aging baby boomer generation has created 7.86 million more homeowners and 2.82 million renters age 60 and older — growth rates higher than any other demographic.

March 4 -

The number of homes sold in Marin County, Calif., in January dipped 5.4% to 141 over the 149 homes sold in January 2018, according to CoreLogic.

March 4 -

Rises in the amount of low down payment loans and private mortgage insurance due to tight affordability led to the most first-time homebuyers since 2006, according to Genworth Mortgage Insurance.

March 1 -

Freddie Mac again increased its origination forecast for the next two years, as the rate drops of the past few months are expected to boost refinance volume.

March 1 -

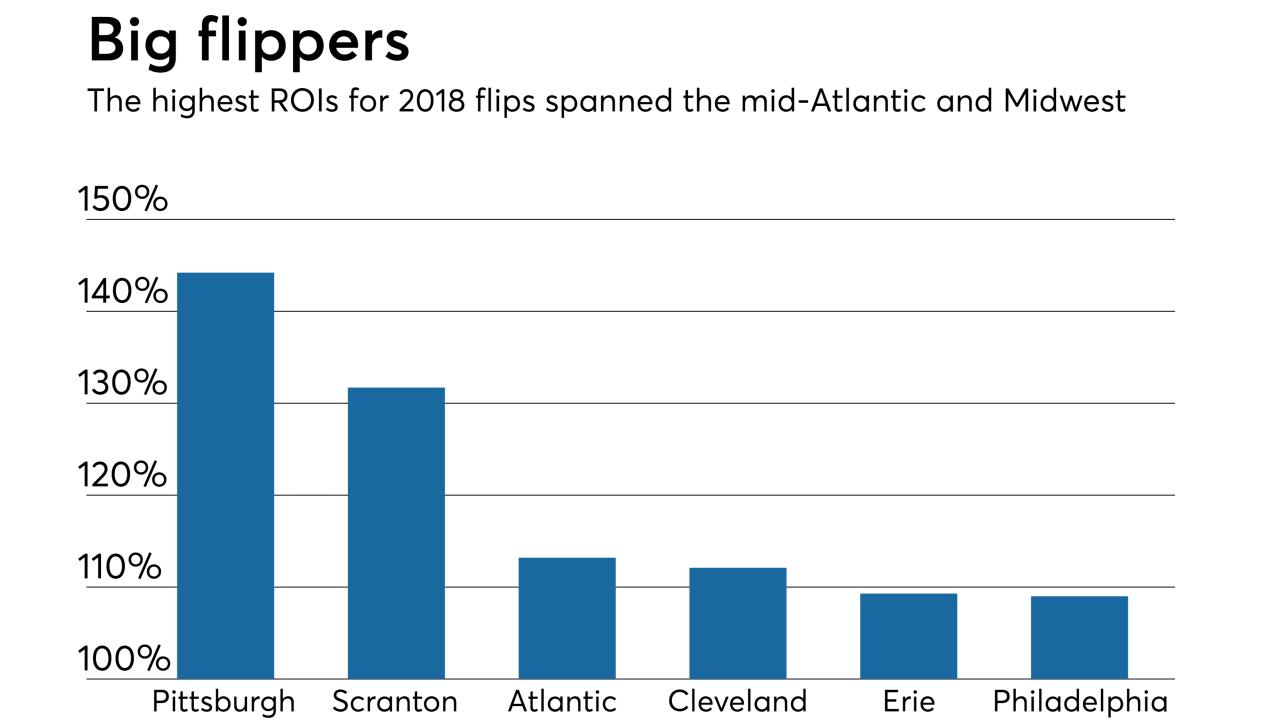

Financing poured into purchasing homes to flip in 2018, reaching the highest total since 2007, according to Attom Data Solutions.

February 28 -

A strong spring home purchase season is likely to further increase mortgage loan application defect risk, which already spiked in the past two months, according to First American.

February 28 -

With few headlines to drive up or down movement in the bond markets, mortgage rates held steady after declining for three consecutive weeks, according to Freddie Mac.

February 28 -

Toll Brothers Inc.'s new home orders dropped 24% in the fiscal first quarter, the steepest annual decline for the biggest U.S. luxury homebuilder since the depths of the housing crash in 2010.

February 27 -

Contract signings to purchase previously owned homes rose by more than forecast in January, snapping a six-month streak of declines and suggesting lower mortgage rates along with a strong job market are helping stabilize demand.

February 27 -

Home prices in the Portland, Ore., area rose last year at their slowest rate since 2012.

February 27 -

Mortgage applications increased 5.3% from one week earlier, as the stable rate environment enticed homebuyers into the market, according to the Mortgage Bankers Association.

February 27 -

Slower home price growth and cooled mortgage rates could bring buyers out in droves in 2019, according to NerdWallet.

February 26 -

Home prices in 20 U.S. cities rose in December at the slowest pace in four years, continuing to decelerate as buyers balked at purchases amid still-elevated housing costs and a falling stock market.

February 26 -

New-home construction in December fell to the lowest since September 2016, as builders held back during a turbulent month for financial markets.

February 26 -

Rising household incomes paired with December's drop in mortgage rates gave consumers their largest monthly jump in home buying power since 2013, according to First American Financial Corp.

February 25 -

Mortgage prepayment speeds fell to a 19-year trough despite recent interest rate declines, but could rise if those lower rates lead to an increase in home purchases, according to Black Knight.

February 25 -

Palm Beach County, Fla., home sales plummeted in January to their lowest level since the Great Recession, a drop that reflected consumer concern about rising mortgage rates and an overall slowing in the real estate market.

February 25