-

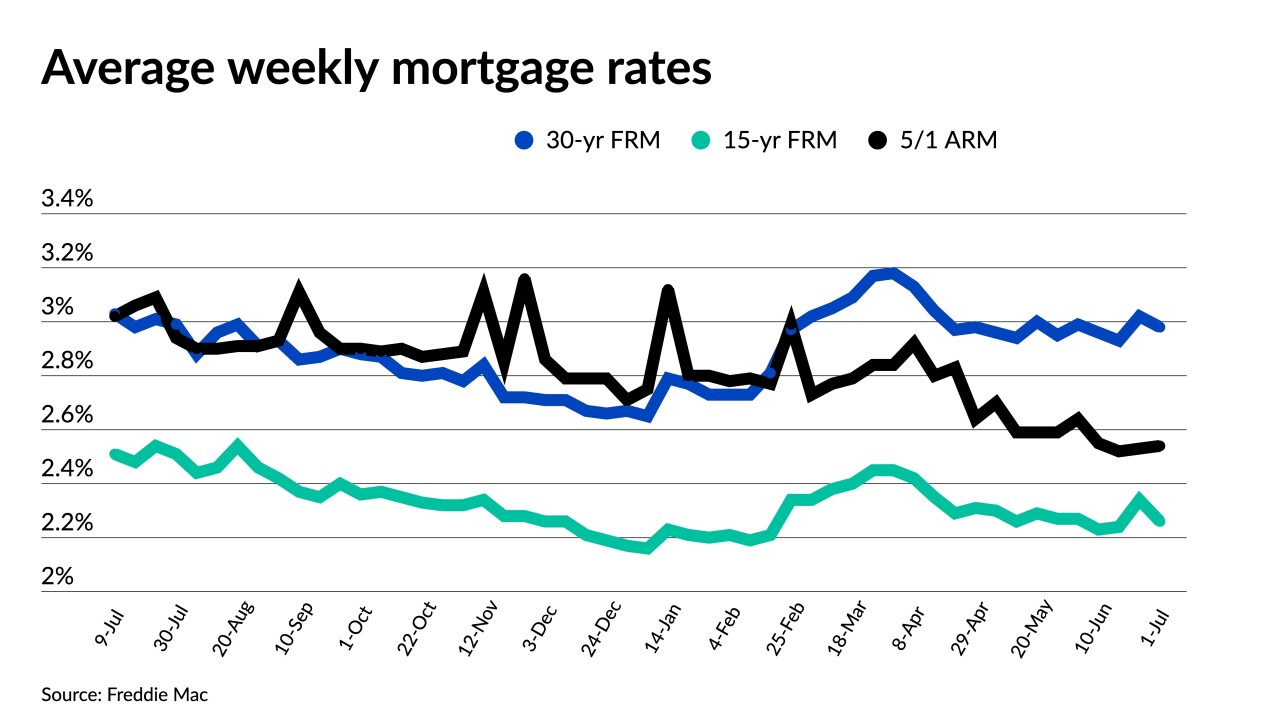

With talk of an overheating economy abating, economists see few signals that would indicate near-term rate spikes.

July 8 -

But some local markets in the Midwest and oil regions are seeing a lag compared to nationwide annual gains, Veros Real Estate Solutions found.

July 8 -

Officials responded to a more elevated outlook for prices by penciling in two interest-rate hikes for 2023, according to the median of their projections, while seven of 18 wanted to raise interest rates next year.

July 8 -

The White House's firing of Federal Housing Finance Agency Director Mark Calabria sparked immediate speculation about who will run the agency and help chart the future of the two mortgage giants. Potential nominees include ex-Obama administration officials, congressional staffers and members of the Biden transition team.

July 8 -

The dynamic between housing market players diverged to an even greater degree amid intense demand and surging home prices, according to Fannie Mae.

July 7 -

Government-sponsored loans gain volume share, but overall numbers tumble to a point not seen since before the pandemic.

July 7 -

The number of grievances about evictions and federal student loans declined between January 2020 and May 2021. Nonetheless, the Consumer Financial Protection Bureau warned financial firms that poor customer service can undermine government efforts to provide aid.

July 2 -

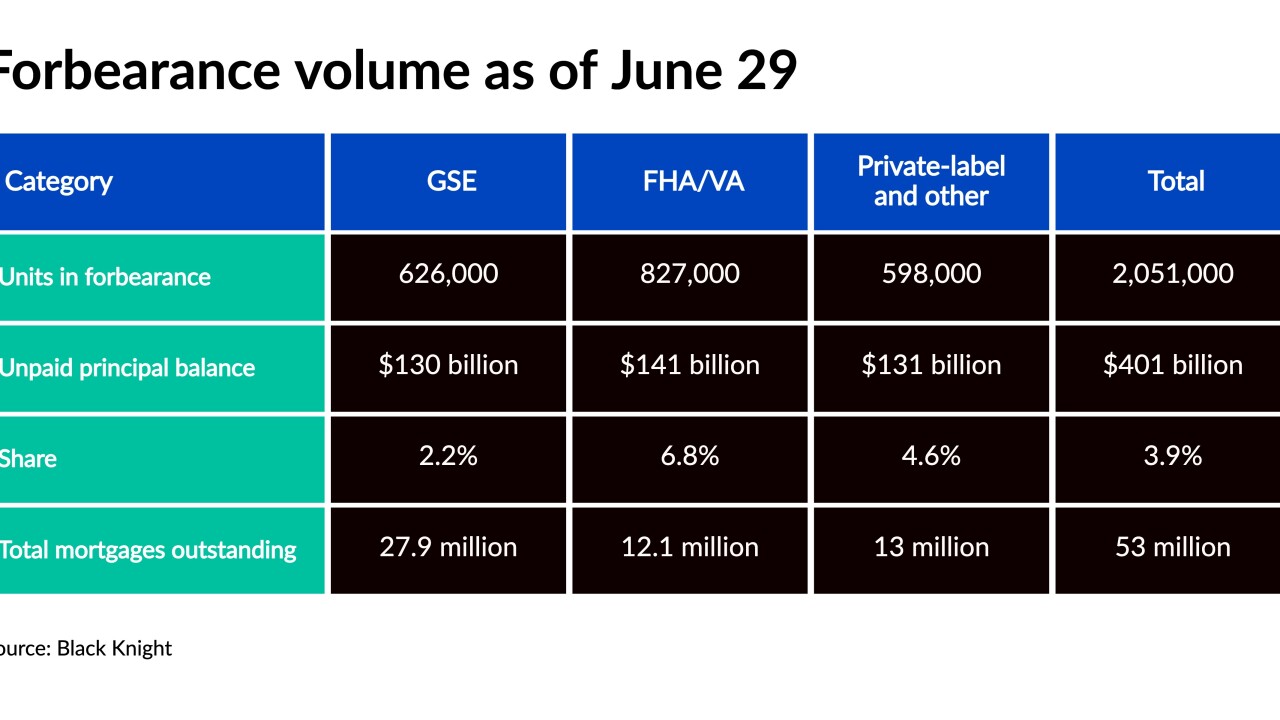

The number of GSE-backed and government sponsored loans in forbearance declined, while portfolio and private-label loans increased.

July 2 -

It is only a modest positive for new publicly-traded mortgage companies if acting Federal Housing Finance Agency head Sandra Thompson rolled back the caps put in place by the agreement with the Treasury.

July 2 -

The department's antitrust division said Thursday that it was withdrawing from the November 2020 agreement because its terms prevent the division from continuing to investigate association rules that may harm homebuyers and sellers.

July 2 -

Estimates suggest public funds in aggregate may be adequate to cover arrears and potentially keep many in their homes as the eviction ban ends, but may not be evenly distributed.

July 1 -

Private mortgage insurers can continue to hold less capital for forborne delinquent loans, which helps them potentially upstream payments to parent companies in the third and fourth quarters.

July 1 -

Markets react calmly to inflationary worries, but short supply and rising home prices loom as a greater concern.

July 1 -

The financial services company will incentivize existing card members with statement credit for taking out or refinancing a home loan with either lender.

July 1 -

The ruling confirms that a state precedent regarding forward mortgages also applies to home equity conversion loans.

July 1 -

Federal Reserve officials who favor prioritizing mortgage-backed securities when they begin to scale back asset purchases have added Governor Christopher Waller to their ranks.

July 1 -

Consumer advocates and mortgage industry officials are urging Sandra Thompson, the new acting director of the Federal Housing Finance Agency, to undo many policies that her predecessor, Mark Calabria, put in place over the past year.

July 1 -

The deal comes after a tumultuous 12-month period for CoreLogic, which saw itself twice targeted for acquisition.

June 30 -

The change makes it easier for borrowers exiting forbearance to get access to home retention options that might otherwise be out of reach due to skyrocketing home prices.

June 30 -

Limited housing supply, climbing rates cause applications to decline across the board.

June 30