-

Recent reports show inflation rising, but employment underperforming, while interest rates dropped across the board.

June 10 -

The Federal Housing Finance Agency said it is reviewing compensation policies for Fannie Mae and Freddie Mac and requesting feedback from the public. Some have said the $600,000 limit for executives imposed by Congress makes it hard to find talent.

June 10 -

Even though product availability is now at the same point where it was one year ago, it remains at 2014 levels.

June 10 -

More than two-thirds surveyed said they expect to make less money over the next three months as price reductions ramp up along with a market shift to purchases.

June 10 -

Purchase loans tick upward, even as housing demand pushes prices well above 2020 levels.

June 9 -

Between terms as Federal Housing Commissioner — where he oversaw Radian's government-run competitor — he served on the private mortgage insurer's board.

June 8 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

The government-sponsored enterprises have been returning to normal underwriting and are buying more loans than last year, but annual limits they have in place could become a concern.

June 8 -

While a growing share of consumers feel optimistic about the economic recovery underway, the extreme seller’s market made the majority of prospective borrowers pessimistic for only the second time in 10 years, according to Fannie Mae.

June 7 -

For two decades, Alfred Pollard served as the general counsel for Fannie Mae and Freddie Mac’s regulator. He had a front-row seat for the establishment of the Federal Housing Finance Agency, the government’s subsequent seizure of the mortgage giants amid mounting losses in 2008 and the more recent legal dispute over the FHFA’s authority.

June 7 -

The agency is looking to clarify existing regulations around how these accounts are handled, based on questions it received.

June 4 -

Sen. Pat Toomey of Pennsylvania, the Banking Committee's top Republican, is talking up the prospects of a bipartisan deal to overhaul Fannie Mae and Freddie Mac. But Democratic leaders sound less motivated to change the status quo for the government-sponsored enterprises.

June 4 -

Net production income was down from its peak in the third quarter of last year, but it set a survey record for the period between January and March.

June 3 -

The departures of Bryan Schneider and Peggy Twohig come as the Biden administration's nominee to run the consumer bureau awaits Senate confirmation.

June 3 -

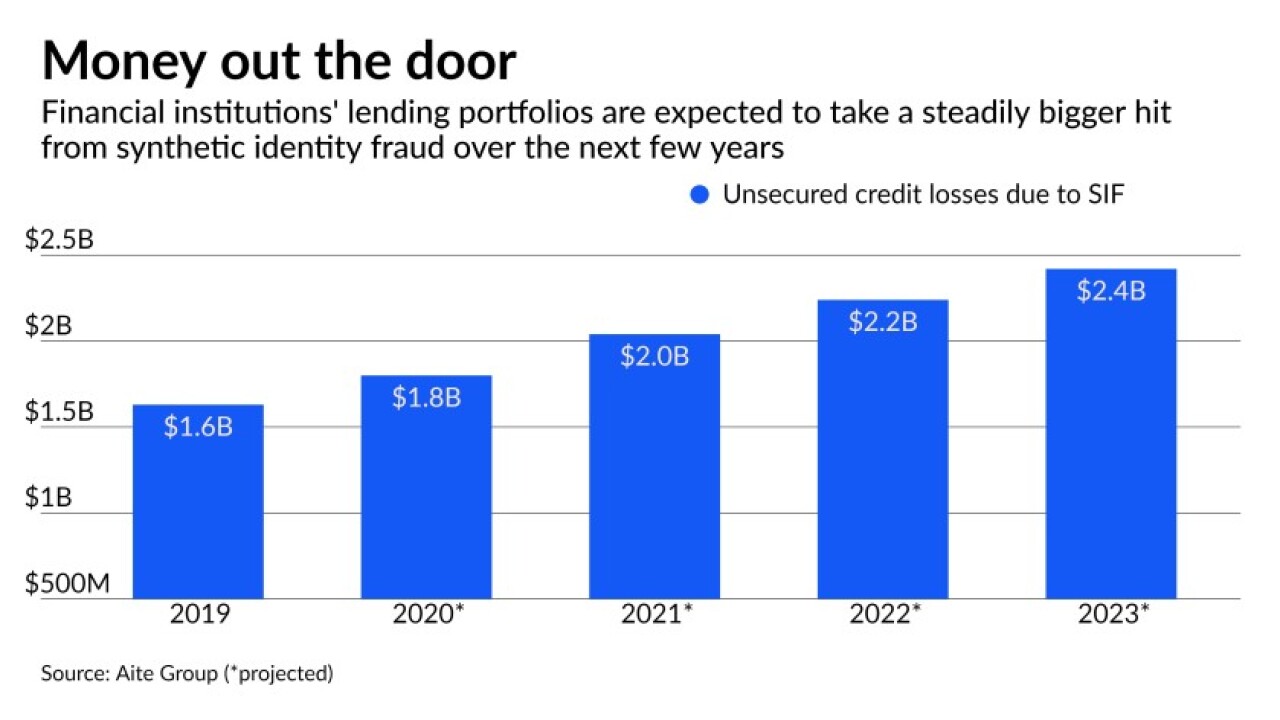

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

June 2 -

The MBA’s Market Composite Index decreased a seasonally adjusted 4% last week, dropping to a point not seen since February 2020.

June 2 -

Borrowers with loans secured by personal rather than real property made up 46% of manufactured housing borrowers in 2019 and of this group, only 5% used the loans to refinance.

June 1 -

Storm-related reconstruction costs — a large share of which may be concentrated in the New York City area — are estimated to total $1.9 trillion for water damage and $8.5 trillion for wind damage.

June 1 -

Federal Reserve Vice Chair Randal Quarles has made it clear that banks failing to make the transition away from the benchmark rate could face supervisory consequences.

June 1 Treliant

Treliant -

Mynd expects to purchase about 20,000 single-family rental homes in the U.S. in the next three years.

June 1