-

Financial institutions said they needed more time to weigh in on issues such as how they use artificial intelligence for fraud prevention and underwriting.

May 17 -

Numbers fell across the board, with private-label and portfolio loans declining most.

May 14 -

Patience and vigilance are virtues when using certain social media for marketing, writes the CEO of Paragon Digital Marketing Group.

May 14 Paragon Digital Marketing Group

Paragon Digital Marketing Group -

Inflation concerns may reverse the trend that has seen the 30-year rate decline six out of the last seven weeks.

May 13 -

Stock prices for the four stand-alone MI companies have declined significantly since the start of May.

May 13 -

Purchase loan volume also increased, as borrowers tried to take advantage of rate dips across all loan types

May 12 -

Expansion of an existing translation clearinghouse is among steps that could be taken, the Mortgage Bankers Association suggested in a letter sent to the leaders of the House Financial Services Committee on Wednesday.

May 12 -

The move formalizes the use of the Rocket Mortgage moniker, which has been a major part of the company’s branding since 2016.

May 12 -

Collectors are mulling a procedural overhaul after a three-judge panel said the practice of using vendors to inform consumers about outstanding debts is illegal. The case may also complicate the CFPB's upcoming rule on electronic messaging.

May 11 -

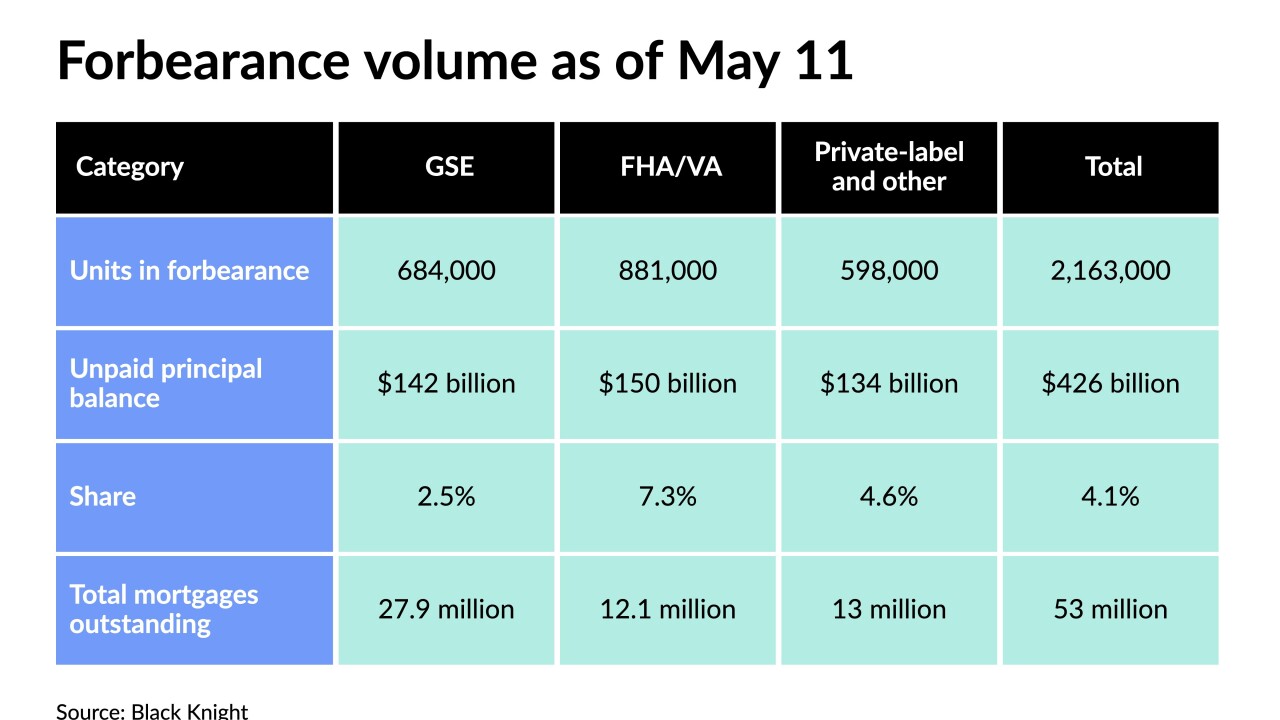

The total number of loans in this category dropped 11 basis points from week to week according to the Mortgage Bankers Association. Meanwhile, the amount of unpaid balance in forbearance dropped almost 23% since the start of the year, a separate report from Black Knight found.

May 10 -

In spite of an improving economy, acute competition and supply scarcity soured homeshoppers on the purchase market in April, according to Fannie Mae.

May 7 -

Fannie and Freddie's regulator says the companies must comply with the new Qualified Mortgage standard by the summer, while the Consumer Financial Protection Bureau has extended the deadline to 2022. The conflicting timetables have stoked uncertainty in the market.

May 7 -

The defendants face 133 felony counts that include allegedly stealing identities to commit mortgage fraud between 2014 and 2020, resulting in the theft of $15 million.

May 7 -

The Federal Housing Finance Agency is calling for input on how to better safeguard against potential lending risks associated with residential buildings filled with short-term rental units.

May 7 -

Promising jobs numbers and favorable economic data are an encouraging sign for the post-pandemic future, but rising interest rates are sure to follow.

May 6 -

The Biden administration may finally be close to naming an acting comptroller of the currency. Whoever gets the interim job or is confirmed to run the agency over the longer term will have a lengthy to-do list, from Community Reinvestment Act reform to deciding the fate of divisive Trump-era rules.

May 6 -

While cash-out refinances were a “significant driver” of risky loans leading to the Great Recession, those mortgages pose less of a threat due to tighter underwriting standards, according to Milliman.

May 5 -

The recent increase in loan size across all application types reflects rising prices, which contributed to a drop in applications, Mortgage Bankers Association economist Joel Kan said.

May 5 -

The company aims to use the additional capacity to get its non-qualified mortgage business back to producing $125 million per month, and anticipates more purchases of mortgage servicing rights, representatives said in its Q1 earnings call.

May 5 -

United Wholesale Mortgage set off a brawl in the press when it forbade brokers from doing business with Rocket and Fairway. As a small group of brokers pursue legal action over the ultimatum, experts weigh in on whether the spat is benefiting the wholesale channel.

May 5