-

Borrowers gained over $6 trillion in home equity since the Great Recession ended and the relative health of the housing market should stave off a coronavirus-induced collapse, according to CoreLogic.

June 11 -

The measures extended by the Federal Housing Finance Agency include alternative methods used for certain appraisals and for verification of employment.

June 11 -

The expected rise in refinance volume overrides pessimism about purchase activity for their businesses.

June 11 -

Mortgage rates increased slightly for the second consecutive week, buoyed early on by positive economic news such as the jobs report that came out last Friday, according to Freddie Mac.

June 11 -

Lenders are cautioning not only that second-quarter provisions might exceed the spike seen earlier this year, but also that credit costs could be elevated into 2021 if the economic slowdown drags on or fears of a second coronavirus wave are borne out.

June 11 -

The Federal Housing Administration's move to insure loans with forbearance could help support homeownership opportunities constrained by the coronavirus if one change was made to it, trade groups said.

June 10 -

Groups representing community banks and credit unions generally support the new percentage-based goals set by the Federal Housing Finance Agency.

June 10 -

The Federal Reserve pledged to maintain at least the current pace of asset purchases and projected interest rates will remain near zero through 2022, as Chairman Jerome Powell committed the central bank to using all its tools to help the economy recover from the coronavirus.

June 10 -

Mortgage investors can take heart knowing the Federal Reserve considers agency MBS a primary arena through which to conduct monetary policy.

June 10 -

Mortgage applications increased 9.3% from one week earlier, fueled by low mortgage rates and the release of pent-up demand, according to the Mortgage Bankers Association.

June 10 -

Some lawmakers fear that when forbearance plans and enhanced unemployment coverage expire, the consequences for mortgage borrowers still affected by the pandemic will be severe.

June 9 -

Looming economic uncertainties forced mortgage lenders to tighten underwriting standards in May.

June 9 -

A federal grand jury indicted Ronald J. McCord, 69, of Oklahoma City, on charges of defrauding two banks, Fannie Mae, and others of millions of dollars, money laundering, and making a false statement to a financial institution, said Timothy J. Downing, U.S. attorney for the Western District of Oklahoma.

June 9 -

The FHFA’s proposal is intended to strengthen Fannie Mae and Freddie Mac, but many experts warn that it could boost guarantee fees for lenders that they say may be passed on to borrowers.

June 8 -

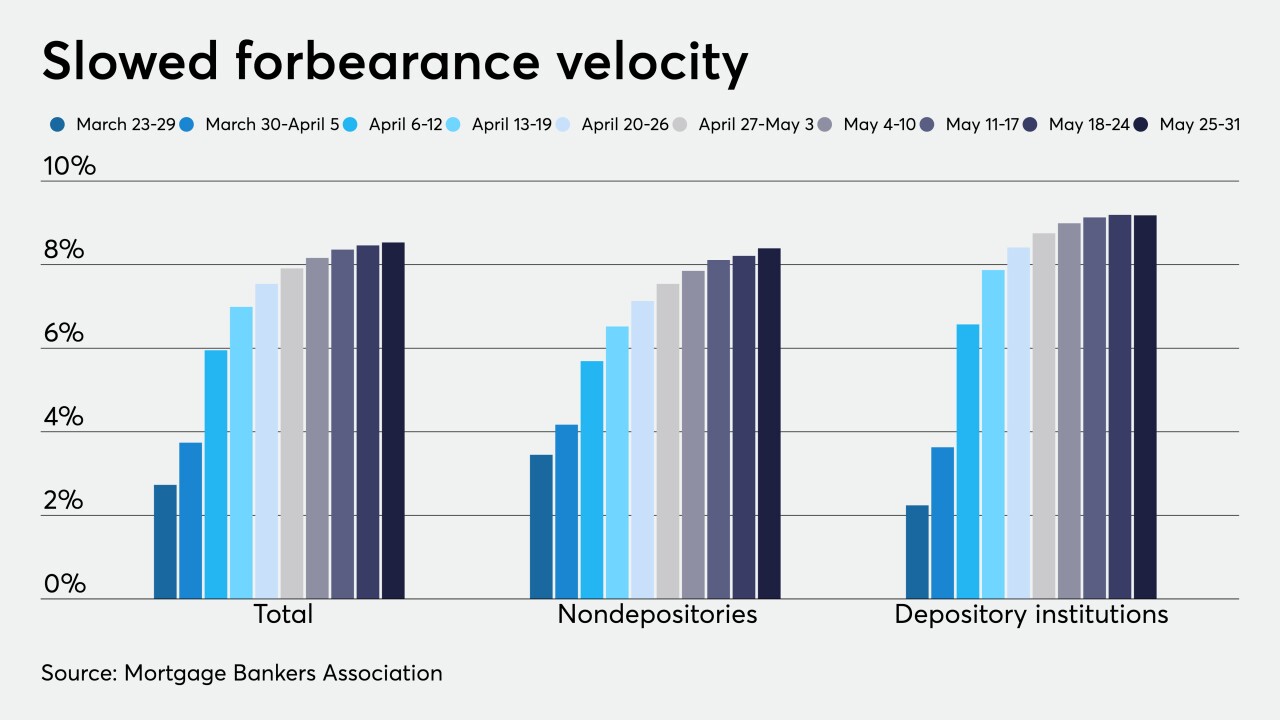

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8 -

After bottoming out at a 10-year low in April, consumer sentiment for home buying rebounded in May, according to Fannie Mae.

June 8 -

About 9% of government-insured loans in forbearance have low equity, which could hamper post-forbearance servicing.

June 8 -

Former Comptroller of the Currency Joseph Otting landed a post with Black Knight, which provides technology solutions to mortgage and real estate companies.

June 8 -

With the impacts of the coronavirus in full bore, housing market experts predict home prices to fall in 2020.

June 8 -

Hudson Americas is pooling its next aggregation of non-qualified, high-balance mortgages in a new securitization that is exposed to a large share of borrowers seeking or already receiving pandemic-related forbearance or deferral on payments. So far, a little over half of those granted the allowance have yet to skip any payments.

June 8