-

Mortgage rates remained generally steady this past week, even with the continuing market volatility, and that is helping the purchase market, according to Freddie Mac.

May 14 -

The agency's announcement came one day after the agency said it would provide borrowers struggling to stay current with an additional payment deferral option.

May 14 -

Homeowners hurt by coronavirus were told they could delay their mortgage payments without facing consequences. Now, some are learning they’re at risk of being shut out of the housing market.

May 14 -

Eligible borrowers can add the forborne payments to the end of their loan term.

May 13 -

If employers maintain flexible working practices after lockdowns get lifted, housing preferences and subsequent property values could greatly change.

May 13 -

Previously, mortgage firms concentrated on borrower-facing systems at the expense of internal experience.

May 13 -

Incoming chief Frank Bisignano downplays any pressure to find $1.2 billion in cost cuts promised to shareholders from the acquisition of First Data. Instead he emphasized his track record of producing revenue growth and pledged to keep funding innovation projects.

May 13 -

The head of the U.S. central bank said its emergency credit programs were not designed to prop businesses up over the long term.

May 13 -

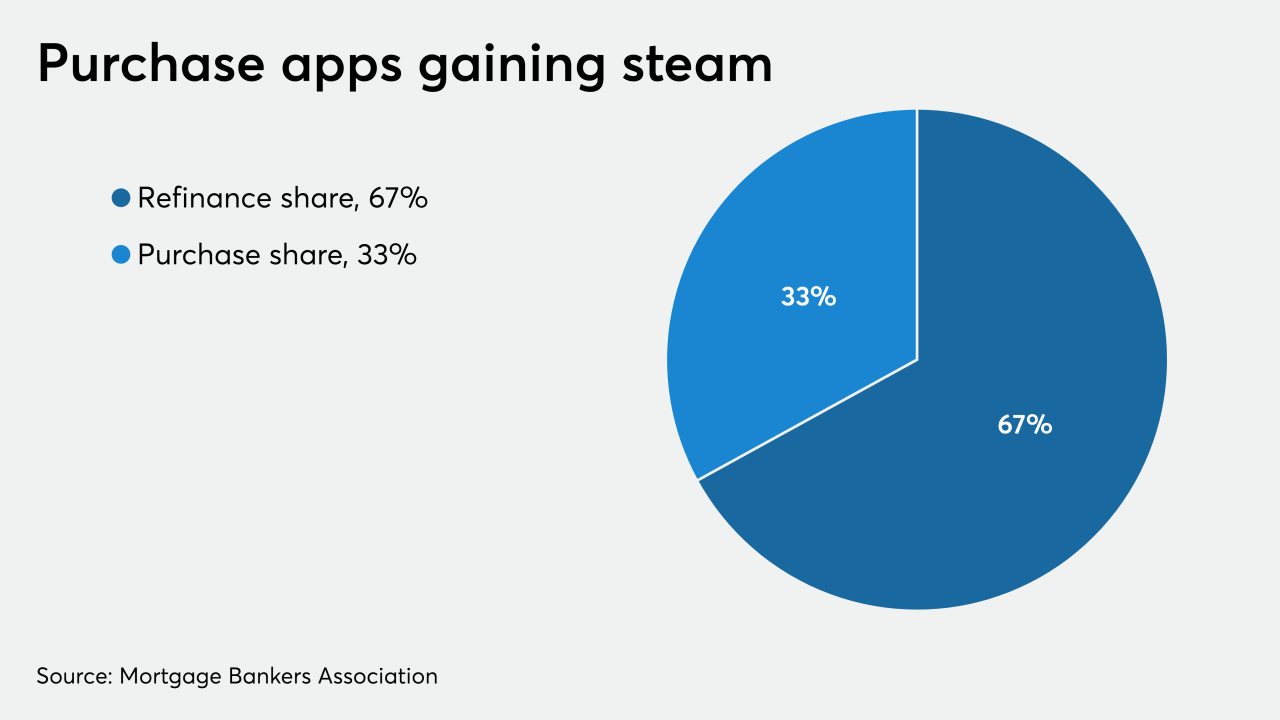

While overall mortgage application volume remained flat, purchase activity continued to rebound — and that should be the case through the remainder of the spring, according to the Mortgage Bankers Association.

May 13 -

A negative Federal Reserve policy rate is still improbable, but if it were to happen it could be a net benefit, according to a note from JPMorgan Chase.

May 13 -

The joint site describes potential strategies for both homeowners and renters economically affected by COVID-19.

May 12 -

By the end of the first quarter, the number of borrowers 30 days late on their mortgage increased by 59 basis points.

May 12 -

U.S. home prices continued climbing in the first quarter, before the impact of the pandemic's economic shutdown took hold.

May 12 -

After over two years of falling delinquency rates, the burgeoning unemployment following the coronavirus economic shutdown will bring a surge of outstanding mortgages.

May 12 -

Specialized Loan Servicing will pay more than $1 million to settle Consumer Financial Protection Bureau allegations that it foreclosed on protected consumers and failed to send required evaluation notices in 2014.

May 12 -

The number of mortgages in coronavirus-related forbearance rose by 37 basis points as the unemployment rate soared, according to the Mortgage Bankers Association.

May 11 -

In a study of four metro areas, housing supply and demand gained momentum in the second half of April, even where the COVID-19 curve continued to grow.

May 11 -

Complaints to the bureau hit an all-time high in April. More than one in five said servicers wouldn't grant deferrals, forced borrowers into forbearance or violated other requirements of the coronavirus relief law.

May 10 -

After ending 2019 on a high note, Ocwen Financial posted an income loss in the first quarter due to the unexpected costs and volatility created by COVID-19.

May 8 -

Hiring by nonbank mortgage and brokers held up unusually well through the early days of the coronavirus outbreak in March, but April's all-time high in unemployment suggests that's unlikely to last.

May 8

![“A growing concern for many [homeowners] is the notion that they would have to make a balloon payment at the end of the mortgage forbearance,” said CFPB Director Kathy Kraninger.](https://arizent.brightspotcdn.com/dims4/default/21bc754/2147483647/strip/true/crop/5000x2813+0+260/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F1e%2F1a%2Fa2ee24e14f76810e720c3b08aee8%2Fkraninger-kathy-bl-031020.jpg)