-

As swelling demand constricts inventory to record-low levels, home price growth cuts into the purchasing power afforded by plunging interest rates, according to First American.

August 24 -

Uncertainty over the economy, the pandemic and politics are keeping existing owners from listing their homes.

August 21 -

May’s overall delinquency rate was up over 100% from the prior year.

August 11 -

The number of loans going into coronavirus-related forbearance was down for the eighth consecutive week, as the growth rate fell 23 basis points between July 27 and August 2, according to the Mortgage Bankers Association.

August 10 -

But refis bring overall mortgage application fraud risk back to its record low, First American said.

July 29 -

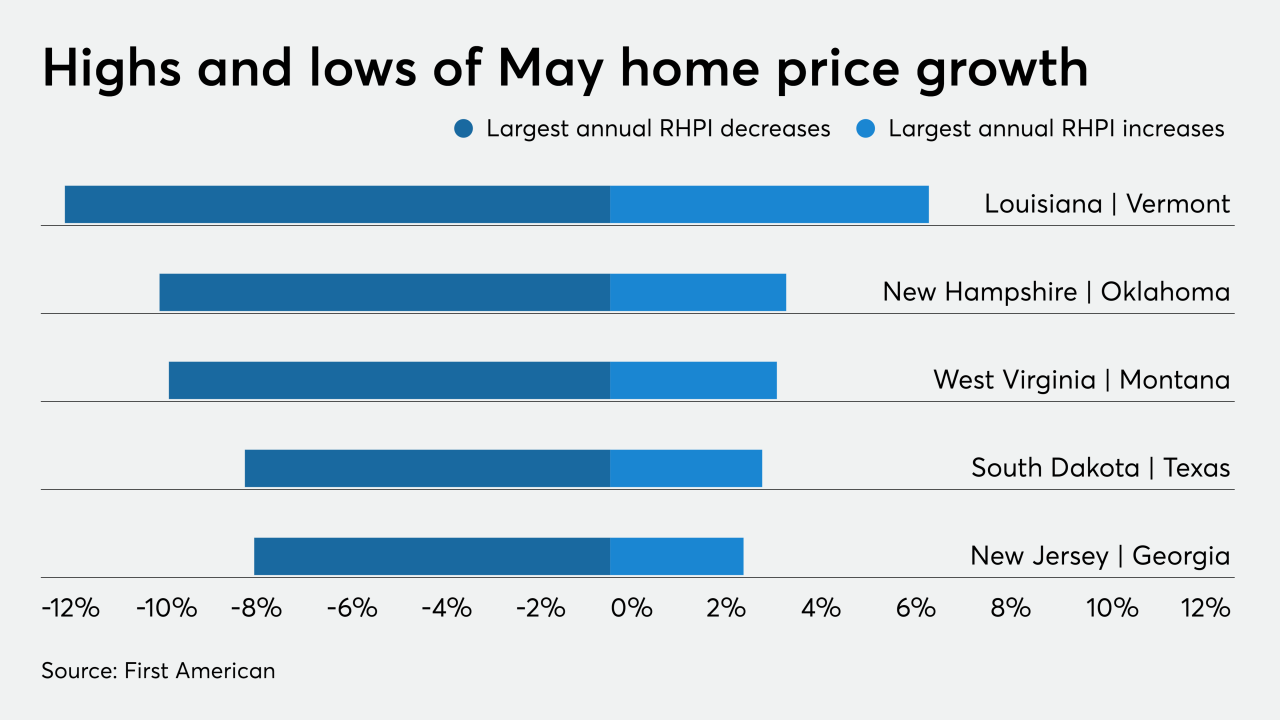

Tight inventory is expected to drive home prices higher over the summer, according to First American.

July 27 -

The surge of COVID-19 cases in much of the nation put a hold on reopening the economy, adding risk to the housing market, First American said.

July 16 -

As the country wrestles economic volatility, millennial homeownership demand rises, fueled by historically low mortgage rates.

July 1 -

First American's Loan Application Defect Index is higher on a month-to-month basis for the first time since February 2019.

June 29 -

Cannae Holdings, a spinoff of Fidelity National Financial, is trying to stage an unsolicited takeover of the property data, analytics and services firm that once had ties to Fidelity's competitor.

June 26 -

Potential sales last month rose compared with April as homes became more affordable due to low mortgage rates.

June 18 -

With would-be sellers too spooked to list their homes and would-be buyers held up due to social distancing orders, home price appreciation accelerated in April. And it could continue into the summer.

June 2 -

Less competition in the marketplace meant customers were less apt to fudge the truth on a loan application.

May 4 -

Pre-pandemic, home-buying power was high, but few are likely to buy a home today given a host of uncertainties regarding coronavirus, First American said.

April 27 -

Low mortgage rates increased new orders, but fallout from the pandemic hurt investment income.

April 23 -

From the crossroads of America down to the bayou, here's a look at 12 housing markets where it's the most financially prudent to buy a home rather than rent, according to First American.

April 16 -

While the housing market will suffer from the COVID-19 crisis, it's stronger than it was in during its last crash in 2008, according to First American Financial.

March 31 -

Title underwriters won’t be hit as hard by the coronavirus as other insurers, but related economic changes will challenge them, Fitch Ratings said, in assigning a negative outlook to the sector.

March 26 -

Investors' purchases of 10-year Treasurys after the Fed's 50 basis point short-term rate cut drove the yield below 1% for a period of time.

March 3 -

Mortgage loan application defect risk is at the lowest point since First American started tracking this data, strictly as a function of the shift to a refinance market.

February 28