-

Despite recriminations about how the crisis and ensuing regulations have tightened loan access, an actual assessment of mortgage credit availability finds the situation is more complicated.

October 24 -

Incenter Mortgage Advisors is facilitating the sale of $3.7 billion in mortgage servicing rights tied to Fannie Mae and Freddie Mac loans, roughly one-third of which have private mortgage insurance.

October 19 -

Donald Layton, who has run the mortgage giant since 2012, discussed the busy agenda leading up to his departure and says Freddie can serve as a "technical adviser" in GSE reform talks.

October 18 -

Conforming mortgage interest rates dropped slightly over the past seven days after weeks of steady increases, according to Freddie Mac.

October 18 -

Exploration and adoption of new technologies is essential for achieving strategic goals and satisfying the needs and expectations of mortgage borrowers.

October 16 Freddie Mac

Freddie Mac -

The departing CEOs of Fannie Mae and Freddie Mac oversaw significant cultural and operational shifts that made the housing finance system safer and more responsive to market needs, but a tough job lies ahead for their successors.

October 16 -

The Federal Housing Finance Agency, Fannie Mae and Freddie Mac have launched an online clearinghouse with resources to assist lenders in serving borrowers with limited English proficiency.

October 15 -

It's a critical time in Washington, with many key institutions in the mortgage and housing industries getting new leaders. At the Mortgage Bankers Association, there's a renewed focus on maintaining effective influence with decision makers on initiatives like housing finance reform, innovation and the evolving needs of home buyers.

October 14 -

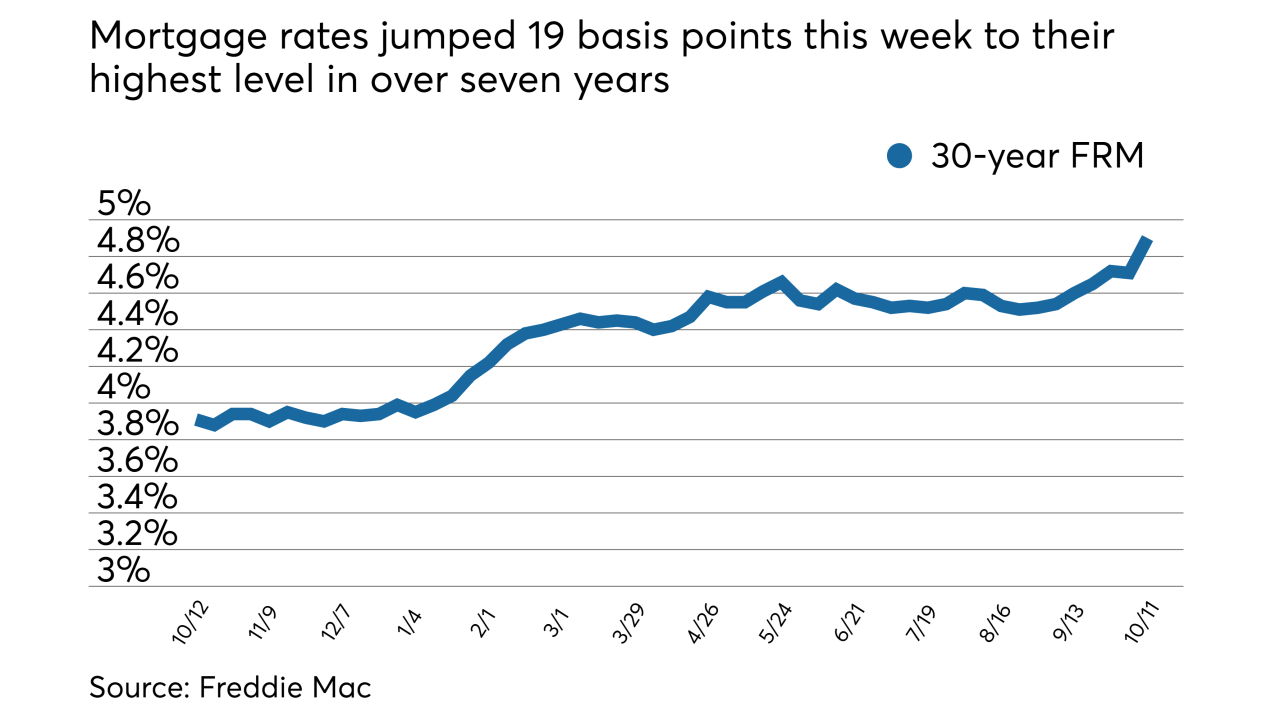

Mortgage rates, after a brief respite last week, rose to their highest level in over seven years, according to Freddie Mac.

October 11 -

Freddie Mac made its first equity investment into a low-income housing tax credit fund in nearly a decade, through a partnership with Enterprise Community Investment.

October 5 -

Mortgage rates dropped slightly for the first time after five weeks of increases, but this is only a temporary lull as the economy remains strong, Freddie Mac said.

October 4 -

First Foundation sold loans to Freddie Mac to free up space for higher-yielding credits. It then bought the securities that were formed to replace other, lower-yielding assets through an often overlooked program.

October 1 -

Fannie Mae and Freddie Mac issued new capital requirements for private mortgage insurers that will create big swings in carriers' asset reserves.

September 27 -

After a run-up in the latter half of last year, delinquencies on mortgages sold to Fannie Mae and Freddie Mac look fairly stable for the time being.

September 27 -

The strong U.S. economy pushed mortgage rates in the past week to their highest level in over seven years, and further hikes are on the way, according to Freddie Mac.

September 27 -

As the House Financial Services Committee prepares to hold a hearing Thursday on oversight of the Federal Housing Finance Agency, the exact focus of the hearing remains somewhat in flux.

September 25 -

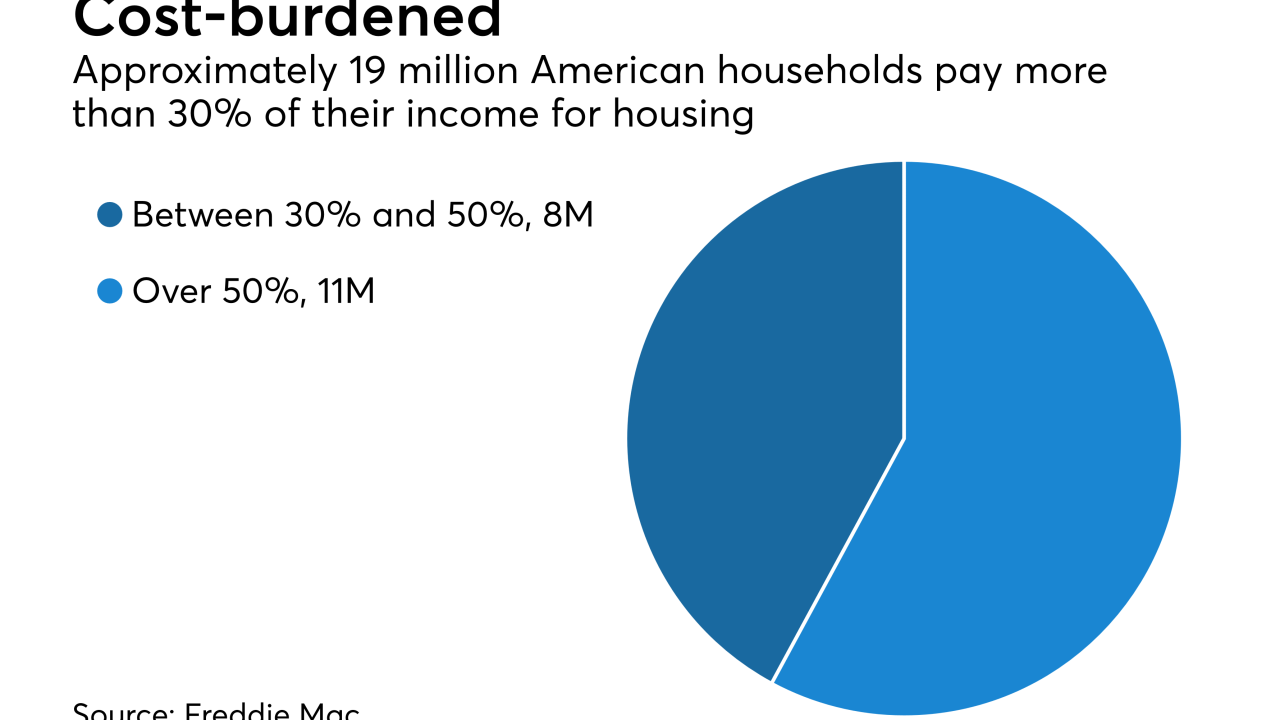

Lower corporate tax rates weakened the incentive for developers to use the Low-Income Housing Tax Credit program, which could prompt affordable housing construction to fall by as much as 40% by 2022, according to data aggregator Reis.

September 25 -

The housing market is stalling, and homebuilder stocks are feeling the pain.

September 24 -

A stronger economy, easing house price appreciation and slightly improving inventory conditions aren't enough to push up home sales this year, according to Freddie Mac.

September 24 -

Fannie Mae will add an appraisal waiver option for mortgages in regions that its Duty to Serve program designates as high-needs rural areas, but only if home inspections are completed instead.

September 24