-

While mortgage volume is expected to shrink next year, it should increase during the following two years and beyond as millennials start buying homes, the Mortgage Bankers Association forecasts.

October 16 -

The consumer bureau’s interim chief told an industry conference that “regulation by enforcement is done.”

October 15 -

The Federal Housing Administration is looking to streamline its single-family loan servicing requirements to align them with industry standards and upgrade outdated technology.

October 15 -

Ex-Ginnie Mae President Joseph Murin is among several industry veterans joining Ainsworth Advisors, a consultancy run by former mortgage banker David Lykken and former Texas Capital Bank executive Gary Ort.

October 15 -

As the mortgage industry confronts tight margins, shifting market share and regulatory uncertainty, a new leader emerges at the Mortgage Bankers Association.

October 14 -

It's a critical time in Washington, with many key institutions in the mortgage and housing industries getting new leaders. At the Mortgage Bankers Association, there's a renewed focus on maintaining effective influence with decision makers on initiatives like housing finance reform, innovation and the evolving needs of home buyers.

October 14 -

From discussing the future of mortgage tech to debating the shifting sands of political policies, here's a preview of the big issues, topics and ideas when the industry gathers in the nation's capital for the Mortgage Bankers Association's Annual Convention & Expo.

October 12 -

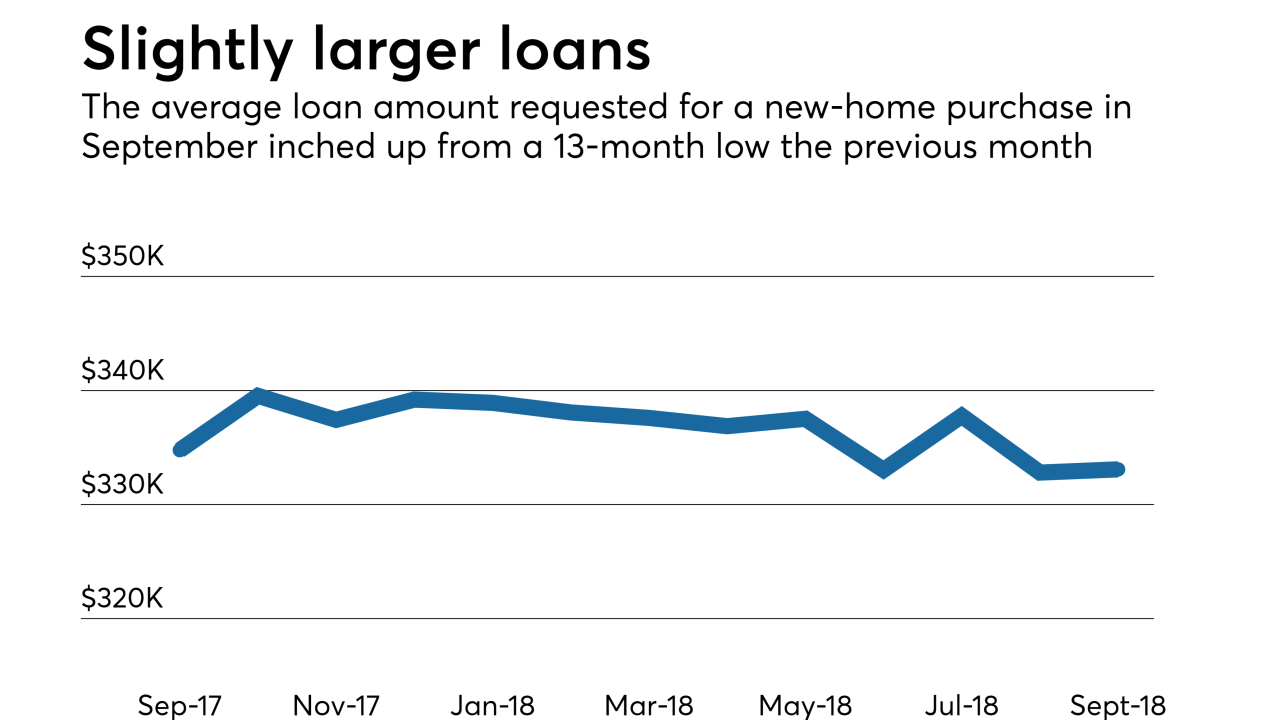

Mortgage borrowers buying new homes generated more loan applications this September than they did a year ago, even though interest rates are higher this year.

October 11 -

Proposition 10 would give local jurisdictions a freer hand to restrict rents, but critics say that would lead to property devaluations. Some see an effect regardless of whether the measure passes.

October 10 -

Mortgage applications fell last week as rates for the 30-year fixed conforming loan topped 5% for the first time since 2011, the Mortgage Bankers Association reported.

October 10 -

Lenders offered fewer government-guaranteed mortgage programs in September, leading to an overall decline in mortgage credit availability, according to the Mortgage Bankers Association.

October 4 -

Mortgage application activity was relatively flat compared with the previous week, as long-term interest rates held steady following the recent Fed rate hike, according to the Mortgage Bankers Association.

October 3 -

If California voters approve Proposition 10 in November, the ramifications will be felt on the state's affordable housing, according to the Mortgage Bankers Association.

October 2 -

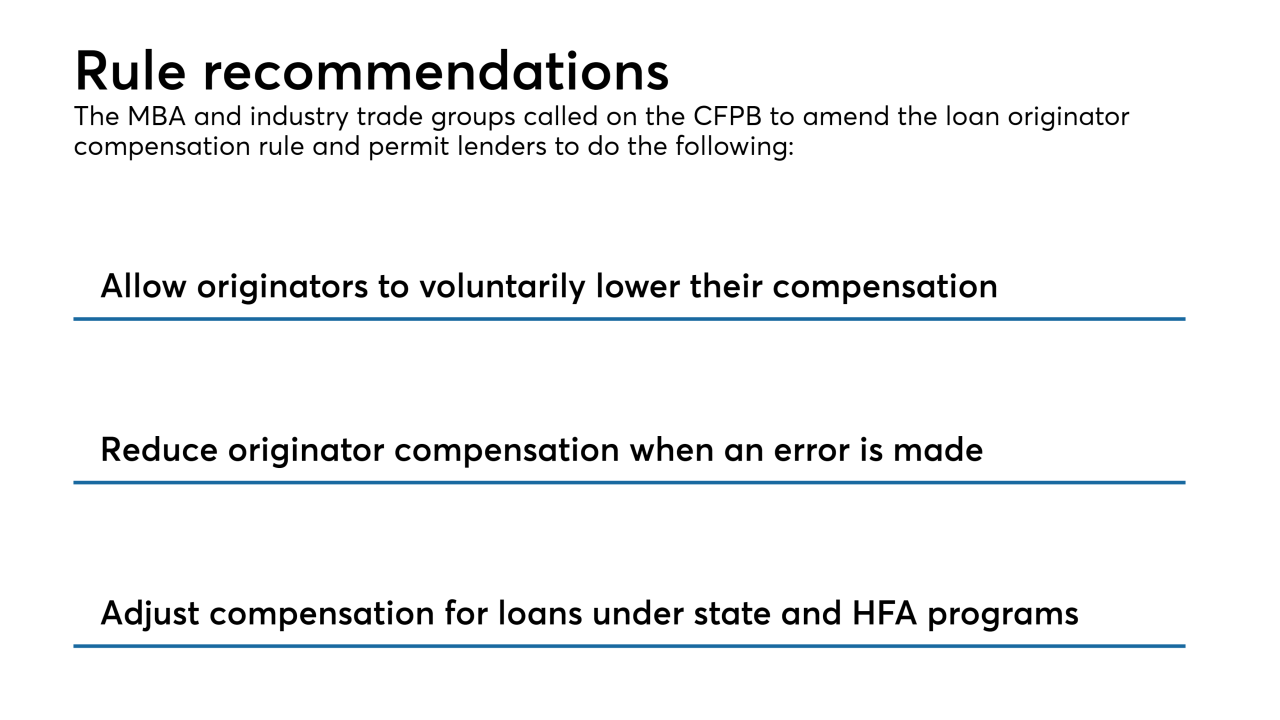

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

Commercial and multifamily mortgage debt outstanding grew by 1.6% during the second quarter, benefiting from improved property values and low interest rates, according to the Mortgage Bankers Association.

September 28 -

Mortgage applications were up 2.9% from one week earlier, even as the rate for the 30-year conforming mortgage reached its highest point in over seven years, according to the Mortgage Bankers Association.

September 26 -

Mortgage applications were up 1.6% from one week earlier, marking only the second increase of the past two months despite key interest rates rising, according to the Mortgage Bankers Association.

September 19 -

Increased sales of lower-priced newly built homes was not enough to counter a decline in mortgage application volume for the segment in August, according to the Mortgage Bankers Association.

September 14 -

Mortgage applications decreased 1.8% from one week earlier as refinance submissions fell to their lowest in nearly 18 years, according to the Mortgage Bankers Association.

September 12 -

Mortgage credit accessibility dropped for the first time in four months as jumbo loan products took a step back, according to the Mortgage Bankers Association.

September 11