-

Millennial homeowners took advantage of April's drop in mortgage rates by quickly securing refinance loans, which closed faster than purchases for the first time since March 2016, according to Ellie Mae.

June 5 -

Refinance mortgage application activity surged as interest rates fell to their lowest level since the start of 2018, but potential homebuyers remained sidelined due to economic uncertainty, according to the Mortgage Bankers Association.

June 5 -

The most borrowers in three years currently qualify for refinancing as the average for the 30-year fixed-rate mortgage dropped below 4% for the first time in over a year, according to Black Knight.

June 3 -

Mortgage company merger and acquisition activity should continue to increase in 2019 as loan production costs rise and originations stay flat.

June 3 -

Mortgage application fraud risk declined for the first time since last summer because the home sales market became less competitive with an easing of the inventory shortage, First American said.

May 31 -

Mortgage prepayment speeds may rise with the strong U.S. rate rally, and that may be cause for alarm for mortgage investors.

May 29 -

Consumer worries over the direction of the U.S. economy affected mortgage application activity this past week even as interest rates remained flat or declined, according to the Mortgage Bankers Association.

May 29 -

The decline in average mortgage rates since the start of the year is driving higher purchase demand, especially at the higher end of the market, according to Freddie Mac.

May 23 -

With mortgage rates falling to their lowest level in over a year, refinance volume drove this week's increase in application activity, according to the Mortgage Bankers Association.

May 22 -

Prepayments tied to repeated VA loan refinancing activity have had an adverse effect on Ginnie’s mortgage securities that persists despite countermeasures. The government bond issuer is making new plans to address the impact.

May 21 -

The era of plentiful refinance volume is over for the foreseeable future, because mortgage rates remained in a very narrow band for the past decade, said Mortgage Bankers Association Chief Economist Mike Fratantoni.

May 21 -

Housing finance reform cannot be piecemeal, but must be done using a comprehensive approach, an independent mortgage banker says.

May 17 Hallmark Home Mortgage

Hallmark Home Mortgage -

Mortgage rates descended through the onset of spring's home buying season, pushing up the share of refinance loans and volume of new-home purchase applications, according to Ellie Mae and the MBA.

May 16 -

Even if the U.S. economy slows during the rest of 2019, the outlook for the housing and mortgage market remains strong, said economists at Fannie Mae and Freddie Mac.

May 16 -

The trade dispute with China is likely to affect consumers' willingness to buy a home and apply for a new mortgage loan, according to the Mortgage Bankers Association.

May 15 -

While prepayment speeds on agency mortgage-backed securities rose in April, that increase should be short-lived as further significant interest drops are not expected, said a report from Keefe, Bruyette & Woods.

May 13 -

The Government Accountability Office called on Ginnie Mae to undertake four reforms to its operations, citing concerns regarding the ongoing shift in size and capitalization of mortgage-backed securities issuers.

May 10 -

Lower rates hurt the value of Impac Mortgage Holdings' servicing rights and overall earnings in the first quarter, but they could help improve the company's second-quarter results.

May 10 -

Lenders and policymakers could further build on a recent surge in Asian-American homeownership if they took three steps, according to the Asian Real Estate Association of America.

May 9 -

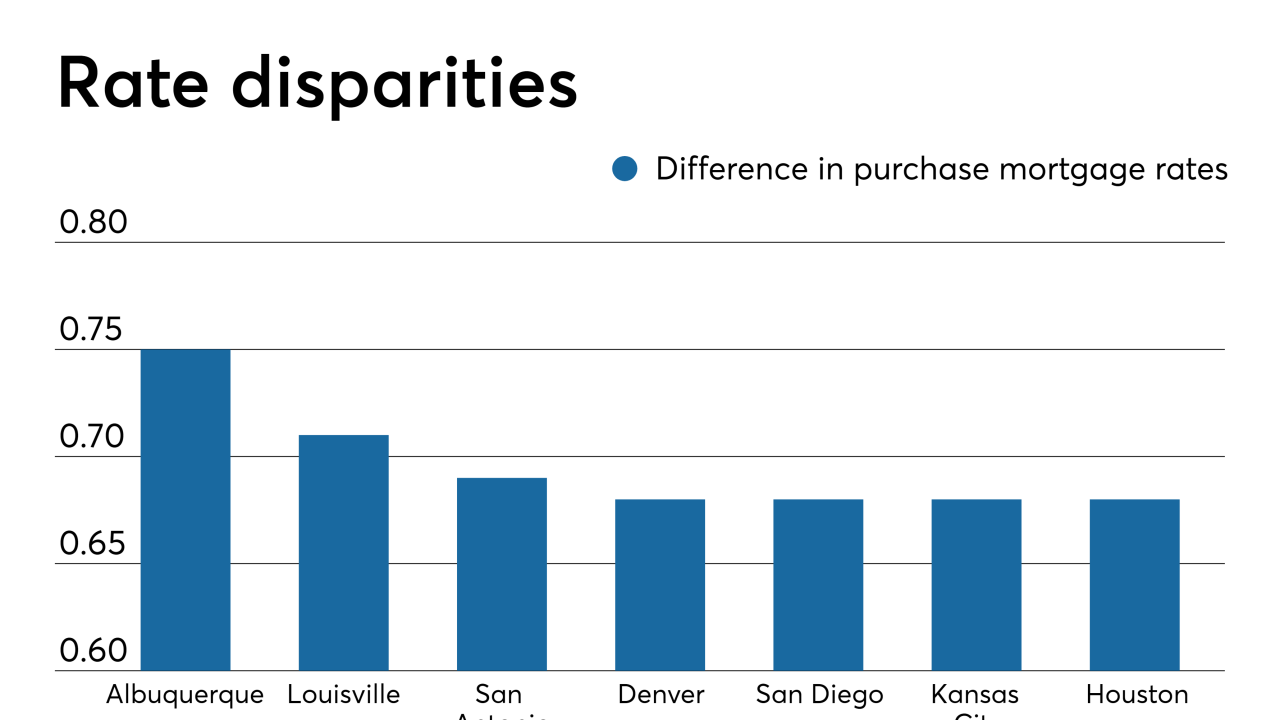

Lenders can help both the consumer save money and their own volumes by offering the most competitive rates or reducing their fees. Here's a look at the 12 housing markets borrowers save the most over the life of their loan by shopping around for a mortgage, according to LendingTree.

May 8