-

Mortgage volume continues to surge, driven by borrowers refinancing behind record-low interest rates, according to Ellie Mae.

October 21 -

From pervasive discrimination at work to the dangers of #BankingWhileBlack, Black people in America face serious hurdles when engaging with the financial services. Join us for a panel discussion featuring guests from the upcoming Access Denied: Systemic Racism in Financial Services podcast.

-

The pivotal issue of the November vote will be a divided government versus a united government, and its possible effect on policies that can drive the economy and markets.

-

In too many places, identity verification and other vetting is still done manually, says Signicat's John Erik Setsaas.

October 19 Signicat

Signicat -

The predominantly white universe of real estate investors may be used to working with people and companies with enough financial resources to have a track record in the business, but historic inequities have limited those opportunities for Black executives.

October 16 -

Strong mortgage and capital markets activity helped offset credit costs and one-time items in the third quarter at Citizens Financial Group. In a period of low rates, CEO Bruce Van Saun says he’d like to buy more fee-generating businesses.

October 16 -

As financial distress mounted, 12.4% of mortgagors missed payments across the second and third quarters of 2020 — and it could get worse, according to a study from the Mortgage Bankers Association.

October 16 -

The events of 2020 have only served to accelerate a number of potentially disruptive trends among consumers when it comes to banking and financial services — What does the emerging future of consumer and retail banking now look like?

October 16 -

Customers' needs and expectations changed drastically in 2020, overturning conventional thinking about their experience in the process. How can we strike the right balance between embracing digital channels and recognizing the value of human touch?

October 15 -

CEO Charlie Scharf disappointed investors by failing to provide either a detailed road map for long-term expense reductions or say when he might release such a plan.

October 14 -

Providers, including investors in low-income housing tax credits, have become hesitant to make deals.

October 14 -

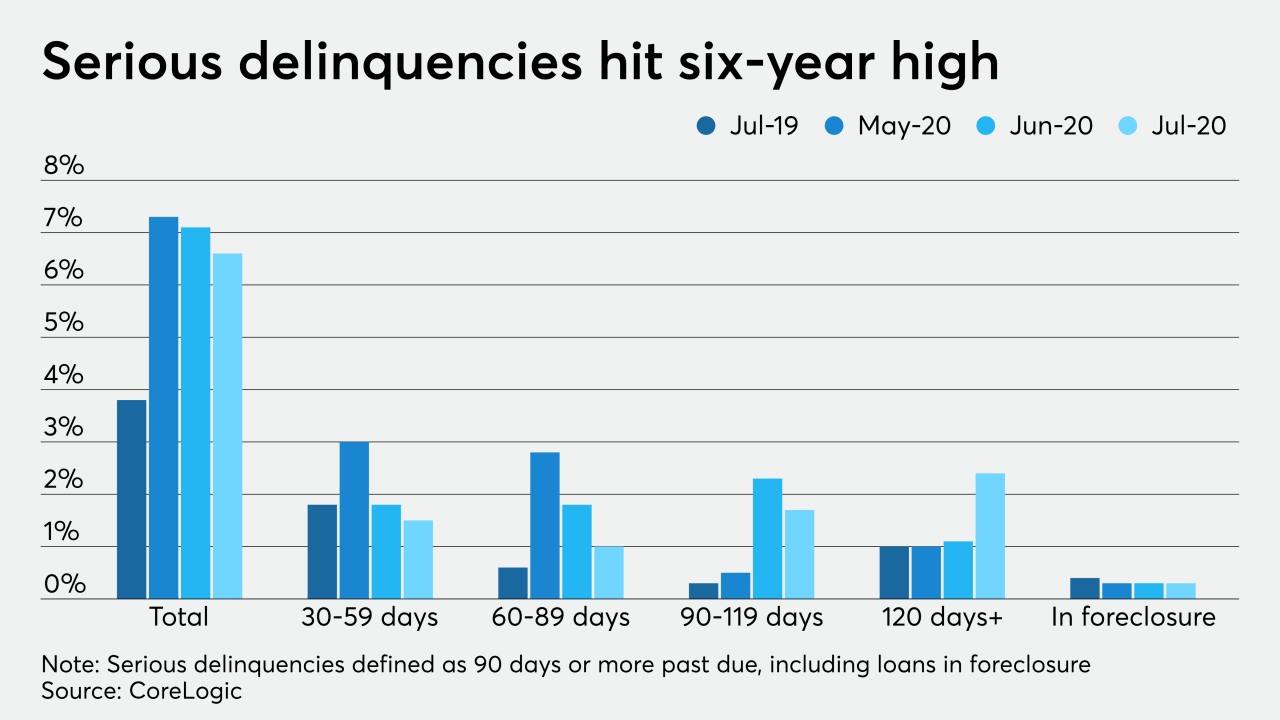

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13 -

The Consumer Financial Protection Bureau's overhaul of its Qualified Mortgage standard is alarming free-market advocates who say it will precipitate a return to easy credit and higher defaults and could disproportionately harm minorities.

October 8 -

Deferrals may be hiding credit issues, leading lenders to track deposit flows, property maintenance and other factors to gauge the true health of their portfolios.

October 8 -

The government-sponsored enterprises set a Sept. 30 deadline for sellers to accept applications for Libor adjustable-rate mortgages.

October 8 -

The company says it plans to originate 40,000 mortgages for Black and Hispanic households and finance 100,000 affordable rental units over five years.

October 8 -

The company, which recently completed an audit, set aside funds to cover issues tied with a lending program it discontinued last year. The move cleared the way for Sterling to file an overdue annual report with the Securities and Exchange Commission.

October 7 -

The industry says the 2017 cut in the corporate rate helped position lenders to support the economy when the pandemic hit. But a plan proposed by Democratic nominee Joe Biden could strain banks' capital investment and hiring, observers say.

October 6 -

HSBC, Bank of the West and Fannie Mae are among those offering green mortgage bonds, financing commercial clients’ efforts to rein in carbon emissions and developing other novel products that help customers tackle environmental challenges.

October 6 -

But most borrowers who have exited forbearance plans are back on track when it comes to paying, and the incidence of loss mitigation plans is high among those who aren't.

October 5