-

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

September 15 -

Legislation favorable to the industry would be unlikely to pass in a divided Congress, but the biggest benefit for banks and credit unions of Republicans' retaining control of the chamber would be defending against the disruption of a Democratic blue wave.

September 14 -

The company's outgoing CFO discussed ways the asset cap is stunting growth, but provided no updates at an industry conference on when the restriction might be lifted or the types of jobs it will cut.

September 14 -

Many states currently have temporary work-from-home guidance for licensed mortgage professionals that extends through at least Dec. 31, but some have fall expiration dates.

September 14 -

From an increased interest in outdoor space to a need for a dedicated home office, the pandemic has created new drivers for refinancing, moving and other housing decisions, TD Bank found.

September 11 -

The median sale price of an existing home in Southern Nevada hit $335,000 in August, a new record, according to the Las Vegas Realtors trade organization.

September 10 -

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8 -

Without further government help, that rate could double again by 2022, CoreLogic said.

September 8 -

Today there are 1 million fewer Americans in forbearance than there were at the peak in May, according to Black Knight.

September 4 -

When it comes to branch cleanliness and mask-wearing, the San Francisco bank is more diligent than its rivals in helping to reduce the spread of coronavirus, according to a new study.

September 4 -

The mortgage industry comes together to address current issues and prepare for a post-COVID marketplace Sept. 14 to 17.

September 4 -

Individuals who received a coronavirus stimulus check earlier this year also qualify for the protection, as do couples who jointly file their taxes and expect to earn less than $198,000.

September 1 -

Gov. Gavin Newsom late Monday signed a stopgap measure to rein in evictions, offering limited protections for tenants and aid to landlords hit financially by the coronavirus pandemic.

September 1 -

America's real estate meccas aren't what they used to be as COVID-19 revives U.S. mobility.

September 1 -

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

August 31 -

Tight inventory and unstoppable buyers pushed Bay Area median home prices higher in July, ignoring the economic drag of the pandemic.

August 31 -

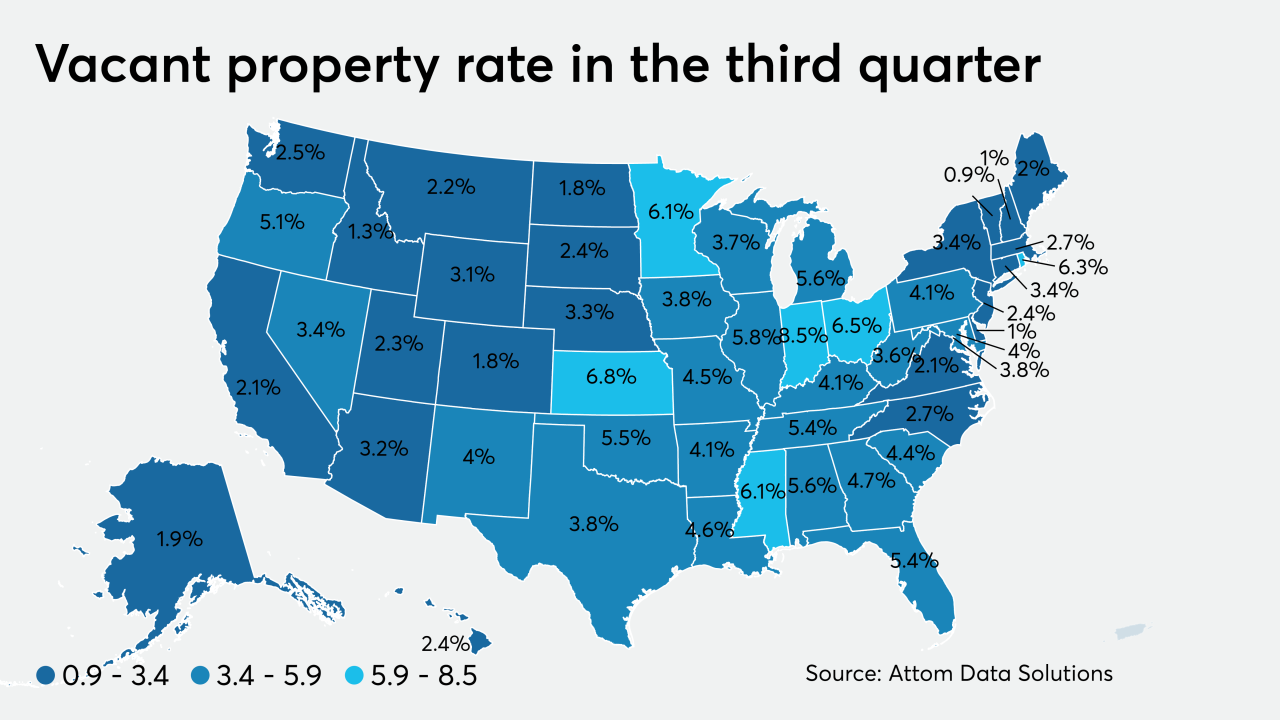

While the overall amount of foreclosures continued to decline due to the coronavirus moratorium, the share of zombie properties grew during the third quarter, according to Attom Data Solutions.

August 27 -

Many mortgage companies are hoping to operate remotely through year-end and are asking regulators for relief to that end.

August 27 -

Both the Federal Housing Finance Agency and Federal Housing Administration are extending relief for homeowners and renters due to the pandemic crisis.

August 27 -

Three non-QM deal issuers in August report varying levels of progress in moving borrowers from expired forbearance programs.

August 27