-

The percentage of seriously delinquent loans hit 5.8% in the third quarter, up from 1.5% a year earlier but down from 6.8% in the second quarter.

December 16 -

Economic instability during the quarter drove the increase in findings regarding income and employment, Aces Quality Management reported.

December 16 -

The forbearance rate continued its improvement, but the surge of COVID-19 cases could lead to more borrowers needing mortgage relief, according to the Mortgage Bankers Association.

December 14 -

While 12,000 mortgages exited forbearance, the most borrowers entered forbearance protection in a week since early September, according to Black Knight.

December 11 -

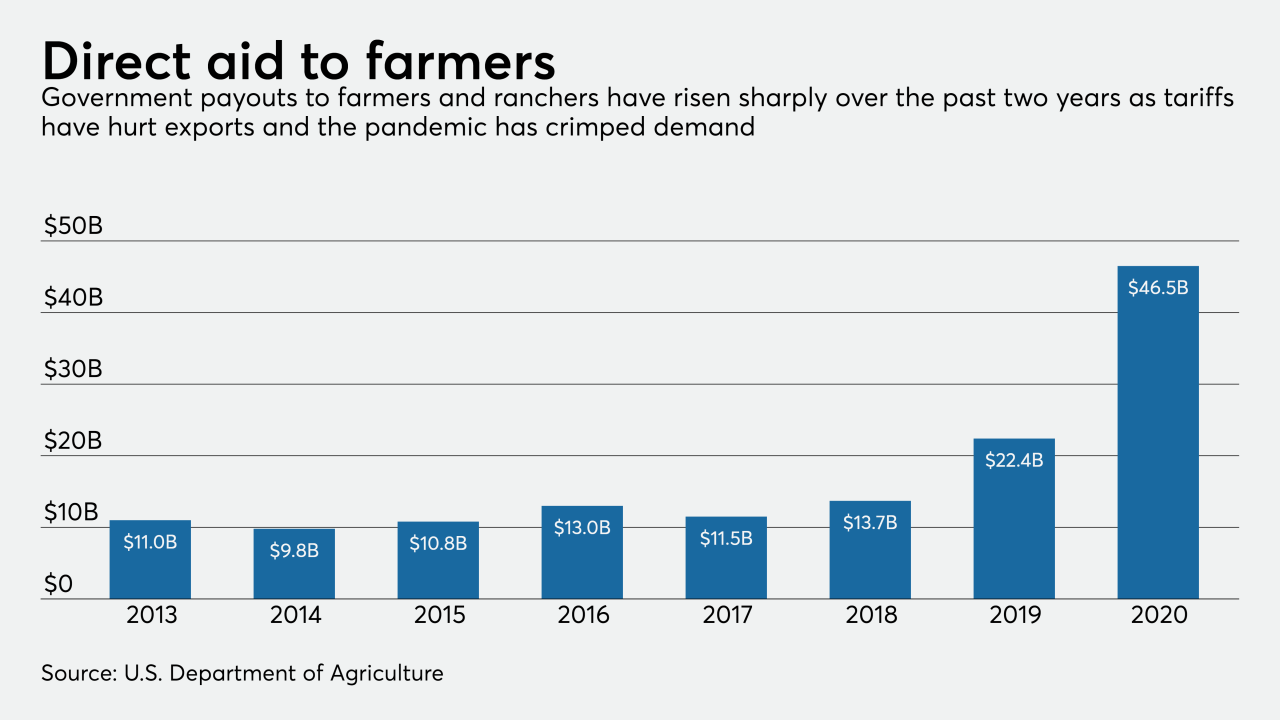

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

December 10 -

The ongoing coronavirus pandemic has done nothing to quell the upward trajectory of home prices in Southern Nevada.

December 10 -

But existing deals are likely to experience issues resulting from higher defaults, faster prepayment speeds.

December 9 -

The COVID-19 pandemic has radically changed consumers’ attitudes and behaviors toward money and payments. What has changed?

December 8 -

The surge of COVID-19 cases slowed economic recovery and hampered improvements in the forbearance rate, according to the Mortgage Bankers Association.

December 7 -

Lower cure rates and possible rises in foreclosures and claims could force these companies to raise capital next year, Fitch Ratings said.

December 4 -

People with scores below 500 are often in communities that suffer the most from economic hardship and violence. Banks and regulators can do more to qualify them for financing, ultimately creating healthier local economies.

December 2 Operation HOPE Inc.

Operation HOPE Inc. -

Tuesday's hearing on the CARES Act was dominated by bickering over Treasury's decision to shut down the Fed's emergency lending facilities, drowning out pleas from some lawmakers for more aid.

December 1 -

The incoming administration chose a battle-tested policymaker who can draw on her nearly two decades at the Fed to help rebuild an economy still struggling from the coronavirus pandemic.

November 30 -

Citigroup's realty arm is sponsoring a $1.06 billion RMBS of highly seasoned mortgage loans with troubled histories. All of the loans were acquired via a Fannie whole-loan auction.

November 25 -

Mortgage rates remained unchanged at their record lows heading into the Thanksgiving holiday, as investors reacted to a growing resurgence in coronavirus cases.

November 25 -

The forbearance rate continued recovering in lockstep with employment improvement, according to the Mortgage Bankers Association.

November 23 -

Weaker consumer spending data coming into the holiday season, as well as a resurgence of the COVID-19 spread, pushed mortgage rates to a new low, Freddie Mac said.

November 19 -

A Freddie Mac study of loans in forbearance from 2017 and 2020 found that, over both periods, borrowers had low credit scores and high debt-to-income ratios.

November 18 -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

November 17 -

If the GOP can hold its majority in the chamber, Sen. Pat Toomey, R-Pa., will likely become the panel's chairman. His ardent support for free-market principles could set up partisan clashes with Democrats over pandemic relief, money laundering rules and more.

November 16