-

So far, only Tulsa County has opted in, but the Indian Nation Council of Governments is working with officials across the state to get other counties on board.

August 6 -

The company, which launched last fall, announced a partnership with an organization that aids military families.

August 5 -

PREIT, which owns a number of large malls, is trimming the salaries of its CEO and chief financial officer while suspending dividend payments as part of a deal with its lenders to stave off default as the coronavirus pandemic continues to take its toll on the troubled company.

August 4 -

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

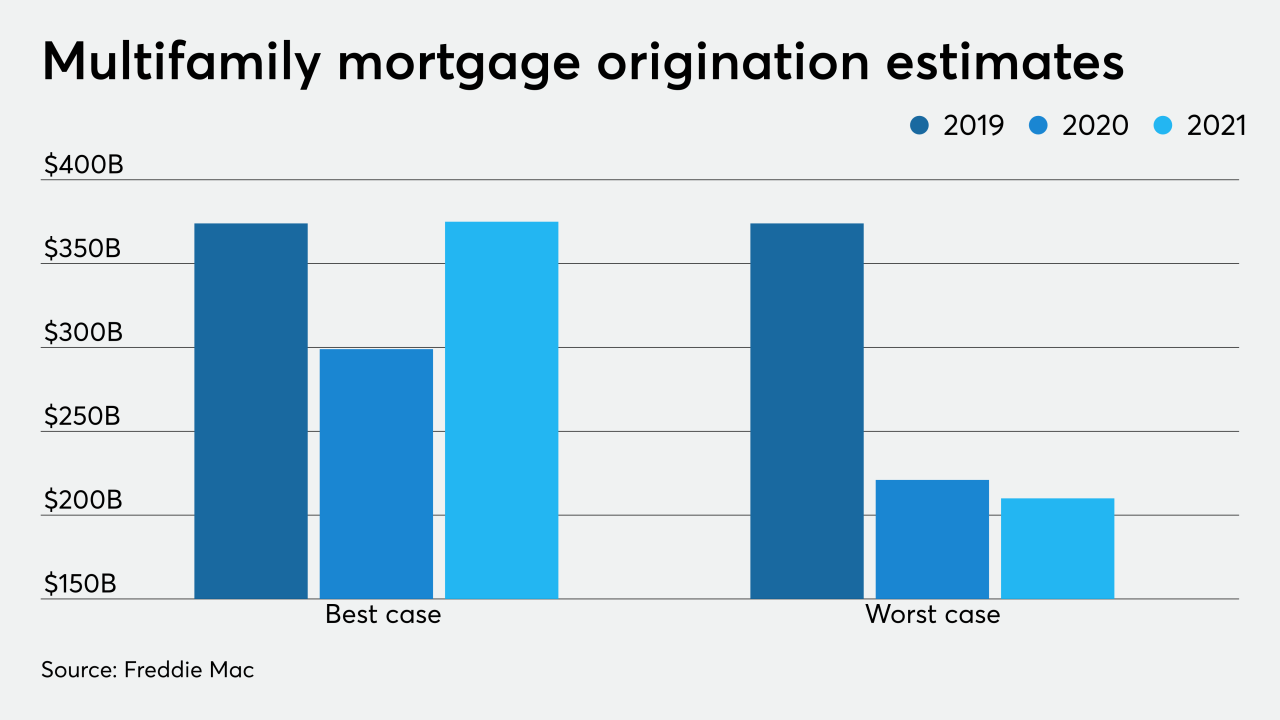

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

Fannie, Freddie also announced they'll face banklike liquidity standards starting Sept. 1.

July 31 -

The combined impact of coronavirus forbearance periods ending while low rates persist means large workloads for title insurers, appraisers and others.

July 31 -

Some real estate agents in the Daytona Beach, Fla., area have been reporting an increase in bidding wars for homes because of the low inventory.

July 31 -

The mortgage giants will have to meet benchmarks for covering cash flow needs during stressed periods. The FHFA views the requirements as a prerequisite to the companies exiting conservatorship.

July 31 -

The government-sponsored enterprise's earnings were up tenfold as it stabilized mortgage market liquidity amid the coronavirus.

July 30 -

Mortgage rates fell 2 basis points this week, remaining near their historic lows as they have for the past month with the markets roiled by uncertainty, according to Freddie Mac.

July 30 -

Even amid a global pandemic — and by all accounts spurred by it — Palm Beach, Fla., single-family property sales surged during the second quarter, according to a new round of real estate reports.

July 30 -

The private equity megalith's mortgage trust made a second-quarter net income of over $17.5 million and $85.2 million in core earnings.

July 30 -

Born from the burgeoning real estate market that preceded the Great Recession, flipping homes has become a national fascination over the past two decades.

July 29 -

From guidelines for remote appraisal alternatives to the ways that forbearance affects borrowers' ability to get new loans, here are five examples of mortgage requirements that have been in flux since the coronavirus outbreak in the United States.

July 29 -

The key word is "temporary" with the FHA's quality control waiver expiring and not likely to be renewed.

July 28 ACES Risk Management Corp.

ACES Risk Management Corp. -

Whalen: "It is tempting to think that low interest rates will cure all ills in the housing sector, but this view is seriously in error, as we learned in 2008."

July 27 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

As home loans surge and lenders look to expand, they're doing a cost-benefit analysis on the possibility of opening more commercial locations.

July 24 -

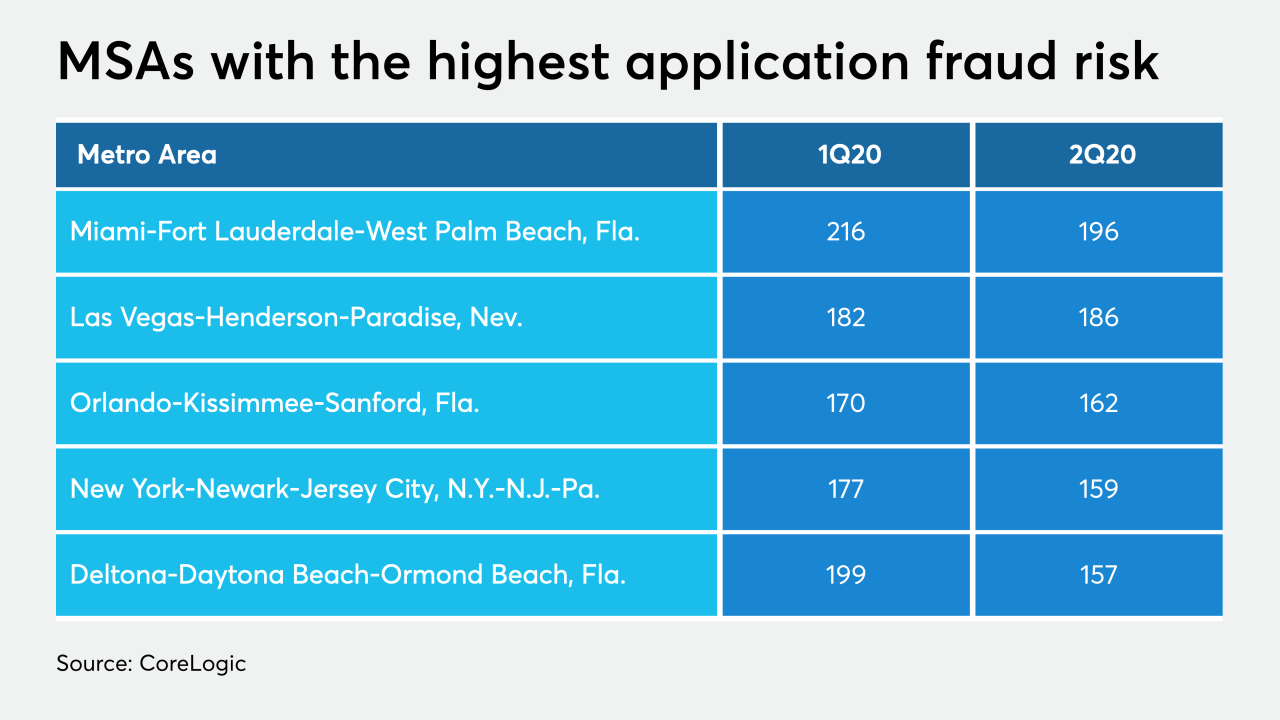

CoreLogic said more refinancings and fewer investor purchase mortgages drove its index down to a level last reached in the third quarter of 2010.

July 24 -

Google has allocated $115 million out of a $250 million investment fund for affordable housing projects in the Bay Area.

July 23