-

Compared with the week prior, approximately 83,000 more loans from all investor types became forborne.

June 26 -

Nonbank servicers have been seeking more sources of cash since the coronavirus disrupted markets and elevated forbearance rates. These are some strategies they may be able to use.

June 26 -

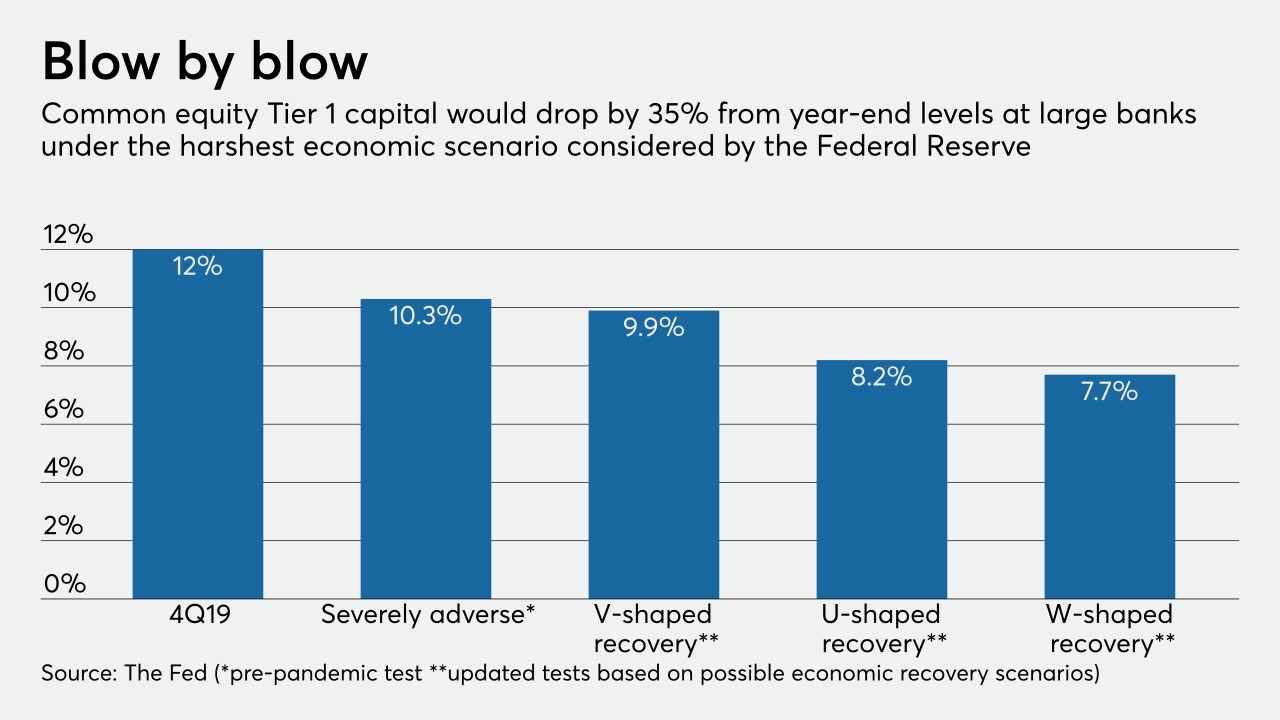

In the most sweeping capital distribution order since the financial crisis, the Federal Reserve says it will prohibit big banks from buying back their stock in the third quarter and limit dividend payments to second-quarter levels.

June 25 -

The government-sponsored enterprises had been considering tightening counterparty requirements for nonbanks, but in light of COVID-19's spread, they've reconsidered that.

June 25 -

The Mortgage Bankers Association points to better lender diversity and a stronger housing finance network as reasons for its support.

June 25 -

For banks with assets between $10 billion and $100 billion, the average exposure is 165% of capital.

June 24 -

The mortgage company will provide up to $17 million in forgiveness to settle charges that modifications it applied to distressed government-related loans were not in keeping with state servicing regulations.

June 24 -

For potential higher-end homebuyers, the pandemic was merely a pause, but for those seeking affordable properties — often people of color — it created yet another barrier.

June 23 -

Government-sponsored enterprise reform could be one hurdle to future innovation.

June 23 -

Whatever path Fannie Mae and Freddie Mac take, the Mortgage Bankers Association would like to see them preserve many of the changes they made while in government conservatorship.

June 23 -

The Consumer Financial Protection Bureau plans to change the definition of what constitutes a qualified mortgage from a 43% debt-to-income limit to a price-based threshold, and further extend a temporary exemption given to Fannie Mae and Freddie Mac.

June 22 -

Community associations have continued to take homeowners to court and initiate foreclosures during the economic crisis for delinquent dues

June 22 -

JA wave of new homebuyers from the northeast and other parts of the country flooded the Hilton Head, S.C., real estate market over the past few weeks.

June 22 -

Compared with the week prior, approximately 57,000 fewer loans from all investor types were forborne.

June 19 -

An Idaho court has ruled against a Treasure Valley resident for his role in a Ponzi scheme that bilked millions from real estate investors.

June 19 -

Starwood Capital Group missed two monthly payments on securitized debt tied to five shopping malls anchored by bankrupt department stores including Sears and J.C. Penney.

June 18 -

Potential sales last month rose compared with April as homes became more affordable due to low mortgage rates.

June 18 -

Mortgage rates fell 8 basis points this week to a new low as the economy remains shaky and there are new flare ups of the coronavirus, according to Freddie Mac.

June 18 -

New Residential Investment Corp., fresh off a substantial first-quarter reduction of its asset holdings, is now planning to securitize the receivables on its $200 billion servicing portfolio of Fannie Mae-owned mortgages.

June 17 -

The language most frequently spoken by LEP consumers is Spanish, followed by Chinese, Vietnamese, Korean and Tagalog. The Federal Housing Finance Agency's online clearinghouse translates CARES Act forbearance information into these languages.

June 17