-

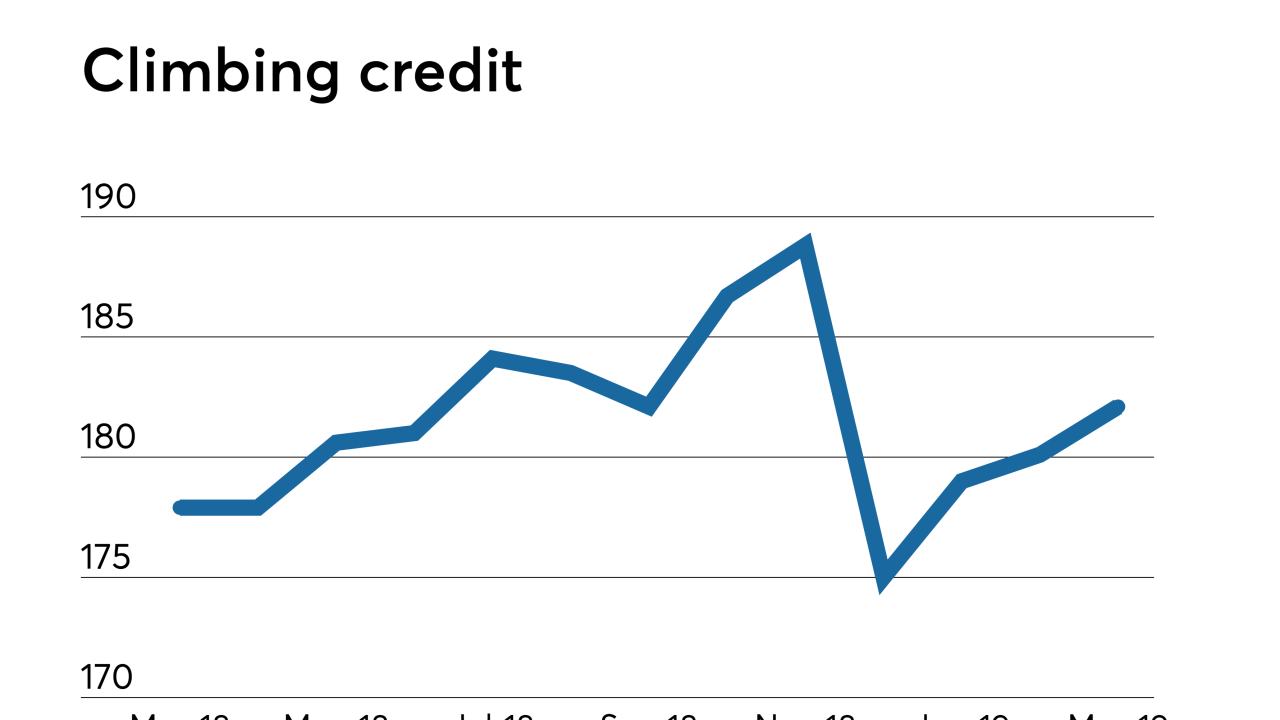

With affordability still an issue despite falling interest rates and harnessed home value growth, lenders further loosened credit standards in June, according to the Mortgage Bankers Association.

July 9 -

Large banks had huge losses from originating mortgages in 2018 as costs were three times higher than similar-sized independent lenders, according to research conducted by Stratmor and the Mortgage Bankers Association.

June 21 -

As purchase applications stall in the heart of home buying season despite mortgage rates nearing two-year lows, lenders continued to loosen credit standards in May, according to the Mortgage Bankers Association.

June 11 -

Plaza Home Mortgage has improved its pricing for certain jumbo loans that Fannie Mae's automated underwriting system approves, but categorizes as ineligible due to loan size.

May 28 -

The shift to nonbank lenders will put the breaks on non-qualified mortgage and home equity line of credit origination growth.

May 20 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Mortgage lending credit standards loosened a bit last month as investors displayed more interest in non-qualified mortgage and nonagency jumbo loans to stay competitive, according to the Mortgage Bankers Association.

May 9 -

Having a cash-out refinance program is important to greater share of originators in the West than it is in the United States as a whole, the Top Producers 2019 survey found.

May 1 -

Mortgage lending standards loosened in March, as a swell in jumbo credit helped drive an expansion in availability for the third straight month, according to the Mortgage Bankers Association.

April 4 -

Plaza Home Mortgage has expanded the guidelines of its wholesale and correspondent non-qualified mortgage program to allow using bank statements for documenting income.

April 3 -

The digital lender rebranded its mortgage business as SoFi Home Loans about four months after it took a step back from real estate finance to redesign its processes.

March 29 -

With the launch of its Medical Professional Mortgage Product, TD Bank is leveraging an opportunity to attract new customers and to address what it says is a knowledge gap among this group of professionals.

March 22 -

Mortgage lenders are optimistic about their business prospects during this spring's home purchase season even with the negative sentiments about demand in the previous three months, Fannie Mae said.

March 13 -

Being too dependent on the automated underwriting tools created by the government-sponsored enterprises to originate loans underlying private-label mortgage-backed securitizations could negatively affect their credit quality, a report from Moody's said.

February 26 -

When it comes to cars, tunnels and rockets, Elon Musk thinks big. The same is true for his household finances.

February 22 -

In a slow mortgage market, construction loans are considered the most likely source of growth for lenders, according to a new study.

January 22 -

The standards for mortgage lending constrained in December, as a drop in conventional credit brought availability to its lowest point since February 2017, according to the Mortgage Bankers Association.

January 10 -

Manhattan home prices fell in the fourth quarter, with the median slipping to less than $1 million for the first time in three years, as ample inventory continued to allow buyers to demand sweeter deals.

January 3 -

Mortgage credit available to consumers increased in November by 1.1% from the previous month as lenders offered more conventional products with expanded underwriting criteria, the Mortgage Bankers Association said.

December 6 -

Bank jumbo mortgage underwriting standards weakened in the third quarter by the most in three years and as profitability remains under pressure, loosening should continue at an accelerated pace, a Moody's report said.

November 16 -

Wells Fargo & Co. raised its required down payment for homebuyers in Connecticut's Fairfield County to 25% from the standard 20% after it categorized the area as distressed.

November 15