-

The shrinking ranks of appraisers, combined with the record number of loan applications in 2020, created "the perfect storm between supply and demand," which inspired the new payment plan, Incenter's Mark Walser said.

February 17 -

Between the dip in refis and the approach of the spring buying season, mortgage lenders are likely to start paying a little more attention to the purchase market, which is less rate-sensitive.

February 17 -

The offering went down to $14 from an anticipated $19 to $21 per share.

February 11 -

But the average amount for a purchase loan increased to an all-time high, showing the upper end of the housing market remains strong.

February 10 -

But the company sees reasons to be optimistic about the second half of the year, CEO and Chairman Michael Nierenberg said during its fourth quarter earnings call

February 9 -

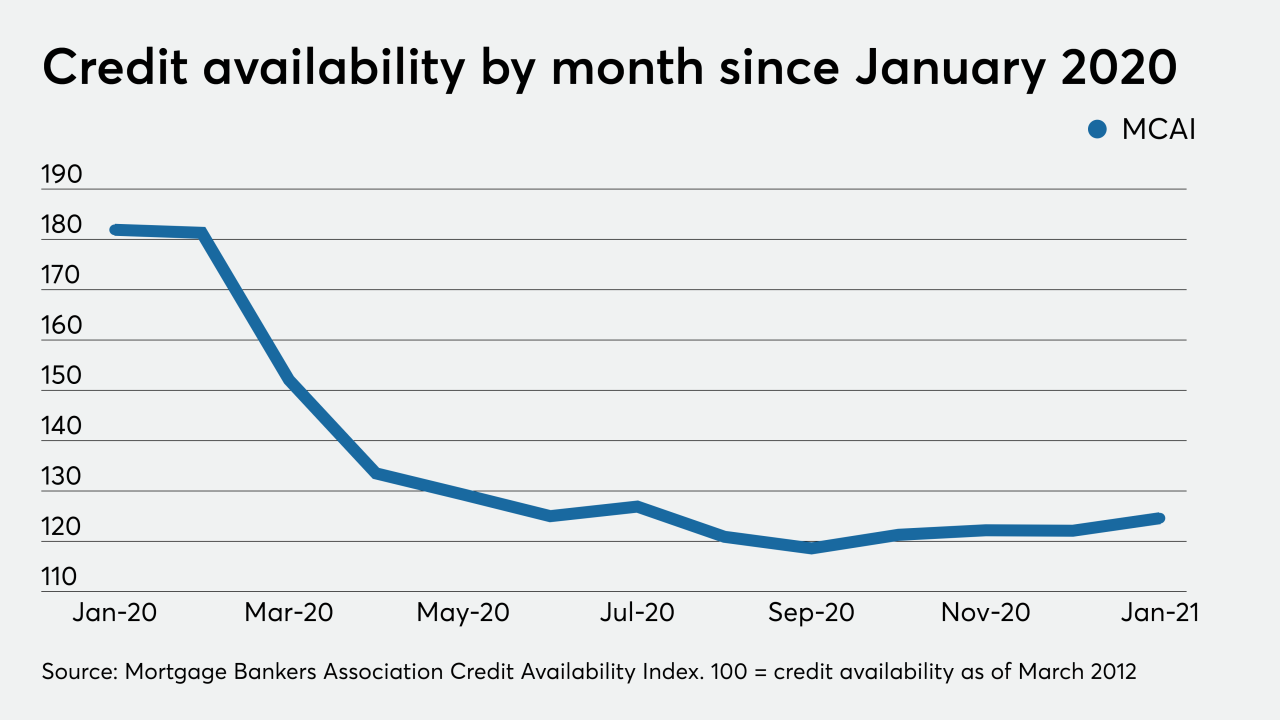

The movement in the MBA’s credit availability index suggests that, amid forecasts of diminished refinancing, lenders want to accommodate consumers buying homes, but they aren’t yet ready to lend as freely as they did before the pandemic.

February 9 -

The mortgage industry’s technology emphasizes speed, but a surge in volume has elongated the closing process for many, which is problematic ahead of a potential seasonal uptick in more time-sensitive purchase loans.

February 9 -

As 2021 shapes up to be a robust year for mortgage volumes, local lenders discuss the 12 metro areas that are expected to get the most interest from buyers, according to Zillow.

February 8 -

2020’s mortgage employment numbers proved to be slightly higher than previously estimated when reconciled with the Bureau of Labor Statistics’ annual business census.

February 5 -

Also, private money is expected to return to the mortgage securitization market, according to lenders who responded to an Altisource survey.

February 5 -

“It’s time for us to stop treating the purchase mortgage as some kind of market impediment or red flag for our forecasts,” says Chairman of JJAM Financial and former Ginnie Mae President Joseph Murin

February 5 Chrysalis Holdings

Chrysalis Holdings -

The acquiring company does business under the name Excelerate Capital and will extend that name to Castle in order to expand its footprint.

February 3 -

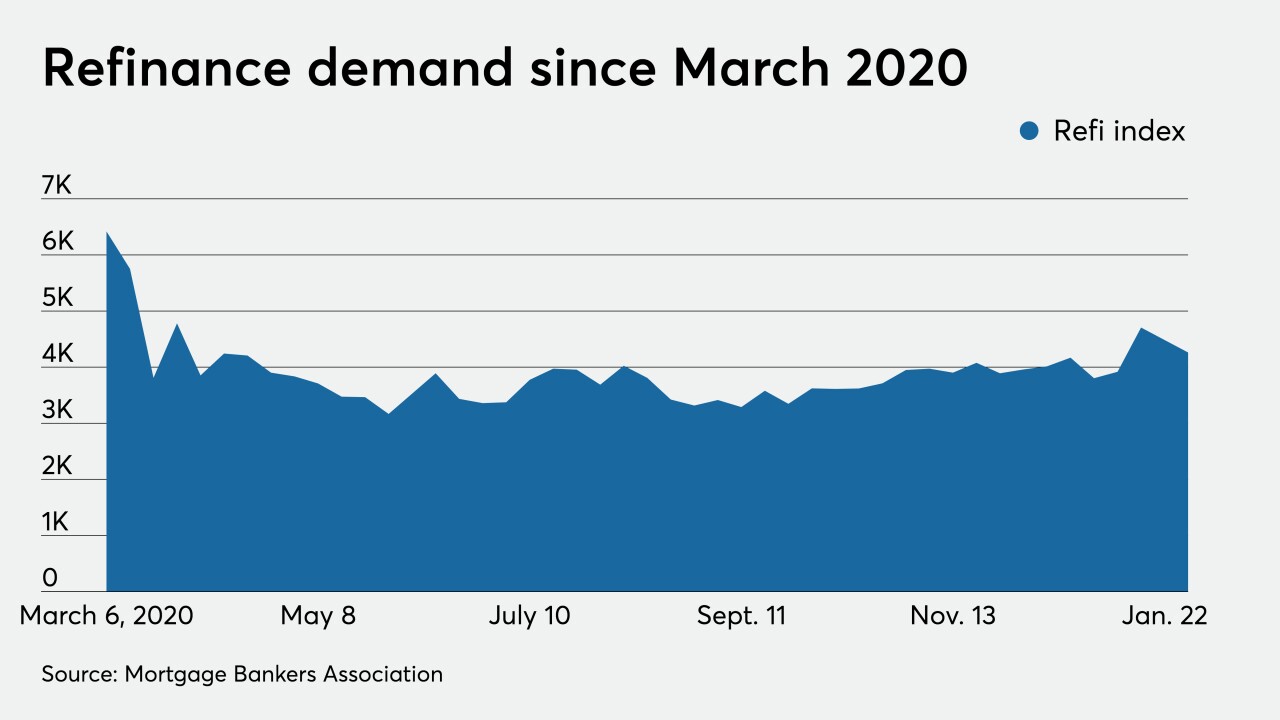

After mortgage rates rose for three weeks, borrowers took advantage of a 3-basis-point dip and sparked a short-term refinancing rally, according to the Mortgage Bankers Association.

February 3 -

With the shift to a low-rate environment dominated by no cash-out refinancing, use of an alternative to traditional valuations has soared.

February 2 -

While financing costs are still low enough to offset sticker-shock from rising home prices, a slight increase in the average 30-year conforming rate weighed on borrowers, according to the Mortgage Bankers Association.

January 27 -

The mortgage lender will promote its brand, products and services through MLB-related television or radio ads, in addition to digital outlets.

January 26 -

The subsidiary of New Residential Investment produced nearly $400 million in non-QM volume in the first quarter of 2020 before putting a hold on the product offering in March.

January 25 -

Plus, 4Q earnings show strong mortgage volumes, growth forecasted for jumbo loan market and more.

January 22 -

Mortgage industry hiring and new job appointments for the week ending Jan. 22.

January 22 -

Despite that decline, the company notched its second-best quarterly earnings ever over that period.

January 21