-

“It’s time for us to stop treating the purchase mortgage as some kind of market impediment or red flag for our forecasts,” says Chairman of JJAM Financial and former Ginnie Mae President Joseph Murin

February 5 Chrysalis Holdings

Chrysalis Holdings -

The acquiring company does business under the name Excelerate Capital and will extend that name to Castle in order to expand its footprint.

February 3 -

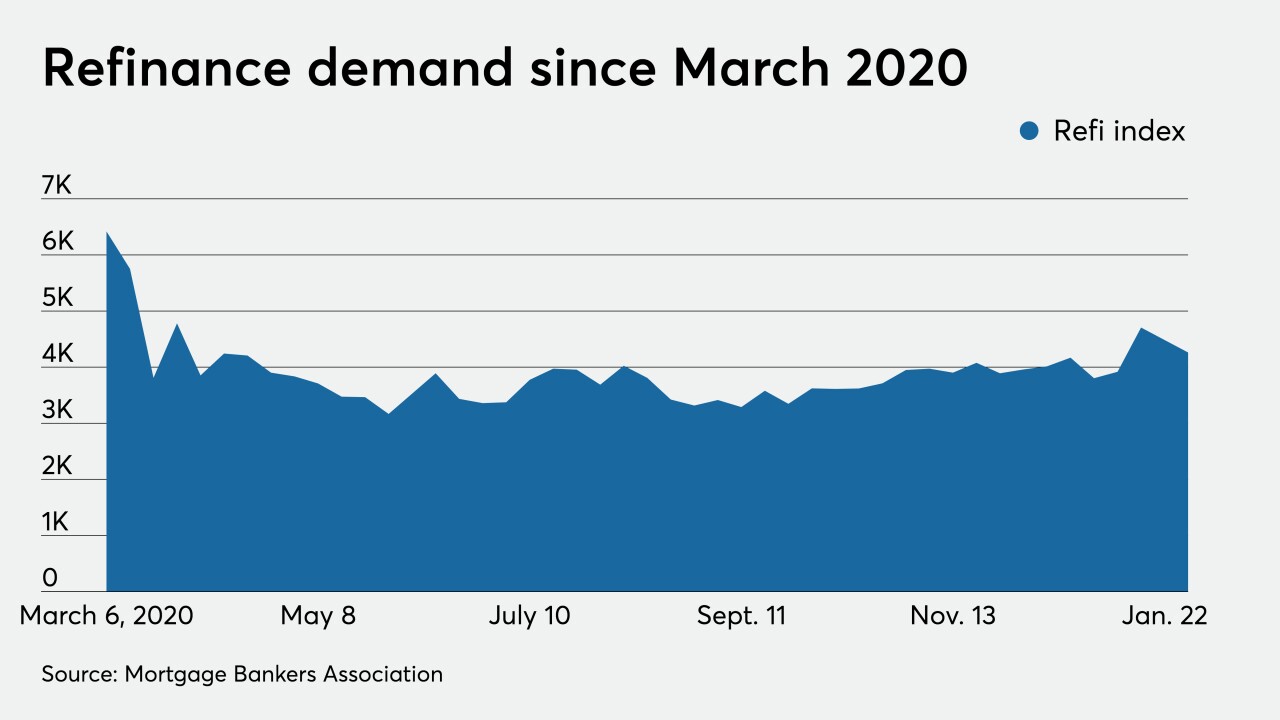

After mortgage rates rose for three weeks, borrowers took advantage of a 3-basis-point dip and sparked a short-term refinancing rally, according to the Mortgage Bankers Association.

February 3 -

With the shift to a low-rate environment dominated by no cash-out refinancing, use of an alternative to traditional valuations has soared.

February 2 -

While financing costs are still low enough to offset sticker-shock from rising home prices, a slight increase in the average 30-year conforming rate weighed on borrowers, according to the Mortgage Bankers Association.

January 27 -

The mortgage lender will promote its brand, products and services through MLB-related television or radio ads, in addition to digital outlets.

January 26 -

The subsidiary of New Residential Investment produced nearly $400 million in non-QM volume in the first quarter of 2020 before putting a hold on the product offering in March.

January 25 -

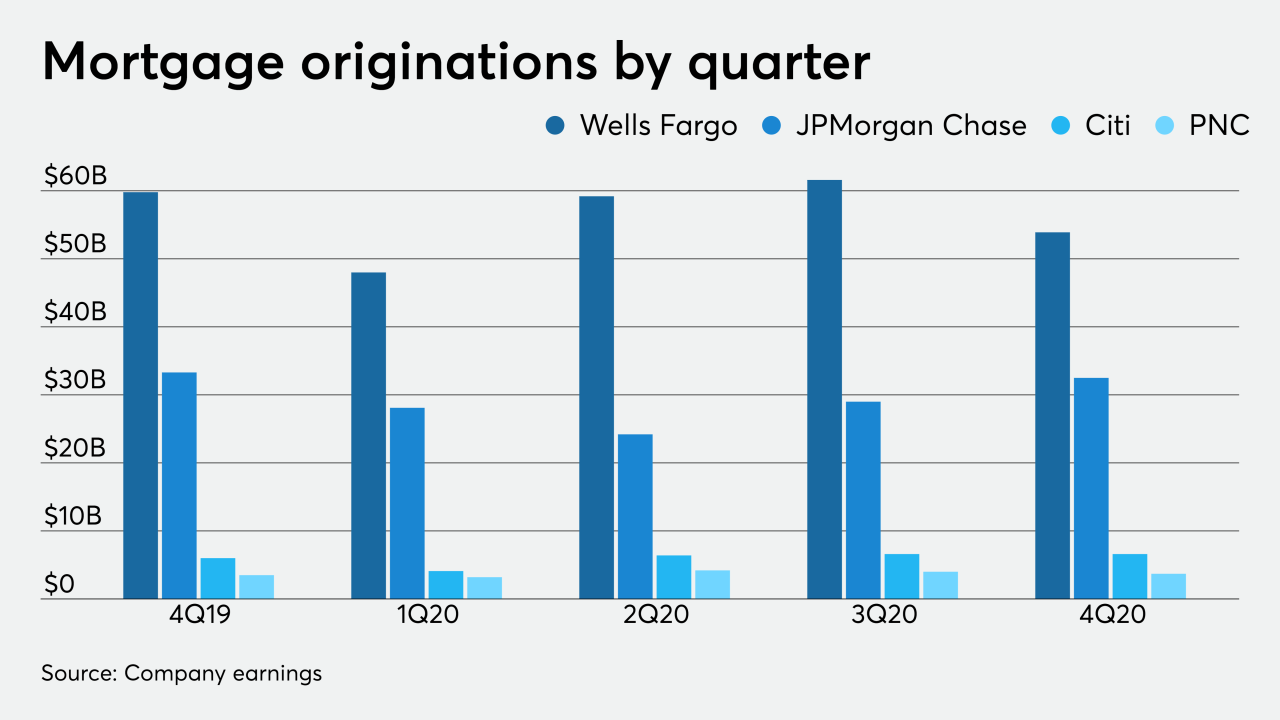

Plus, 4Q earnings show strong mortgage volumes, growth forecasted for jumbo loan market and more.

January 22 -

Mortgage industry hiring and new job appointments for the week ending Jan. 22.

January 22 -

Despite that decline, the company notched its second-best quarterly earnings ever over that period.

January 21 -

What if mortgage lenders could earn borrowers’ confidence and affection even earlier, so that they would turn to them repeatedly for other loans, including that initial mortgage, CampusDoor CEO Steve Winnie asks.

January 21CampusDoor -

The Department of Housing and Urban Development bulletin waives “non-citizens” language in the FHA’s handbook, which one Trump administration official had claimed made DACA recipients ineligible for FHA loans.

January 20 -

Mortgage applications decreased 1.9% from one week earlier as rising rates started to affect refinance activity, according to the Mortgage Bankers Association.

January 20 -

The company’s 4Q originations were down from the same time in 2019 and the number of overall loans for 2020 marked a decline from the year before.

January 19 -

With refinance volumes predicted to fall — but currently continuing apace — lenders explain how they’re readying themselves for eventual contraction and its implications for their expenditures.

January 19 -

The CFPB’s allegations are similar to unresolved accusations Connecticut first levied against the company in 2018.

January 15 -

While some industry forecasts predicted origination volumes would fall 7% quarter-to-quarter in 4Q, early earnings numbers from Wells Fargo, JPMorgan Chase, Citi and PNC Bank show they were down just 3% when purchased loans are excluded.

January 15 -

Despite mortgage rates expected to rise modestly in 2021, a bolstered Biden administration stimulus package and COVID-19 vaccination efforts bring promise for economic recovery.

January 15 -

Mortgage industry hiring and new job appointments for the week ending Jan. 15.

January 15 -

Purchase apps for new homes only eked out a small gain in December but the Mortgage Bankers Association is forecasting that they will continue to increase.

January 14