-

What if mortgage lenders could earn borrowers’ confidence and affection even earlier, so that they would turn to them repeatedly for other loans, including that initial mortgage, CampusDoor CEO Steve Winnie asks.

January 21CampusDoor -

The Department of Housing and Urban Development bulletin waives “non-citizens” language in the FHA’s handbook, which one Trump administration official had claimed made DACA recipients ineligible for FHA loans.

January 20 -

Mortgage applications decreased 1.9% from one week earlier as rising rates started to affect refinance activity, according to the Mortgage Bankers Association.

January 20 -

The company’s 4Q originations were down from the same time in 2019 and the number of overall loans for 2020 marked a decline from the year before.

January 19 -

With refinance volumes predicted to fall — but currently continuing apace — lenders explain how they’re readying themselves for eventual contraction and its implications for their expenditures.

January 19 -

The CFPB’s allegations are similar to unresolved accusations Connecticut first levied against the company in 2018.

January 15 -

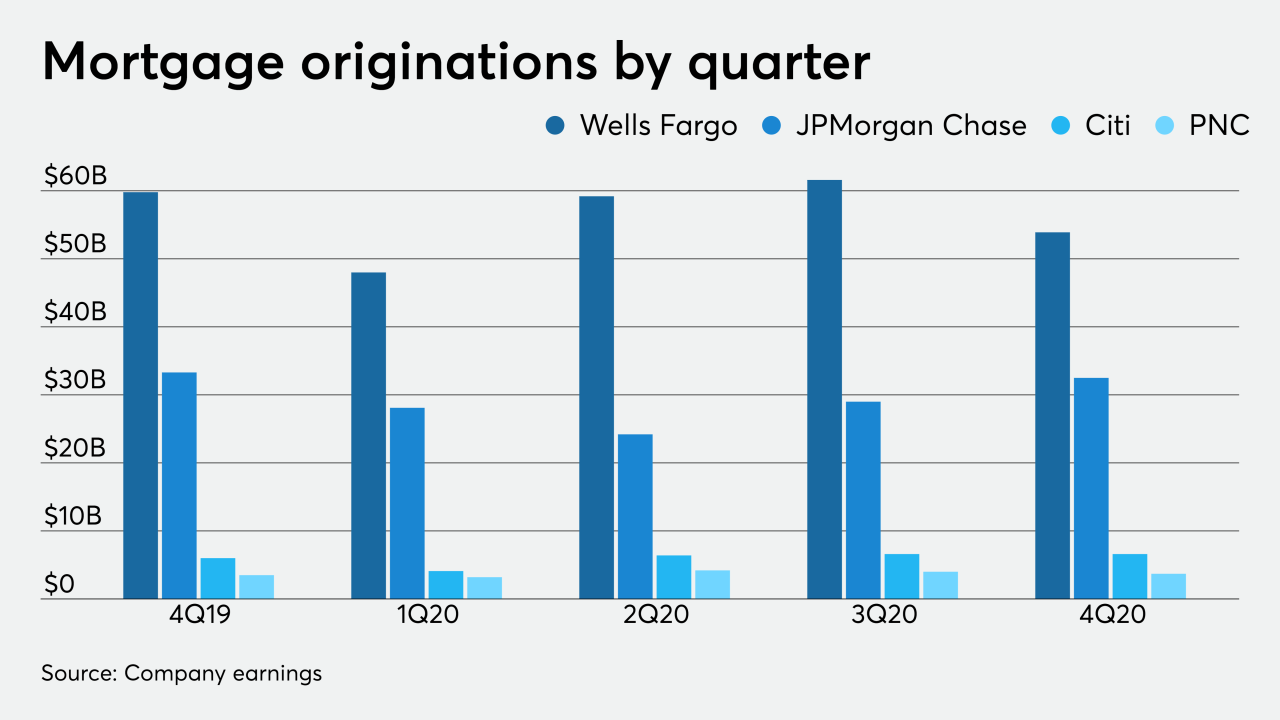

While some industry forecasts predicted origination volumes would fall 7% quarter-to-quarter in 4Q, early earnings numbers from Wells Fargo, JPMorgan Chase, Citi and PNC Bank show they were down just 3% when purchased loans are excluded.

January 15 -

Despite mortgage rates expected to rise modestly in 2021, a bolstered Biden administration stimulus package and COVID-19 vaccination efforts bring promise for economic recovery.

January 15 -

Mortgage industry hiring and new job appointments for the week ending Jan. 15.

January 15 -

Purchase apps for new homes only eked out a small gain in December but the Mortgage Bankers Association is forecasting that they will continue to increase.

January 14 -

The new complaint filed by the lender in the state’s Superior Court is aimed at compelling a January decision on the 2018 allegations.

January 13 -

Mortgage applications increased 16.7% from one week earlier to their highest level in 10 months, although rates rose in expectation of additional government pandemic relief, according to the Mortgage Bankers Association.

January 13 -

The company aims to make financed home purchases more competitive with cash offers by creating a faster mortgage process.

January 12 -

But will the company's second attempt to go public come to fruition in a market where two lenders already put their offerings on hold?

January 12 -

The deal will add to SitusAMC’s tech suite, making the connection between loan originators and lenders more efficient.

January 11 -

The volume of Ginnie securities issued in December marked the first time more than $80 billion has been issued in a month.

January 11 -

The estimates in the Bureau of Labor Statistics latest numbers were only marginally higher than the previous month, which may reflect more deliberate hiring and a preholiday slowdown.

January 8 -

The survey period runs through Feb. 19, so don't dally!

January 8 -

Mortgage industry hiring and new job appointments for the week ending Jan. 8.

January 8 -

Fannie Mae and Freddie Mac’s underserved markets plans usually cover a three-year period, but their terms have been shortened due to the pandemic.

January 7