-

One could change how commercial property is taxed, the other could change rent control policies. Both might affect financing.

October 14 -

-

Mortgage applications decreased 0.7% from one week earlier, but lending activity should continue strong for the remainder of the year as rates stay low, according to the Mortgage Bankers Association.

October 14 -

But current owner Blackstone and FOA management will keep 70% of the company after its merger with a SPAC.

October 13 -

The recent decrease in the rate at which current loans became impaired could further encourage the cautious return of the non-QM market currently underway.

October 9 -

The expanded relief on tax income data will become accessible this fall, according to a press release LoanBeam issued this week during Freddie Mac's Connect client conference.

October 9 -

Mortgage industry hiring and new job appointments for the week ending Oct. 9.

October 9 -

Mortgage rates remained flat this week, a sign that the bottom has possibly been reached, but the housing market looks to remain strong for the near future, according to Freddie Mac.

October 8 -

-

The up-and-down pattern for mortgage application activity continued, as volume rose 4.6% from one week earlier led by refinancings, according to the Mortgage Bankers Association.

October 7 -

-

Whether low rates will continue to outweigh health and employment concerns for millennials and Generation Z remains to be seen.

October 2 -

With the onset of COVID and the reaction by the Federal Reserve Board and other agencies, market pressures have reduced credit availability significantly.

October 2 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Mortgage industry hiring and new job appointments for the week ending Oct. 2.

October 2 -

The government-sponsored enterprise's first multifamily sustainability bond transaction, totaling $600 million, is part of Freddie's K-Deal program.

October 1 -

Mortgage rates fell back toward their all-time low this week, increasing purchasing power for homebuyers. But the lack of homes for sale drives up prices and reduces affordability, according to Freddie Mac.

October 1 -

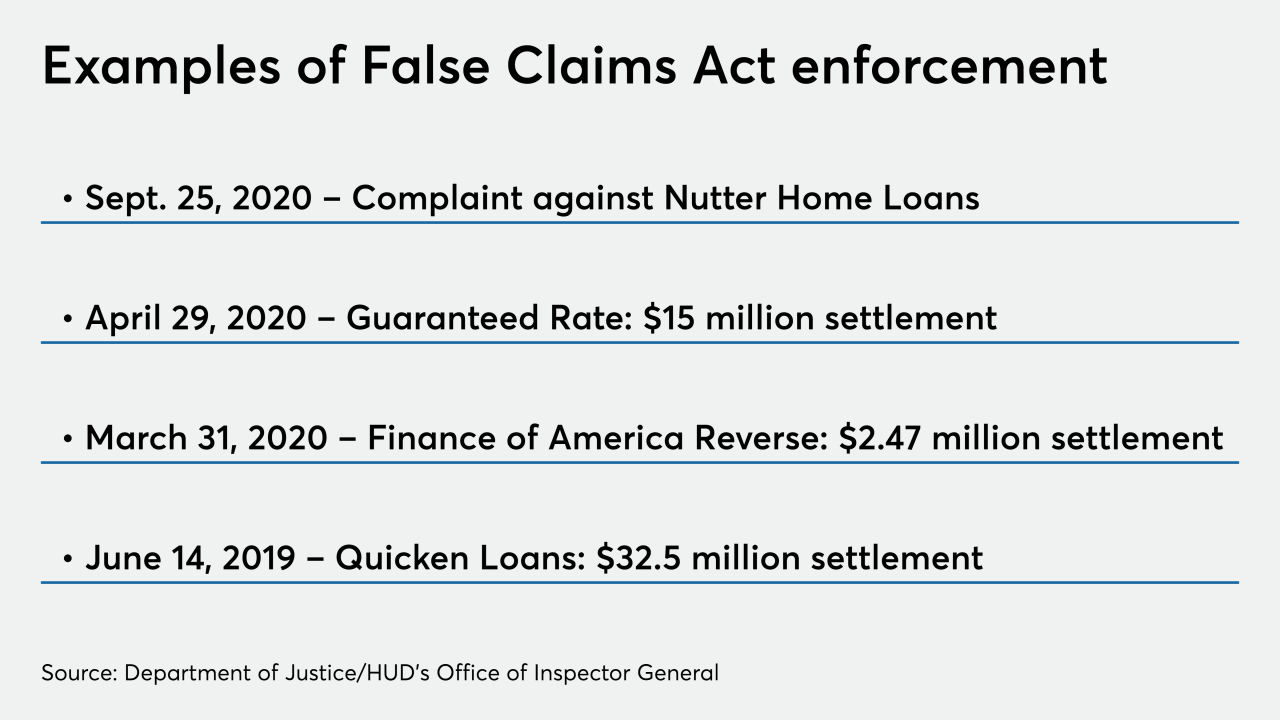

The accusations against Nutter Home Loans, like an earlier settlement with the Department of Housing and Urban Development, center on concerns related to FHA-insured reverse mortgages. The company "strongly disputes" them.

September 30 -

Pending home sales rose more than expected in August, reaching the highest level on record as low mortgage rates fuel a housing rally.

September 30 -

The Mortgage Industry Standards Maintenance Organization drew up the recommended wording in consultation with a group of lenders and investors after the passage of the Taxpayers First Act last year.

September 30 -

Mortgage applications decreased 4.8% from one week earlier, as refinance activity was down even as average rates fell to a new record low, according to the Mortgage Bankers Association.

September 30