-

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

Mortgage industry hiring and new job appointments for the week ending Nov. 22.

November 22 -

Lender profitability rose to a high not seen since 2012 in the Mortgage Bankers Association's latest quarterly report despite some variability in revenue generated per loan.

November 21 -

River City Mortgage is staging an eight-state expansion of its footprint, and recently hired Carrington Mortgage Services President Raymond Brousseau to help oversee and direct its growth.

November 21 -

Mortgage lenders are operating in a refinance-dominated market again for the first time in years, but it may offer diminishing returns.

November 20 -

From the municipalities surrounding Silicon Valley to New York's concrete jungle, here's a look at the 14 most expensive ZIP codes to buy a home in 2019, according to PropertyShark.

November 20 -

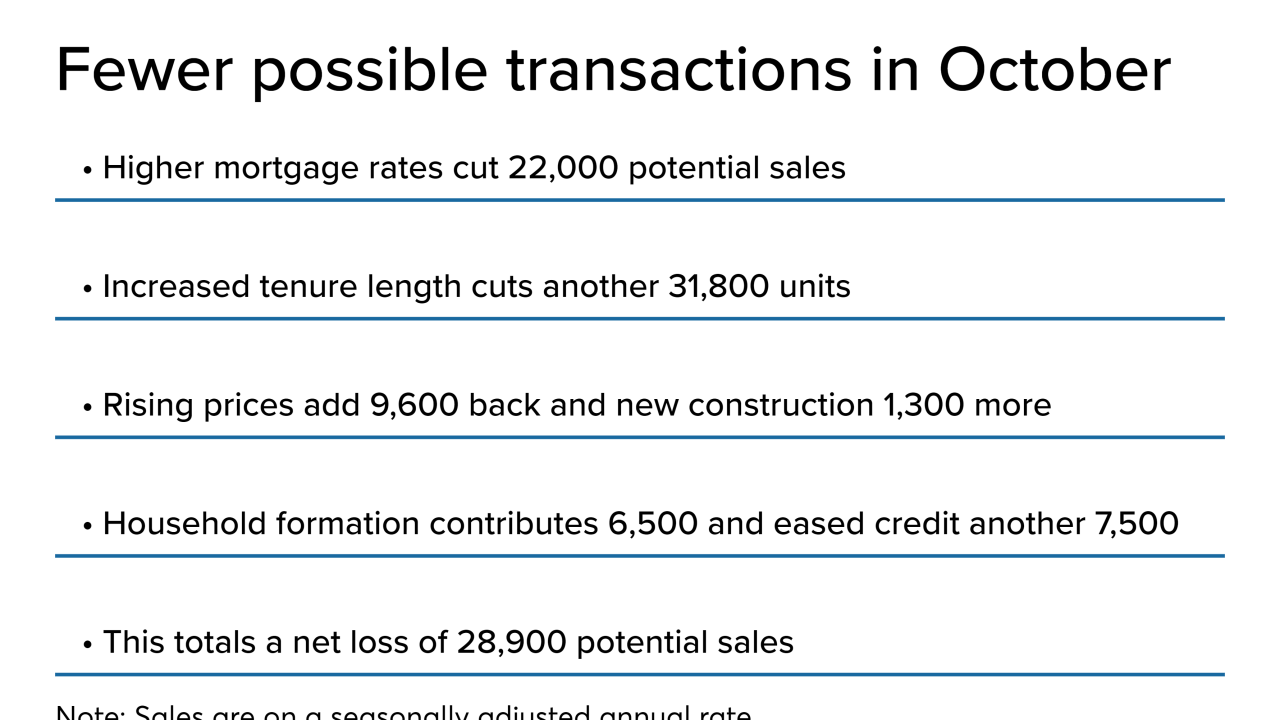

Existing-home sales outperformed their estimated potential for October on improved consumer buying power since the start of 2019 and lower mortgage rates, First American said.

November 20 -

For the second consecutive week, mortgage application activity unusually moved in the same direction as interest rates, decreasing 2.2% from one week earlier, according to the Mortgage Bankers Association.

November 20 -

Loan applications to purchase newly constructed homes during October rose by nearly one-third year-over-year as sales reached their highest annual pace since the Mortgage Bankers Association started tracking this data.

November 19 -

With economic expansion expected to keep churning through at least the first half of next year, Fannie Mae upwardly revised its single-family mortgage origination outlook for 2019 and 2020.

November 18 -

Guild Mortgage CEO Mary Ann McGarry is giving up the president's title as the San Diego-based company continues its national expansion plans.

November 18 -

The Consumer Financial Protection Bureau issued new rules governing mortgage lenders' screening and training of loan originators with temporary authority.

November 15 -

Mortgage industry hiring and new job appointments for the week ending Nov. 15.

November 15 -

Mortgage rates rose modestly this week as investors have a more positive view of the economy and so they are moving money out of the bond market, according to Freddie Mac.

November 14 -

The percentage of recent mortgage borrowers with subprime credit scores still resides in the single digits, but nearly doubled what is was in 2013, according to TransUnion.

November 13 -

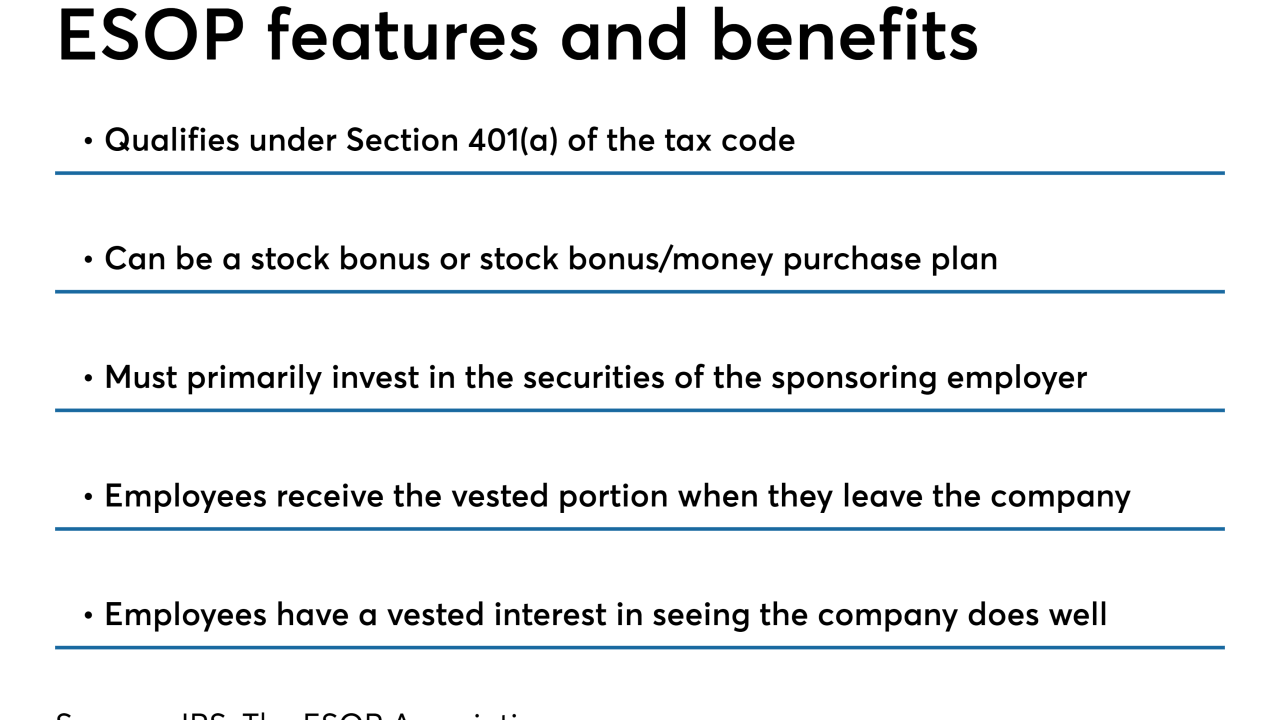

The American Mortgage Network name is being revived again, this time for a de novo company that will be 100% employee owned.

November 13 -

Mortgage applications increased from one week earlier, although conforming loan interest rates moved back over 4%, according to the Mortgage Bankers Association.

November 13 -

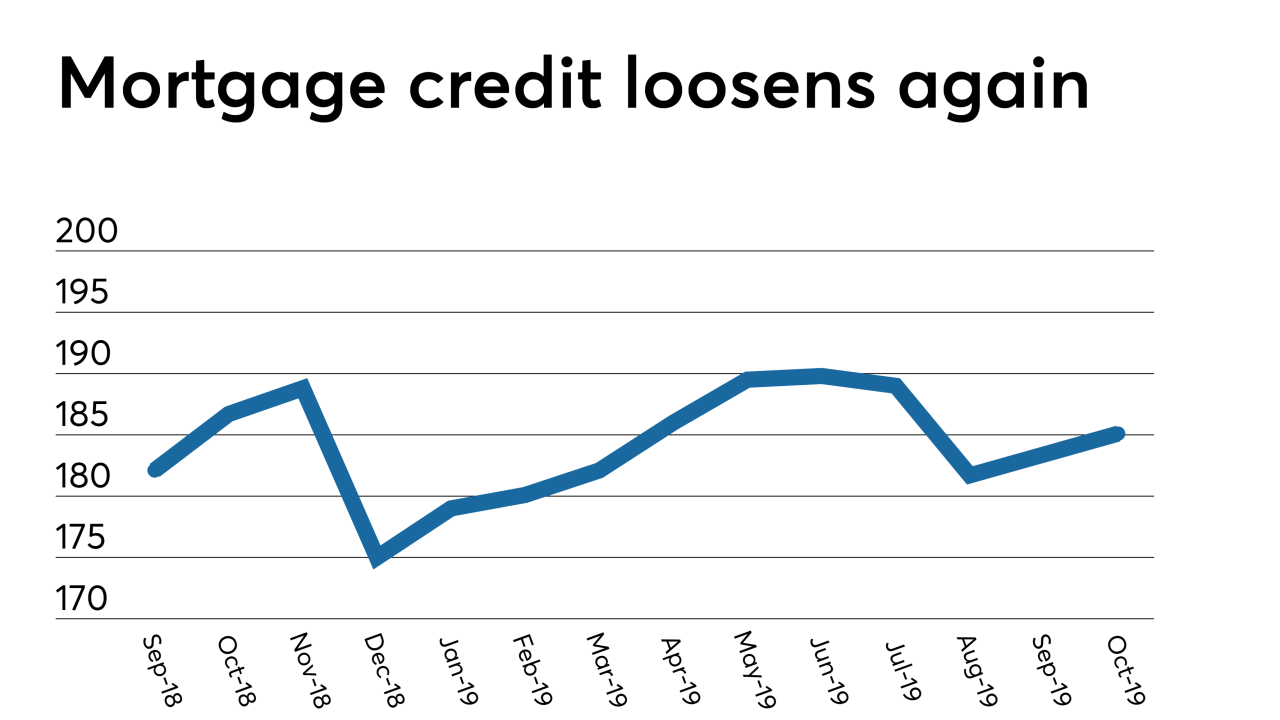

Mortgage credit availability increased in October from the previous month, as mortgage lenders increased their product offerings outside the government market, according to the Mortgage Bankers Association.

November 12 -

Zillow Group reported third-quarter revenue that beat estimates as growing sales in its online marketing and home-flipping businesses sent shares higher in late trading.

November 8 -

Mortgage industry hiring and new job appointments for the week ending Nov. 8.

November 8