-

-

Mortgage industry hiring and new job appointments for the week ending Nov. 9.

November 9 -

Mortgage application activity dropped to its lowest level since December 2014 as interest rates reached an eight-year high, according to the Mortgage Bankers Association.

November 7 -

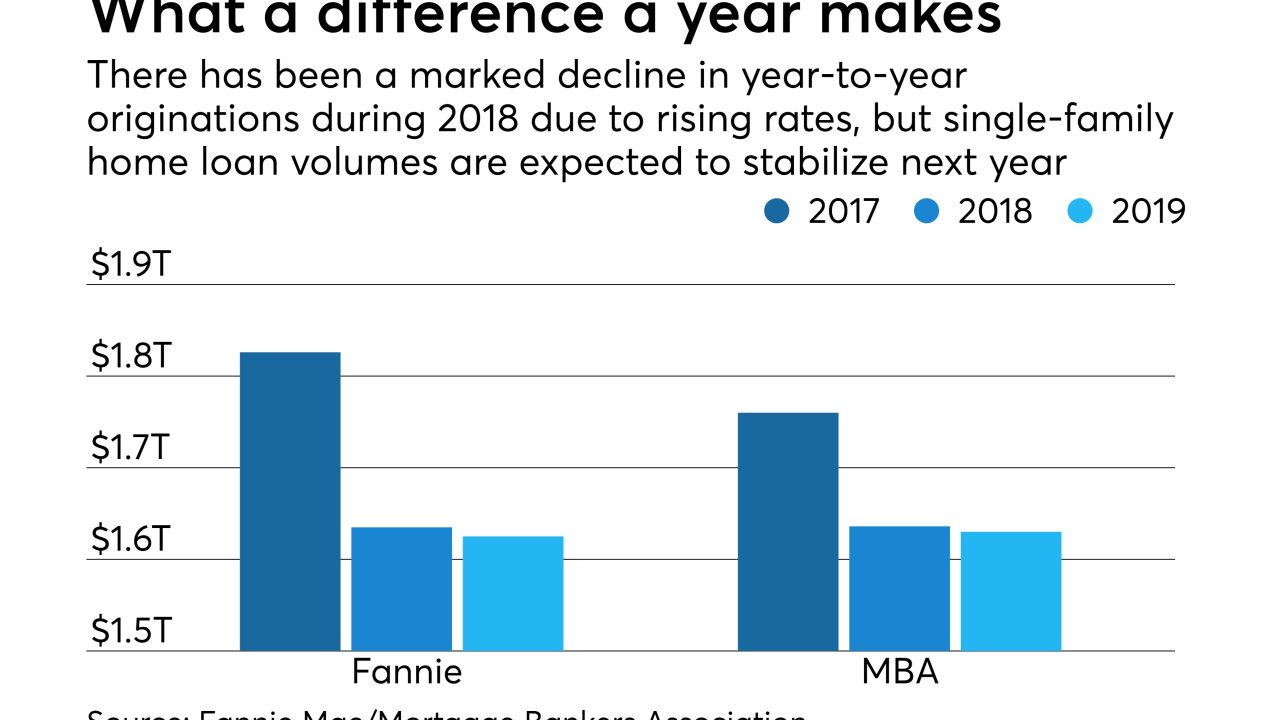

Although forecasts anticipate a continuing drop in overall originations, private-label residential mortgage-backed securitizations backed by newer loans are expected to keep increasing through next year, according to Bank of America.

November 5 -

Mortgage industry hiring and new job appointments for the week ending Nov. 2.

November 2 -

Mortgage applications decreased 2.5% from one week earlier as purchase activity compared with 2017 fell for the first time in nearly three months, according to the Mortgage Bankers Association.

October 31 -

Mortgage industry hiring and new job appointments for the week ending Oct. 26.

October 26 -

High property values and low mortgage rates pushed commercial and multifamily originations beyond their projected totals in 2017 to a new market peak, according to the Mortgage Bankers Association.

October 25 -

An increase in refinance activity in the period after Columbus Day drove mortgage applications 4.9% higher from one week earlier, according to the Mortgage Bankers Association.

October 24 -

A surge in home equity borrowing may be around the corner as household equity levels surpassed their previous housing bubble peak, according to a TransUnion study.

October 19 -

As mortgage rates recently hit their highest point in seven years, closed refinances fell back to their low point of 2018, according to Ellie Mae.

October 19 -

Mortgage industry hiring and new job appointments for the week ending Oct. 19.

October 19 -

Despite mortgage rates at a seven-year high and rising home prices and low inventory that are keeping consumers from buying homes, rental prices are declining in many markets.

October 18 -

Increasing pessimism about housing is driving Fannie Mae's estimates for originations this year down a little further.

October 18 -

Mortgage applications decreased sharply from one week earlier as key interest rates stayed above 5%, although purchase volume grew from a year ago, the Mortgage Bankers Association reported.

October 17 -

As the mortgage industry confronts tight margins, shifting market share and regulatory uncertainty, a new leader emerges at the Mortgage Bankers Association.

October 14 -

Mortgage-related earnings at five banks were lower due to the effect of higher interest rates on loan volume this year, even though late-season homebuyers improved consecutive-quarter origination numbers at three companies.

October 12 -

Mortgage industry hiring and new job appointments for the week ending Oct. 12.

October 12 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

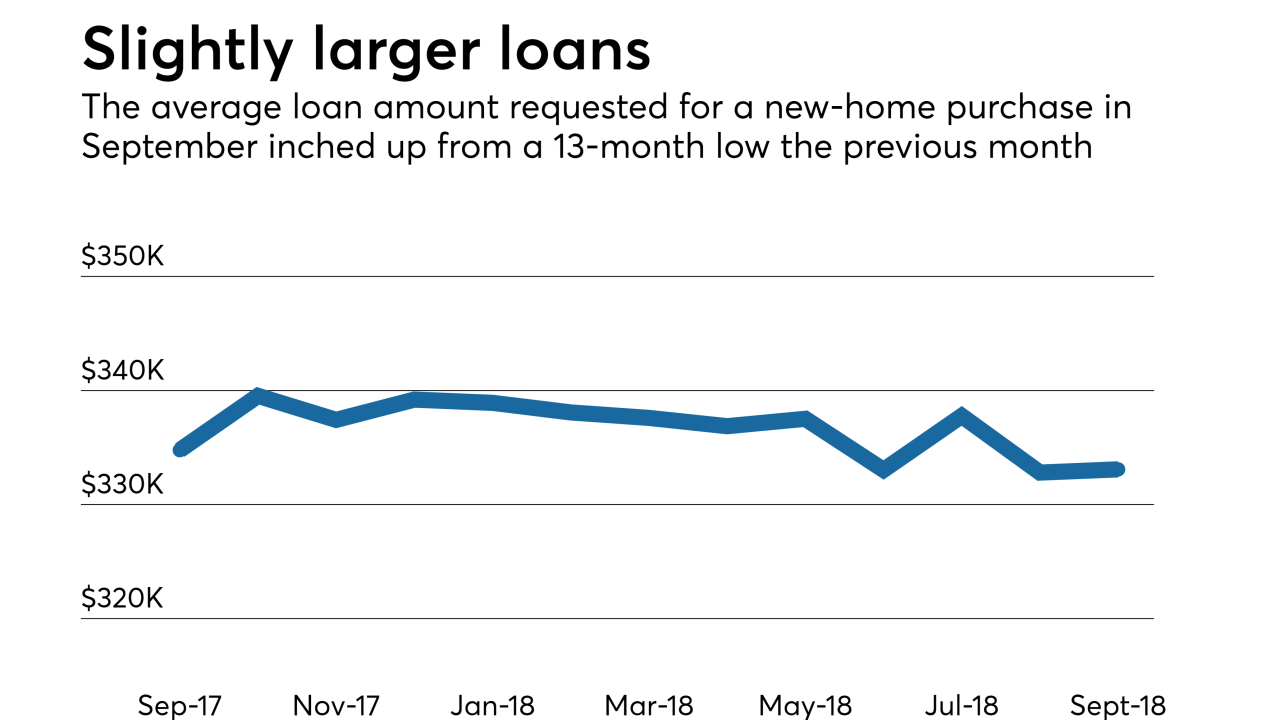

Mortgage borrowers buying new homes generated more loan applications this September than they did a year ago, even though interest rates are higher this year.

October 11