-

While the first quarter is typically the weakest period for the title business, the sector benefited from strong refinance volumes that were driven by low interest rates.

May 10 -

Loans bought on the secondary market have become increasingly important as borrower demand has ebbed and companies have sought to obtain mortgages through additional outlets to maintain production levels.

May 4 -

System updates, which may be a result of changes to the Preferred Stock Purchase Agreements, have Community Home Lenders Association members saying loans that were approved previously are getting rejected when put back through.

April 26 -

With independent title companies scoring the largest market share gain last year, the sector saw a 22% increase in premiums overall, the American Land Title Association said.

April 9 -

More lenders are willing to take on borrowers who are lower on the qualification spectrum as the economy rebounds.

April 8 -

One year after its internal merger, the fintech and fulfillment services provider’s COO Debora Aydelotte discusses the company’s support for community banks and its placement in the ranking of Best Fintechs to Work For.

April 6 -

In an increasingly volatile market, lenders need to come to terms with the fact that outsourcing might be the best option, writes Rob Wilson of Merchants Mortgage.

March 31 Merchants Mortgage, a division of Merchants Bank of Indiana

Merchants Mortgage, a division of Merchants Bank of Indiana -

Point of sales providers are bringing improvements to their systems as loan officers look for ways to keep their pipelines active.

March 30 -

Willis, Texas led the list, with the most borrowers who would be likely to default if faced with sudden financial hardship.

March 24 -

These trends, in addition to the increase in appraisal contingency waivers, could add risk to mortgage lender businesses.

March 22 -

From offering operations folks big bonuses to grooming recent grads, lenders are getting creative in their efforts to manage staffing throughout the boom-bust cycle.

March 22 -

After its three acquisitions since last August, the Philadelphia area-based credit data firm predicts more industry consolidation is on the way.

March 17 -

Finance of America Reverse's product combines features of a forward mortgage, like 10 years of payments, with parts of a non-recourse reverse loan.

March 10 -

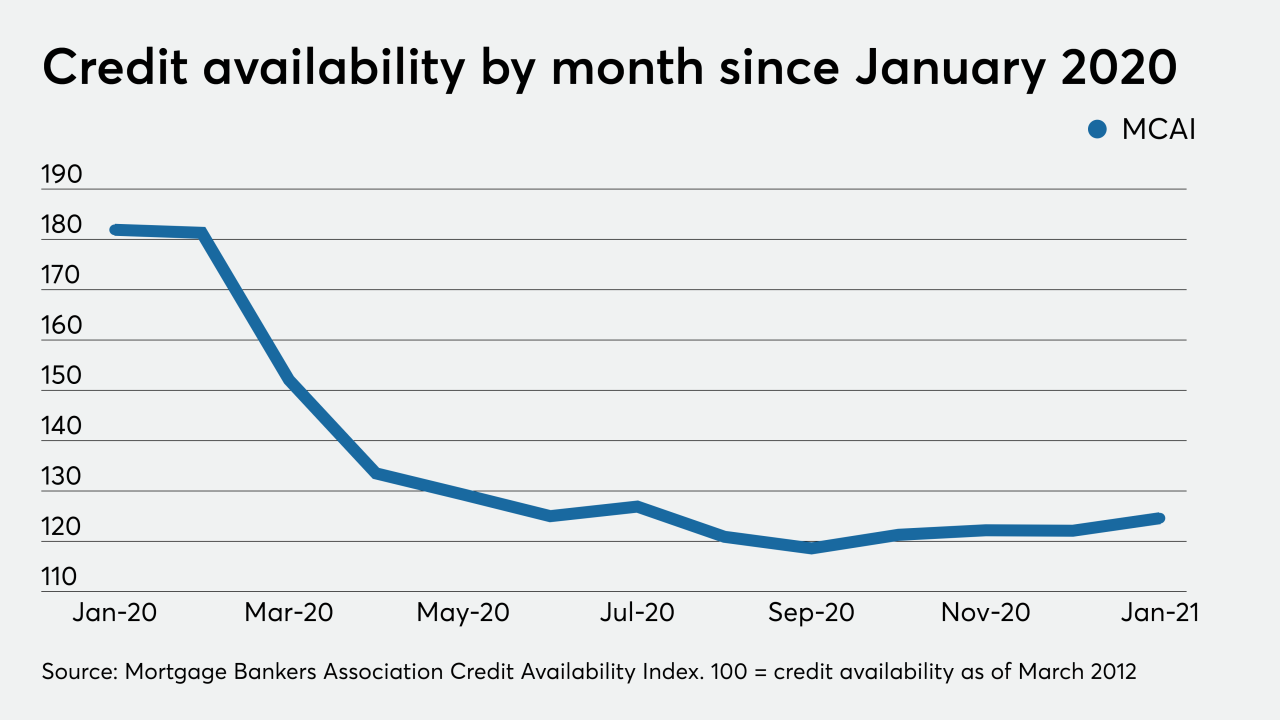

The number of product offerings stayed at a level last seen in 2014 as slight gains in government and jumbo loans were offset by fewer conventional mortgages coming on the market.

March 9 -

Some applaud the agency's recent delay of the mandatory compliance date for a new Qualified Mortgage standard. Others say it leads to more uncertainty for lenders, opens the door to additional changes and enables some companies to loosen their underwriting.

March 7 -

The abrupt move paves the way for the $6 billion cash deal with Stone Point and Insight Partners to move forward unimpeded.

March 4 -

Since CoStar made its revised offer in February, its stock price dropped nearly $177 per share.

March 4 -

The merger with Capitol Investment V values the title insurer at $3 billion.

March 3 -

The shrinking ranks of appraisers, combined with the record number of loan applications in 2020, created "the perfect storm between supply and demand," which inspired the new payment plan, Incenter's Mark Walser said.

February 17 -

The movement in the MBA’s credit availability index suggests that, amid forecasts of diminished refinancing, lenders want to accommodate consumers buying homes, but they aren’t yet ready to lend as freely as they did before the pandemic.

February 9