-

Lennar's mortgage banking unit agreed to settle False Claims Act allegations for $13.2 million, a smaller amount than other lenders paid to the government prior to the end of fiscal year 2017.

October 22 -

Providing borrowers with an incentive to create financial reserves after closing is a better tool to prevent mortgage loan defaults than measures taken at underwriting, a JPMorgan Chase Institute study declared.

October 18 -

Exploration and adoption of new technologies is essential for achieving strategic goals and satisfying the needs and expectations of mortgage borrowers.

October 16 Freddie Mac

Freddie Mac -

Nomura Holding America and affiliates agreed to pay a $480 million penalty to resolve U.S. claims that the bank misled investors in marketing and selling mortgage-backed securities tied to the 2008 financial crisis, according to the Justice Department.

October 16 -

Industry downsizing resulted in an increase in critical defects found in closed mortgages as loan packaging errors continued to rise during the first quarter, according to Aces Risk Management.

October 15 -

Movement Mortgage, citing the continuing deterioration of the housing market, is eliminating approximately 180 back office positions on Oct. 5.

October 4 -

Some lenders are tapping artificial intelligence and machine learning to improve operational efficiency and enhance the borrower experience, but complexities do exist in implementing the technology.

October 4 -

Lenders offered fewer government-guaranteed mortgage programs in September, leading to an overall decline in mortgage credit availability, according to the Mortgage Bankers Association.

October 4 -

Mortgage application defect risk is down from a year ago, but Hurricane Florence will likely tear through results in affected areas in the coming months.

September 26 -

Mid America Mortgage CEO Jeff Bode is on a mission to show reluctant title agents and other business partners the value of embracing digital mortgages.

September 24 -

Increased competition among non-qualified mortgage lenders leading to lower starting interest rates for borrowers should result in fewer of these loans prepaying within one year of origination, said Standard & Poor's.

September 24 -

Fannie Mae will add an appraisal waiver option for mortgages in regions that its Duty to Serve program designates as high-needs rural areas, but only if home inspections are completed instead.

September 24 -

Mortgage rates increased 5 basis points this week, up for the fourth week in a row with momentum building for further hikes, according to Freddie Mac.

September 20 -

Bill Emerson, the vice chairman of Quicken Loans, said mortgage lenders need to give time to consider innovation and not be deterred by naysayers.

September 18 -

Blend, a provider of mortgage point of sale systems, is offering a new product that uses machine learning to streamline loan closings and analyze loan data quality.

September 18 -

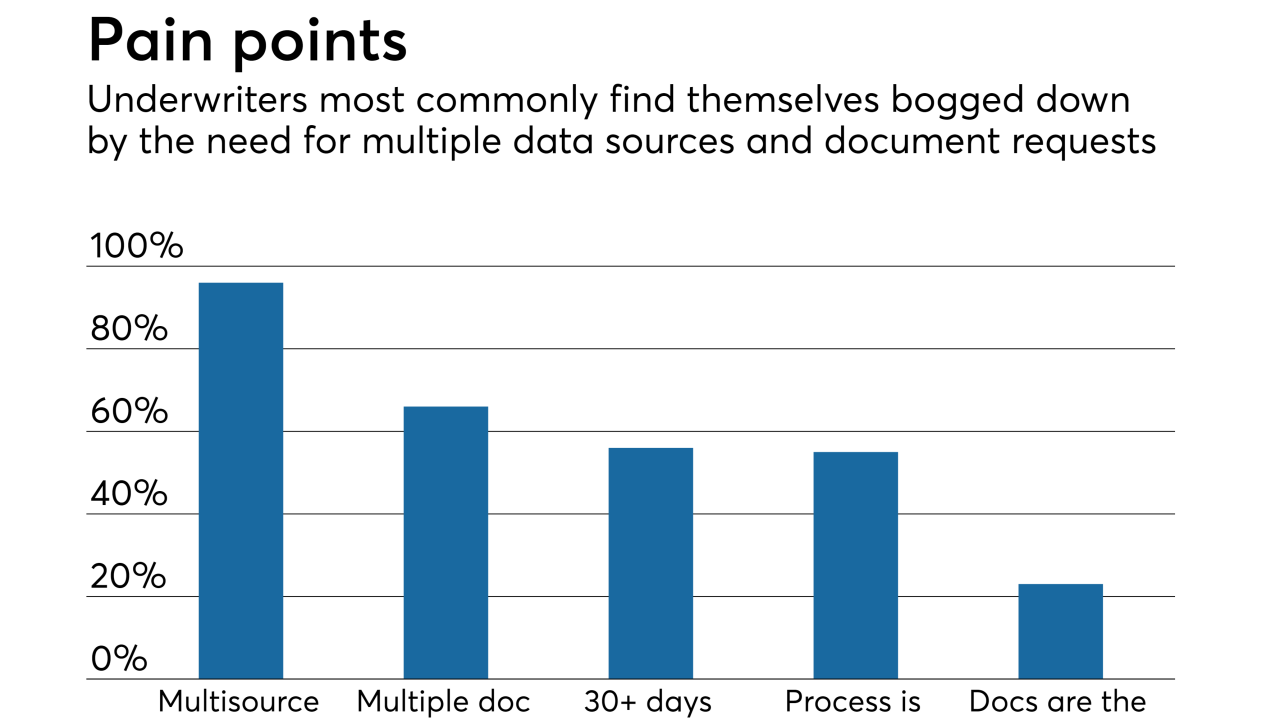

Accessing a mortgage applicants' data from a direct source goes a long ways toward shortening the origination process, according to 96% of mortgage underwriters responding to a recent CoreLogic survey.

September 17 -

A decade after the credit crisis, investors are returning to where it all began. The mortgage sector, blamed in large part for the near-collapse of the global financial system, is now seen by many as a high-quality market forged by fire.

September 14 -

New Penn Financial has launched a condo loan program that features more flexible property restrictions than what's allowed under Fannie Mae and Freddie Mac guidelines.

September 13 -

Mortgage rates jumped 6 basis points over the past week, which led to the largest year-over-year gain in over four years, according to Freddie Mac.

September 13 -

Mortgage credit accessibility dropped for the first time in four months as jumbo loan products took a step back, according to the Mortgage Bankers Association.

September 11