-

Increased competition among non-qualified mortgage lenders leading to lower starting interest rates for borrowers should result in fewer of these loans prepaying within one year of origination, said Standard & Poor's.

September 24 -

Fannie Mae will add an appraisal waiver option for mortgages in regions that its Duty to Serve program designates as high-needs rural areas, but only if home inspections are completed instead.

September 24 -

Mortgage rates increased 5 basis points this week, up for the fourth week in a row with momentum building for further hikes, according to Freddie Mac.

September 20 -

Bill Emerson, the vice chairman of Quicken Loans, said mortgage lenders need to give time to consider innovation and not be deterred by naysayers.

September 18 -

Blend, a provider of mortgage point of sale systems, is offering a new product that uses machine learning to streamline loan closings and analyze loan data quality.

September 18 -

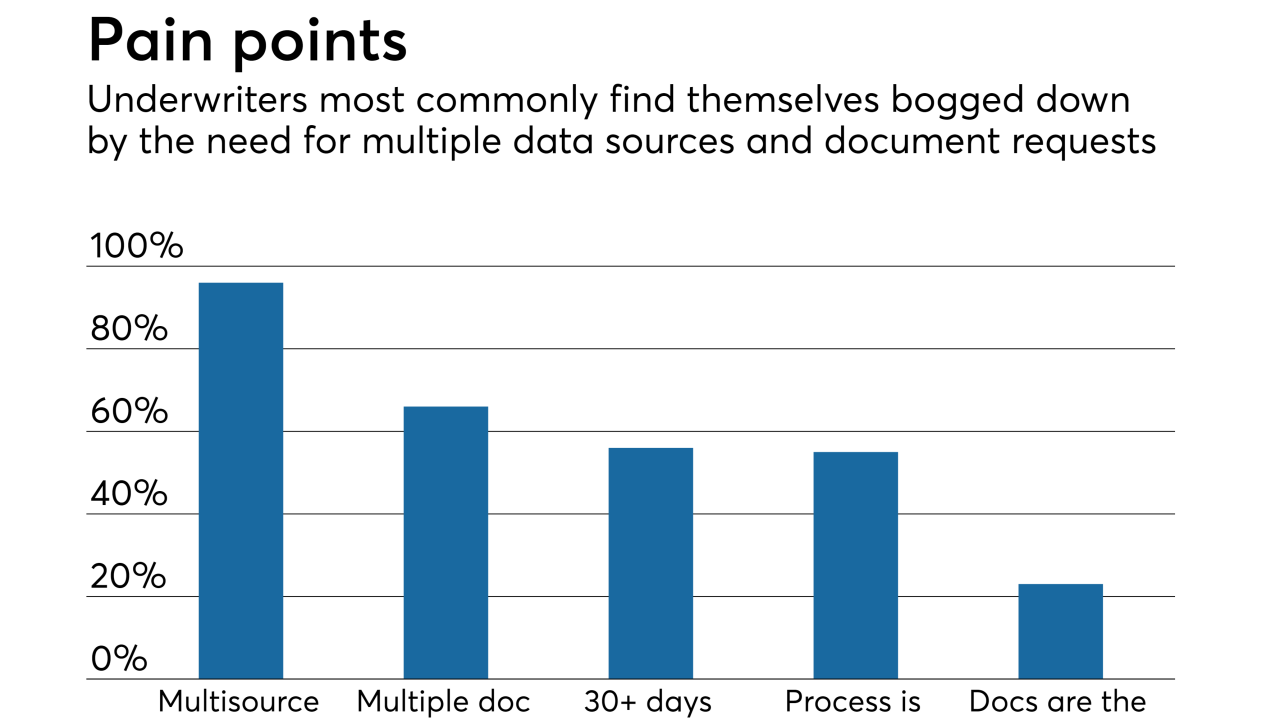

Accessing a mortgage applicants' data from a direct source goes a long ways toward shortening the origination process, according to 96% of mortgage underwriters responding to a recent CoreLogic survey.

September 17 -

A decade after the credit crisis, investors are returning to where it all began. The mortgage sector, blamed in large part for the near-collapse of the global financial system, is now seen by many as a high-quality market forged by fire.

September 14 -

New Penn Financial has launched a condo loan program that features more flexible property restrictions than what's allowed under Fannie Mae and Freddie Mac guidelines.

September 13 -

Mortgage rates jumped 6 basis points over the past week, which led to the largest year-over-year gain in over four years, according to Freddie Mac.

September 13 -

Mortgage credit accessibility dropped for the first time in four months as jumbo loan products took a step back, according to the Mortgage Bankers Association.

September 11 -

Mortgage rates inched higher for the second straight week and further increases are likely in the near term, according to Freddie Mac.

September 6 -

Nearly half of July's millennial homebuyers were single, a sign that they are not waiting for certain milestones like marriage before deciding to become homeowners, according to Ellie Mae.

September 5 -

New Jersey Governor Phil Murphy signed a bill to revise the state's Residential Mortgage Lending Act to facilitate transitional licensing for loan officers and to streamline the law's provisions for borrower fees.

August 31 -

Future reductions in loan application defect risk are likely because of mortgage lenders' fintech investments, even as the purchase origination share grows, said First American Financial.

August 31 -

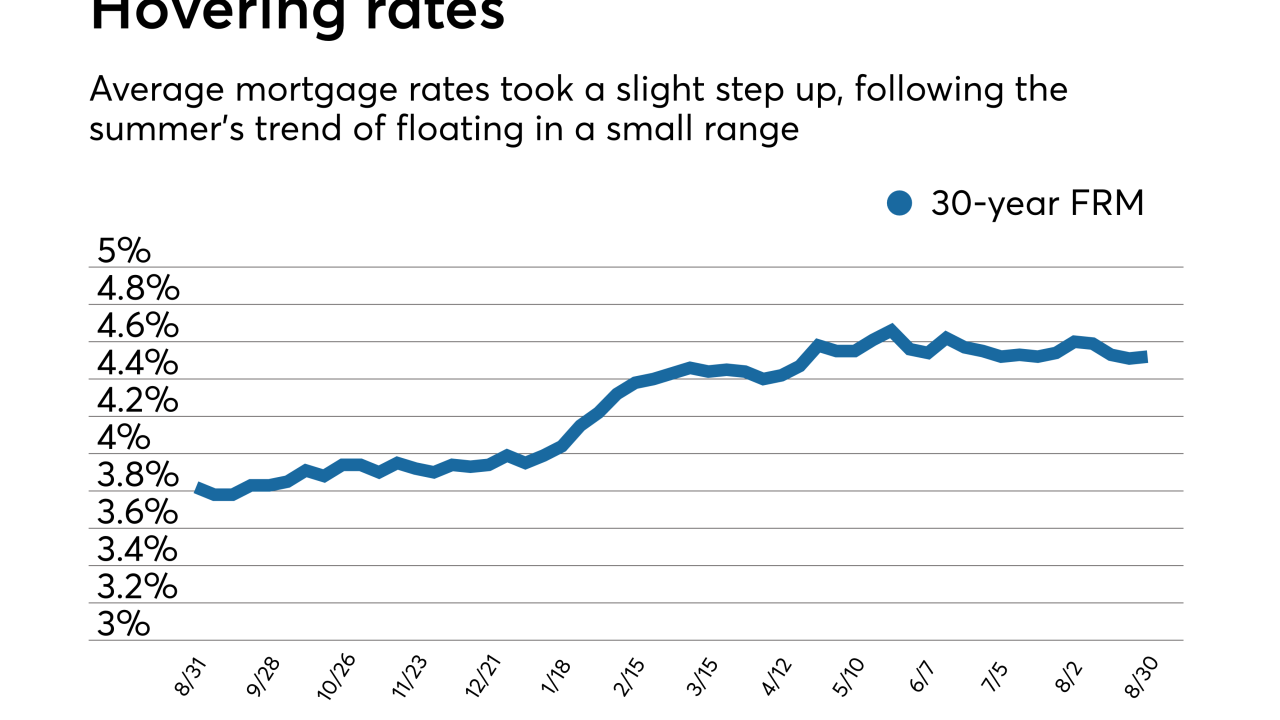

Mortgage rates took small steps up after hitting a four-month low, but continued hovering around the same range they have all summer, according to Freddie Mac.

August 30 -

Mortgage rates decreased for the third straight week and reached their lowest level since mid-April, according to Freddie Mac.

August 23 -

July's year-over-year increase in foreclosure starts for 44% of the nation's metro areas is a result of looser underwriting standards and a sign of future growth in defaults, said Attom Data Solutions.

August 21 -

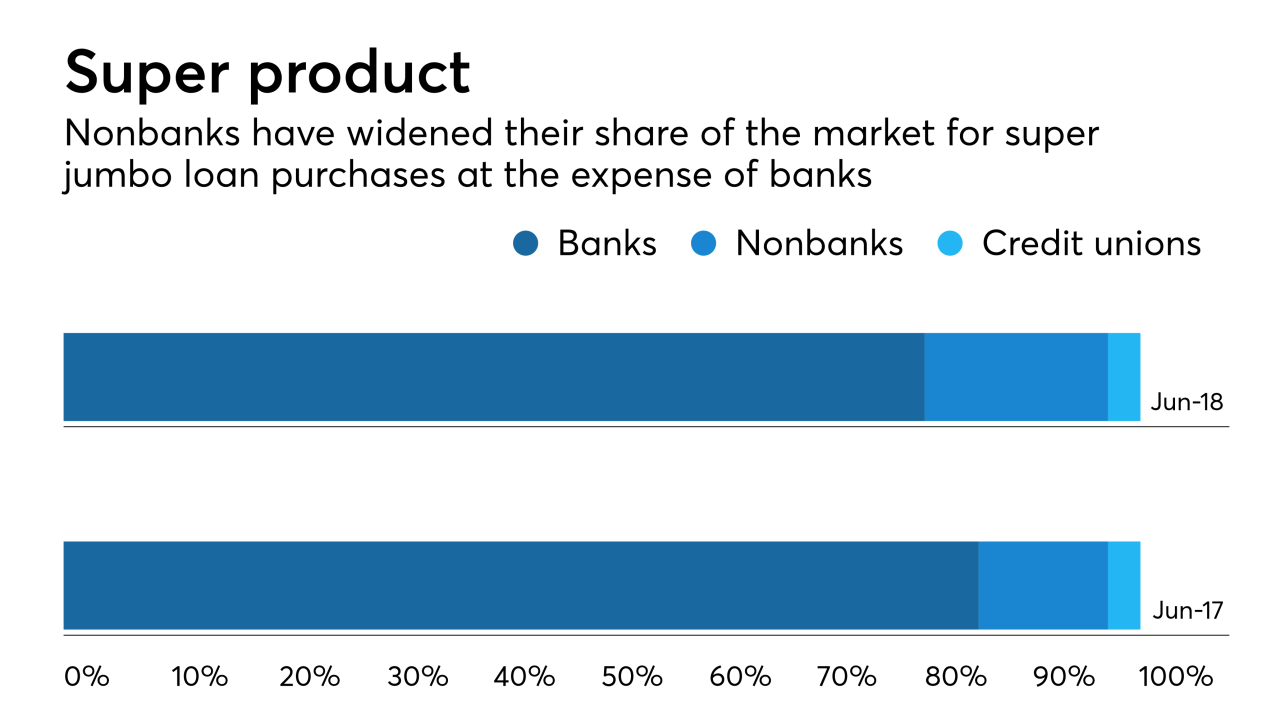

New investor appetite for mortgages over $1 million is motivating more nonbank lenders to offer super jumbo loans, often with weaker credit terms than traditional banks.

August 20 -

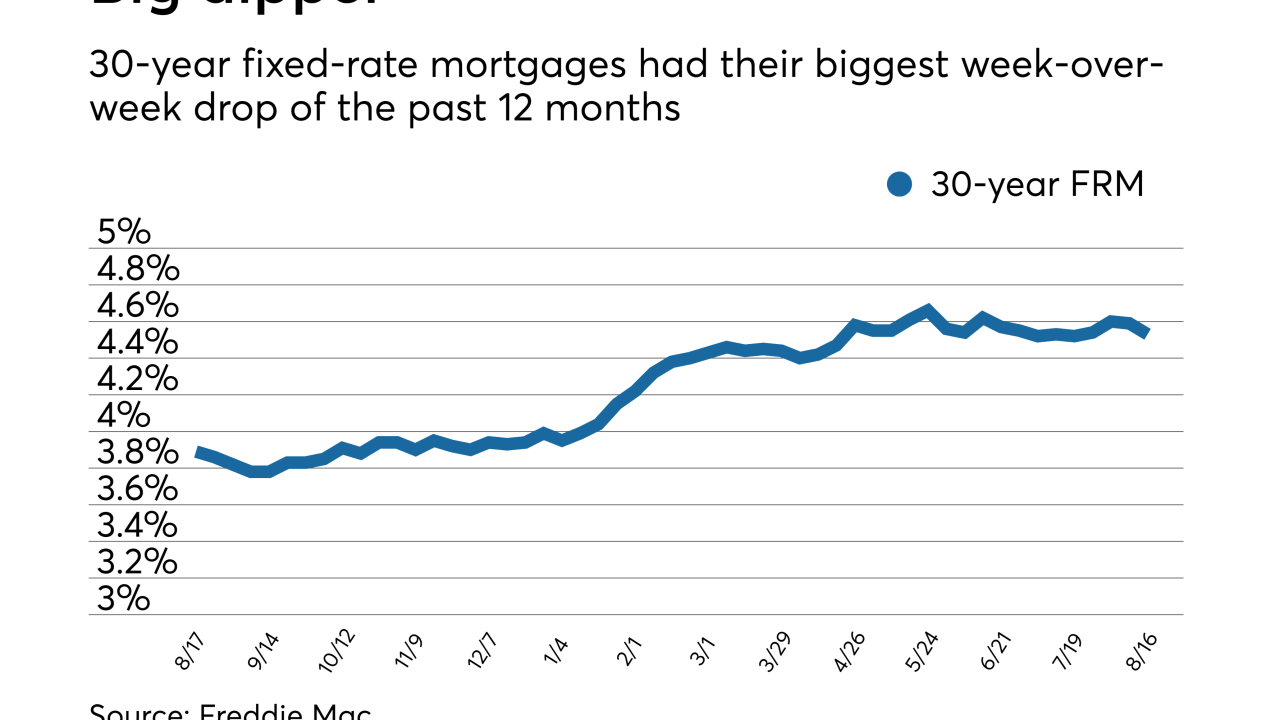

Average mortgage rates fell, including the largest week-over-week drop of the past 12 months, but homebuyer demand stays mum, according to Freddie Mac.

August 16 -

The percentage of low down payment loans using private mortgage insurance continues to grow, and should continue as more first-time homebuyers get conforming loans, according to Keefe Bruyette & Woods.

August 14