Regulation and compliance

Regulation and compliance

-

Residential mortgage-backed securities servicers are better able to weather a downturn and the resulting loan defaults today versus before the crisis because of their investments in technology and regulatory compliance, Fitch Ratings said.

February 1 -

The Senate Banking Committee chairman released an outline for overhauling the U.S. housing finance system more than 10 years after the government put Fannie Mae and Freddie Mac into conservatorship.

February 1 -

China Oceanwide's acquisition of Genworth has been postponed until March, prolonging uncertainty about the fate of the acquired company's U.S. private mortgage insurance unit that could be resolved by the deal.

January 31 -

The agency's acting director said he welcomes lawmakers' “insight and perspective” on how to end the conservatorships of Fannie Mae and Freddie Mac.

January 30 -

Ginnie Mae has restricted loanDepot's ability to securitize Veterans Affairs mortgages because of apparent churning of recent originations.

January 30 -

A White House spokeswoman said the administration wants to work with Congress on a housing finance reform plan, providing evidence that changes might not be imminent.

January 29 -

Fixing the housing finance system is "the last piece of unaddressed business from the financial crisis," according to a summary of to-do items released by the Banking Committee's chairman.

January 29 -

The same TILA-RESPA integrated disclosure errors continue to plague mortgage lenders, though those documents have been required for over three years, a report from MetaSource said.

January 29 -

The hiring of a former GOP congressional aide suggests the bureau will continue to rely on political appointees in senior positions.

January 28 -

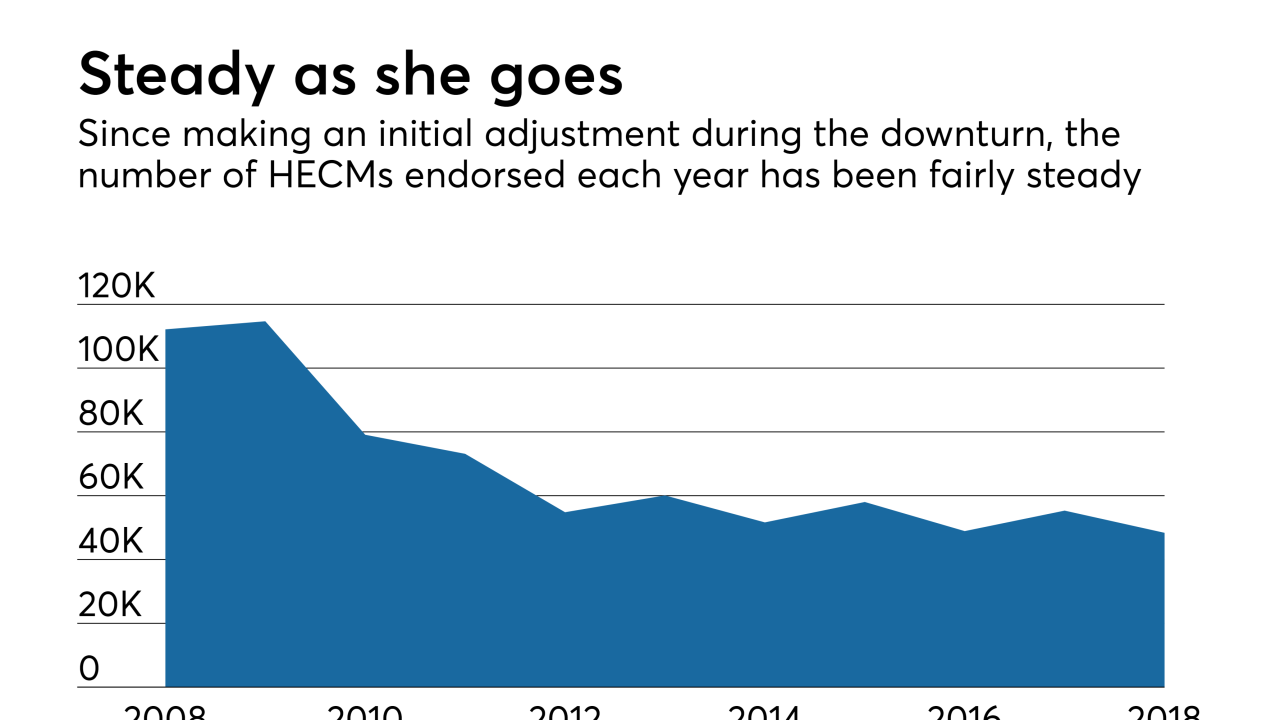

Home equity loans the Federal Housing Administration offers to older borrowers are in a better position now that the government shutdown has temporarily ended.

January 28 -

The acting head of the Federal Housing Finance Agency has promised substantial changes for Fannie Mae and Freddie Mac, but the exact mechanics and timeline of an administration plan are still a mystery.

January 28 -

New York State is providing additional funding to municipalities that will boost efforts regarding mortgage servicer compliance with the state and local vacant property laws.

January 28 -

As suspense builds over which firm will be the first to seek the special-purpose charter, a side discussion has emerged over which financial services sector has the most to gain — or lose — from the new option.

January 27 -

Recent comments attributed to the acting head of the Federal Housing Finance Agency (who is also comptroller of the currency) have stoked speculation about the Trump administration’s housing finance policy.

January 25 -

Plans to begin rating securitizations backed by fix-and-flip mortgages may help lenders create new capacity and satisfy growing demand for short-term financing of house flipping projects.

January 25 -

Across rural America, the government shutdown has eliminated one of the best options for low-to-middle income homebuyers, a zero down payment mortgage from the U.S. Department of Agriculture.

January 24 -

The 30-year fixed-rate mortgage remained unchanged for the third consecutive week, according to Freddie Mac, even with political uncertainty affecting the overall economic outlook.

January 24 -

Chris D’Angelo, the CFPB's associate director of supervision, enforcement and fair lending, is leaving the bureau after eight years to become a chief deputy attorney general in New York state.

January 24 -

Several new members of the House Financial Services Committee with backgrounds in housing could use their experience to address Chairman Maxine Waters' top agenda items.

January 23 -

In a slow mortgage market, construction loans are considered the most likely source of growth for lenders, according to a new study.

January 22