-

Originations from all sources, including commercial and reverse mortgages, total $9.2 billion.

December 2 -

And how people involved with Replay Acquisition made it more attractive than an initial public offering, according to CEO Patricia Cook.

October 22 -

But current owner Blackstone and FOA management will keep 70% of the company after its merger with a SPAC.

October 13 -

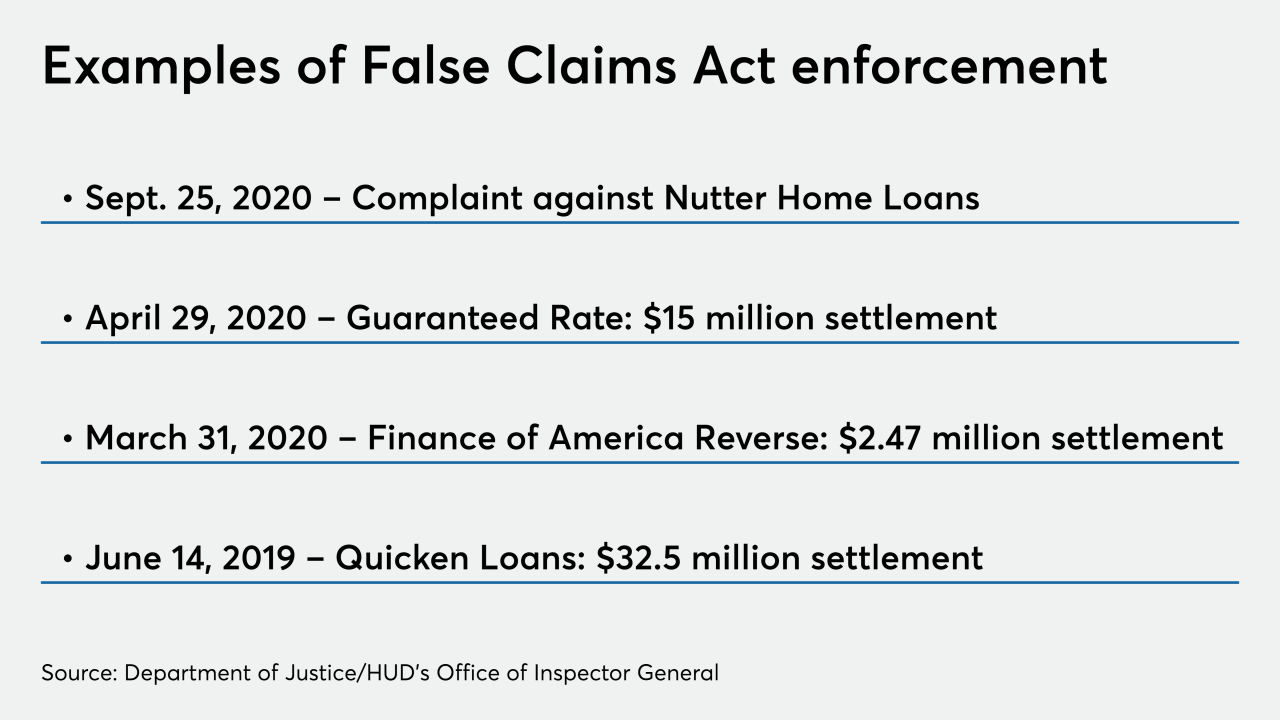

The accusations against Nutter Home Loans, like an earlier settlement with the Department of Housing and Urban Development, center on concerns related to FHA-insured reverse mortgages. The company "strongly disputes" them.

September 30 -

FHA Commissioner Dana Wade offered a preview of ambitions she has for the Federal Housing Administration at a virtual event held by Women in Housing and Finance on Tuesday.

September 22 - LIBOR

The restrictions on the pooling of loans with any interest term based on Libor will be effective for traditional mortgage-backed securities issued starting Jan. 21, 2021, and earlier for reverse-mortgage securitizations.

September 21 -

Also the Federal Housing Administration, which is a key contributor of government-insured loans to Ginnie securitizations, recently set new conditions on mortgage applicants that have been in forbearance.

September 14 -

Ginnie Mae helped to fund more than $70 billion in loans aimed at helping low- and moderate-income borrowers in July.

August 10 -

Finance of America Reverse agreed to pay $2.5 million to settle allegations that a company it acquired violated the False Claims Act for loans submitted for Federal Housing Administration insurance in 2010.

April 2 -

The Department of Housing and Urban Development's 60-day foreclosure halt for Federal Housing Administration borrowers is too short to help reverse mortgage borrowers, a letter from consumer groups stated.

March 25 -

Endorsements of Home Equity Conversion Mortgages fell nearly 14% on a consecutive-month basis in February after a January surge, but stayed relatively strong compared to average levels last year.

March 5 -

The cancellation by New Residential of a money-losing subservicing agreement should benefit Ocwen's financial results going forward, the company said.

February 26 -

Dana Wade would succeed Brian Montgomery, the acting deputy secretary of the Department of Housing and Urban Development.

February 20 -

Many American homeowners count on the equity in their property to help fund their retirement years, but they might be overconfident by relying on that, according to Unison.

January 30 -

The nomination deadline for the 2020 Top Producers program is coming up soon.

January 8 -

A trade group is looking into why New York Gov. Andrew Cuomo felt foreclosure risks were too high to sign a bill that would have approved reverse mortgages for cooperative properties.

December 26 -

Finance of America Reverse has launched a revolving credit line product that allows borrowing power to increase over time by allowing 75% of funds to grow for future use.

December 18 -

Issuance of Ginnie Mae mortgage-backed securities slipped after several months of gains, but high volume still pushed the year-to-date total for 2019 ahead of 2018’s full-year figure.

December 16 -

Nationstar’s next securitization of defaulted or inactive home equity conversion mortgages will have a higher-than-average exposure to properties with steep leverage, as well as ties to judicial foreclosure states.

November 21 -

The Federal Housing Administration's mortgage insurance fund now sits in a much better financial position, but officials say it's still not strong enough to make the premium cuts the industry wants.

November 14