-

Two Harbors Investment Corp., which grew its servicing portfolio by 22% in the fourth quarter, priced a common stock offering to raise funds to buy more rights as well as mortgage-backed securities.

March 19 -

The Securities Industry and Financial Markets Association approved changes to its good delivery guidelines that ease the path to the government-sponsored enterprises issuing uniform mortgage-backed securities starting on June 3.

March 12 -

Agency mortgage-backed security prepayment speeds increased in February with much of the refinance activity coming from newer loans and those with high coupons, a report from Keefe, Bruyette & Woods said.

March 11 -

Being too dependent on the automated underwriting tools created by the government-sponsored enterprises to originate loans underlying private-label mortgage-backed securitizations could negatively affect their credit quality, a report from Moody's said.

February 26 -

The Federal Reserve Bank of New York is streamlining its Ginnie Mae holdings by combining mortgage-backed securities with similar characteristics into larger pass-through instruments.

February 25 -

Och-Ziff Capital is suing BNY Mellon, as trustee, to compel it to calculate interest in a way that is more favorable to the class of securities it holds.

February 6 -

Residential mortgage-backed securities servicers are better able to weather a downturn and the resulting loan defaults today versus before the crisis because of their investments in technology and regulatory compliance, Fitch Ratings said.

February 1 -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28 -

Plans to begin rating securitizations backed by fix-and-flip mortgages may help lenders create new capacity and satisfy growing demand for short-term financing of house flipping projects.

January 25 -

A security lapse left millions of mortgage records exposed online without proper data protections, according to security researchers.

January 23 -

Rising mortgage rates will only be "a mild deterrent" to home purchase activity during 2019 as other indicators like price and demand will cancel that out, according to Standard & Poor's.

January 23 -

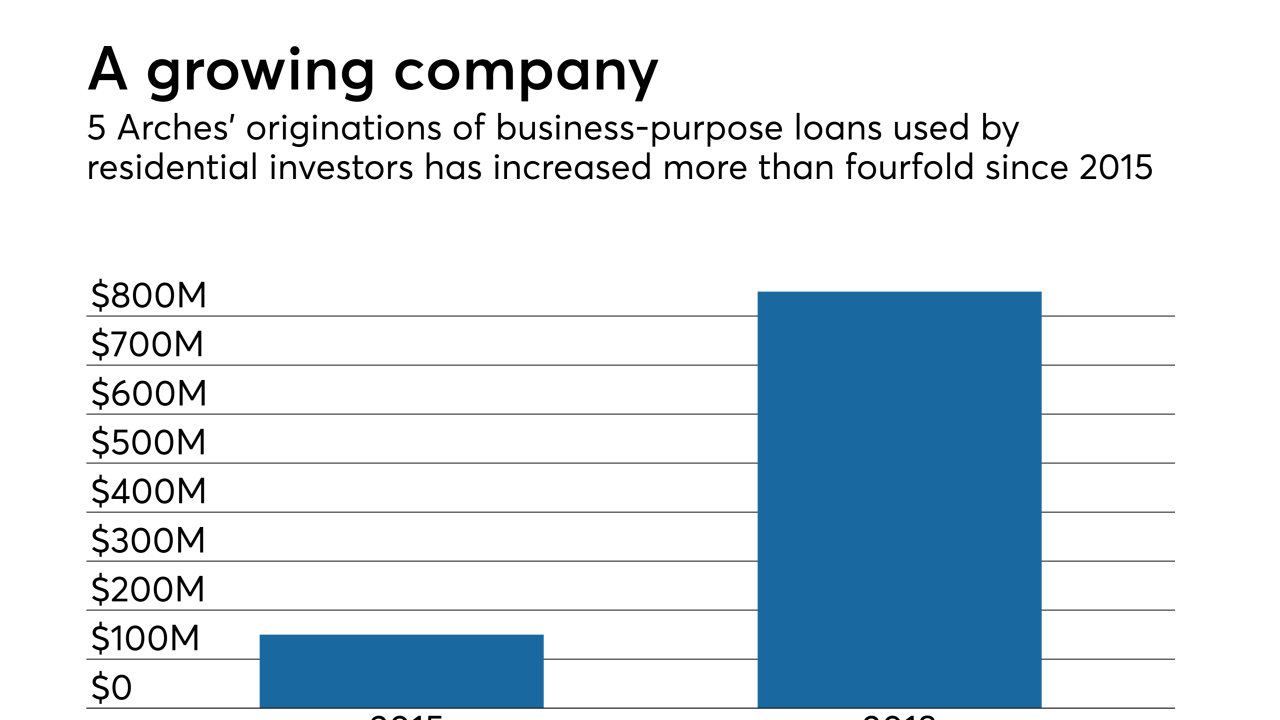

Redwood Trust has exercised its option to expand its minority stake in 5 Arches to 100%, increasing Redwood's exposure to loans used for house flipping and other types of residential investment.

January 23 -

At Ginnie Mae, Michael Bright worked closely with Congress to fight churn in VA mortgages; he plans to bring the same collaborative approach to the Structured Finance Industry Group.

January 10 -

Michael Bright is resigning as acting president of Ginnie Mae to run the Structured Finance Industry Group, a trade association that's been without a CEO since Richard Johns resigned in July amid a reported split with the group's board.

January 10 -

Due diligence firm American Mortgage Consultants has purchased Meridian Asset Services as part of its continuing efforts to expand through acquisition or organic growth.

January 10 -

Acting Ginnie Mae President Michael Bright will leave his post on Jan. 16 and will no longer seek confirmation to be the permanent head of the mortgage secondary market agency.

January 9 -

Cascade Financial Services has become the only manufactured housing loan-focused servicer currently rated by Fitch, adding signs of a rebound in factory-built home financing that could lead to new private securitization.

January 9 -

The expected decline in conventional mortgage volume may open the door for more non-qualified mortgage lending as secondary market investors seek new opportunities to deploy capital, says Tom Millon, CEO of Capital Markets Cooperative.

December 28 -

Liquidity, products and pricing are the main concerns for the secondary mortgage market in 2019.

December 26 -

Next year is unlikely to offer relief from higher rates or housing supply shortages, according to the consensus forecast from 24 of the Securities Industry and Financial Markets Association's member firms.

December 14