Rate discounts are available for both refinance and purchase mortgage applications from several lenders including UWM, Carrington, Chase and Silver Hill.

More mortgage professionals told National Mortgage News they expect their companies to hire, or stand pat, rather than fire workers this year.

More than half of respondents in a National Mortgage News survey predict AI-backed underwriting will fundamentally change mortgage processes in 2026.

New limits on trigger leads push originators toward first-party data, past customers and referral networks as they rethink how to reach borrowers.

An appellate court denied the bank's argument targeting the state's Foreclosure Abuse Prevention Act and ordered it to pay the defendant's legal fees.

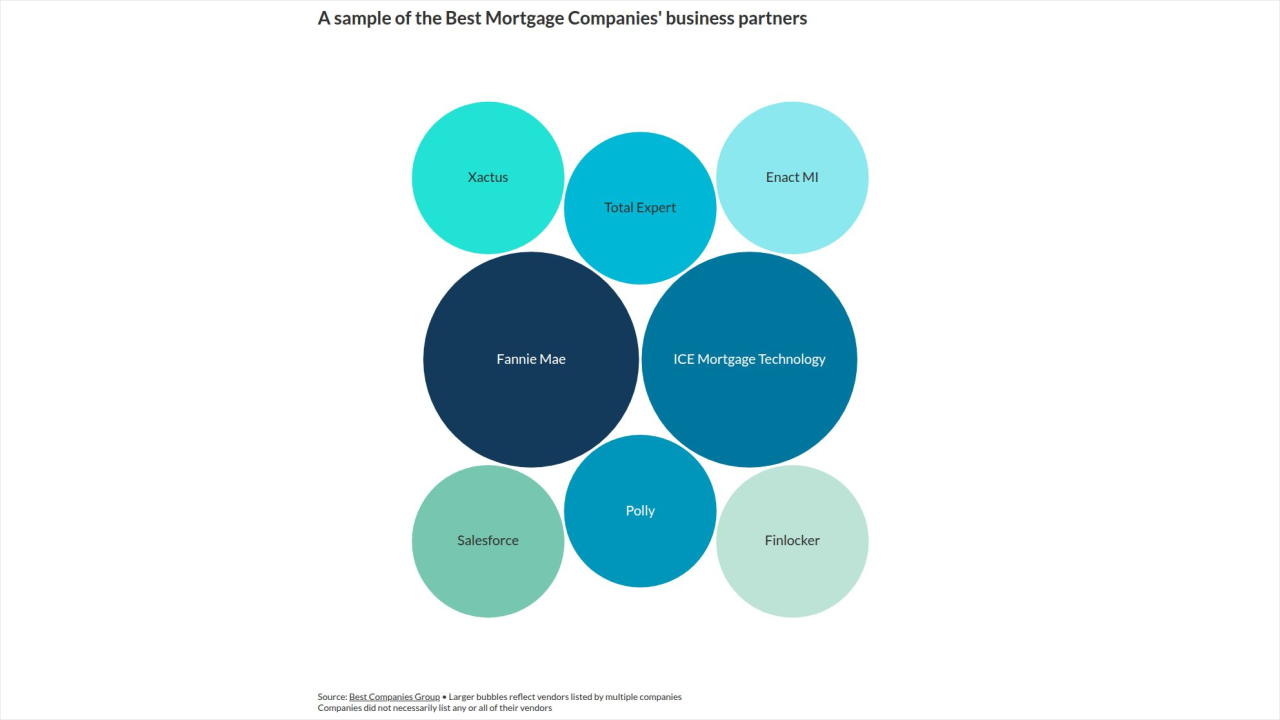

This year 40 companies had what it takes to land on the Best Mortgage Companies to Work For list.

The top employers in home lending value business partners with a large market share and reach but they also need to differentiate themselves.

-

Banks like Grasshopper are already starting to use AI agents where in the past they would have bought software as a service.

-

The deal benefits from three accounts–a Funding, Expense Reserve and Interest Reserve. The Funding Account will fund draws and purchase additional loans.

-

The government-sponsored enterprises' oversight chief severed ties with the AI firm following President Trump's dispute with it over boundaries on military use.

-

Mutual of Omaha, Finance of America and Longbridge Financial rank at the top of HECM endorsements over the past 12 months, Reverse Market Insight reported.

-

A US hedge fund is said to hold about £200 million ($268 million) of mortgage-backed facilities tied to the failed UK company and has declined comment.

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

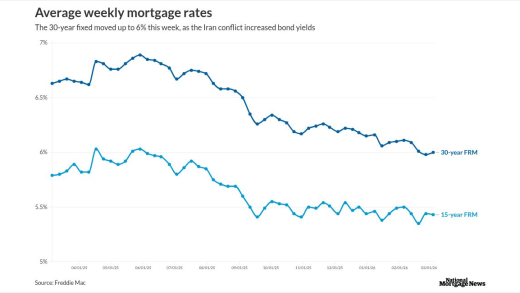

War headlines failed to lift Treasuries; rates sold off, resistance held, and hedging beat rate bets, according to the Head of Correspondent Business Development at AD Mortgage.

-

Bond yields tested key resistance as markets largely shrugged at the data, according to the Head of Correspondent Business Development at AD Mortgage.

-

Bowman's Basel III relief may ease MSR capital but won't bring banks back; risk weights and economics still favor nonbanks, according to the Chairman of Whalen Global Advisors

- UPCOMING LIVESTREAMThursday, March 19, 20261:00 p.m. / 10:00 a.m.

Sean Snaith, Director of the Institute for Economic Forecasting at the University of Central Florida, will provide insight into the FOMC meeting.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- Partner Insights from Hyland

- Partner Insights from Plaid

-

-