Compliance concerns prevent some lenders from moving toward development of an AI plan or policy, but hesitancy may turn out to be a poor business strategy.

The 30-year-fixed conforming loan rate was had its largest in over a month, contributing to the first decline in activity in four weeks, the Mortgage Bankers Association said.

The economic fallout from COVID-19 has highlighted systemic concerns about commercial real estate exposure, business debt and short-term wholesale funding, the Financial Stability Oversight Council said in an annual report.

Lenders and servicers must determine how quickly to act as some legislators look to enable the move a key regulator has ordered while others urge deliberation.

The removal of the commissioner of the Bureau of Labor Statistics is unlikely to change government data practices in the near term, experts say, but the perception of interference will have a big effect on the credibility of government economic metrics going forward.

-

Federal Reserve Vice Chair Philip Jefferson said in a speech Wednesday that elevated tariffs will likely lead to inflation, but time will tell how impactful that spike in prices might be.

-

The Consumer Financial Protection Bureau has dismissed or withdrawn from more than 20 lawsuits as the Trump administration reverses the work done during the Biden era.

-

The increase in purchase mortgage rate lock volume provides support for those looking for a strong Spring market this year, Optimal Blue found.

-

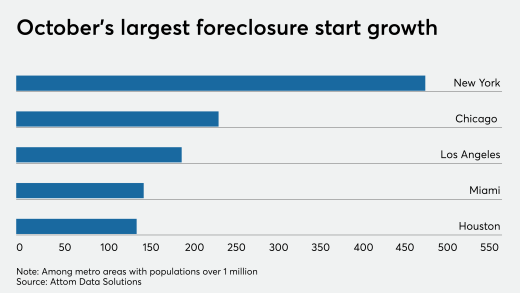

Numbers jumped after the expiration of a moratorium at the end of 2024, but rates of foreclosure rose across all loan types, the Mortgage Bankers Association said.

-

Some policies the industry group is calling for the Office of Management and Budget to definitively rescind have already been pulled back to some degree.

-

Lower is acquiring a top-five ranked real estate portal to create an "end-to-end homeownership platform" to rival Rocket Mortgage.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

We're hearing from the great state of Washington where there has been an increase of almost 1,200 loan originators from November 2012 through March of this year.

-

I have some interesting stories and perspectives on how the fine folks on the left coast live, and how they keep coming up with innovative business models to address their ever changing market.

-

A laundry list of 33 items for managers to find answers for during the interview process.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland